- China

- /

- Renewable Energy

- /

- SHSE:601619

Asian Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of easing trade tensions and mixed economic signals, investors are keeping a close eye on the Asian market for emerging opportunities. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.88 | THB3.03B | ✅ 4 ⚠️ 3 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.40 | THB2.64B | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.192 | SGD38.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.18 | SGD8.58B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.88 | HK$3.25B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.02 | HK$46.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.07 | HK$675.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.19 | HK$1.99B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.00 | HK$1.67B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,175 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

China Vered Financial Holding (SEHK:245)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Vered Financial Holding Corporation Limited is an investment holding company offering asset management, consultancy, financing, and securities advisory and brokerage services in Hong Kong, Mainland China, Japan, and Canada with a market cap of HK$2.08 billion.

Operations: The company's revenue is primarily derived from its Investment Holding segment, which generated HK$65.20 million, followed by Asset Management at HK$14.99 million and Securities Brokerage at HK$9.17 million.

Market Cap: HK$2.08B

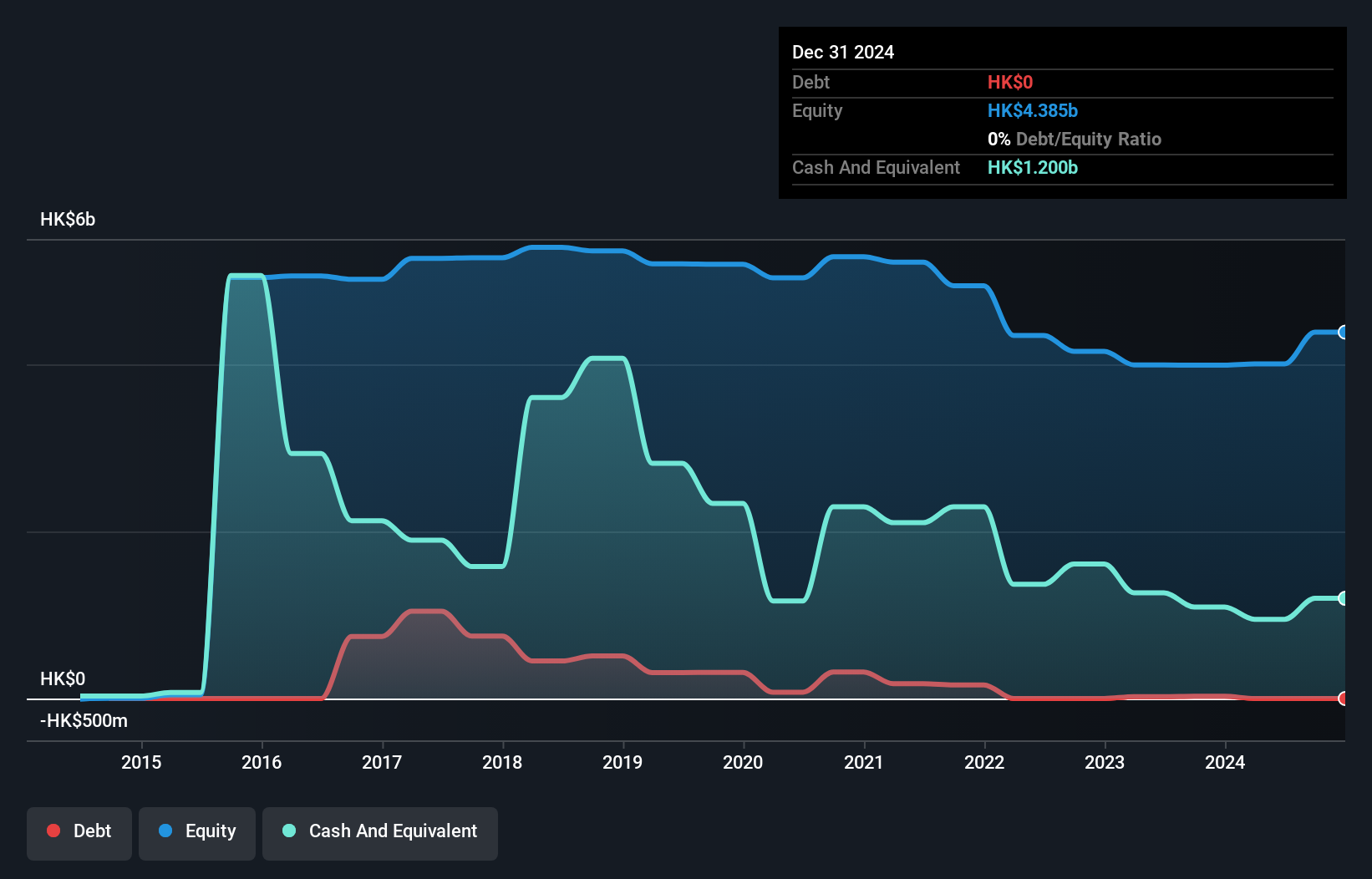

China Vered Financial Holding Corporation Limited has shown a significant turnaround, reporting HK$109.39 million in revenue for 2024 and achieving a net income of HK$222.82 million after a loss the previous year. The company benefits from strong liquidity, with short-term assets of HK$1.4 billion covering both short and long-term liabilities comfortably. Its debt-free status enhances financial stability, while its price-to-earnings ratio of 9.3x suggests potential value compared to the broader Hong Kong market average of 10.8x. However, its Return on Equity remains low at 5.1%, and the board's inexperience may pose governance challenges moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of China Vered Financial Holding.

- Assess China Vered Financial Holding's previous results with our detailed historical performance reports.

Jiaze Renewables (SHSE:601619)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiaze Renewables Corporation Limited is involved in the development, construction, sale, operation, and maintenance of new energy projects with a market cap of CN¥9.08 billion.

Operations: The company's revenue is primarily derived from its operations in China, amounting to CN¥2.49 billion.

Market Cap: CN¥9.08B

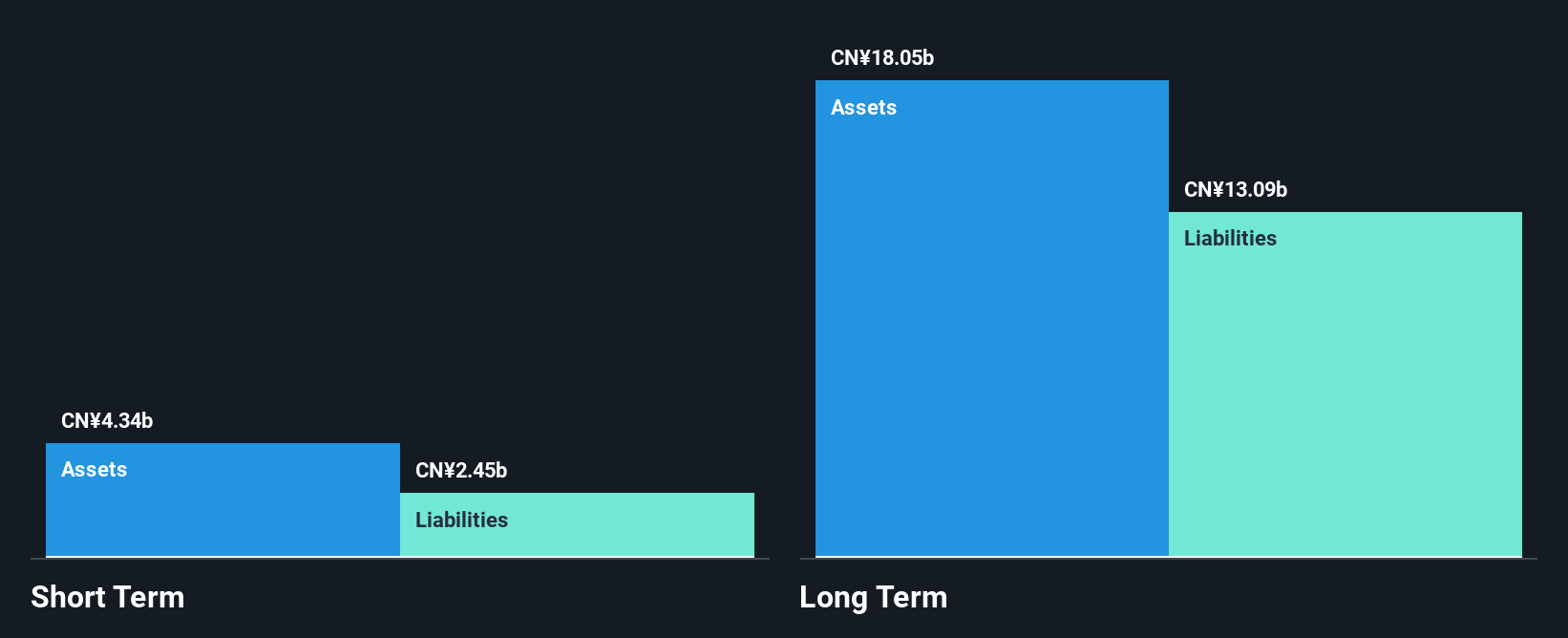

Jiaze Renewables Corporation Limited, with a market cap of CN¥9.08 billion, reported Q1 2025 revenue of CN¥660.7 million, showing growth from the previous year. Despite high net debt to equity at 70.7%, its interest payments are well-covered by EBIT at seven times coverage, and operating cash flow covers 35% of its debt. The company trades significantly below estimated fair value and has experienced management and board teams with average tenures of 7.5 and 3.6 years respectively. However, long-term liabilities exceed short-term assets by a significant margin, posing potential financial challenges despite stable earnings growth forecasts.

- Click here to discover the nuances of Jiaze Renewables with our detailed analytical financial health report.

- Evaluate Jiaze Renewables' prospects by accessing our earnings growth report.

5i5j Holding Group (SZSE:000560)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 5i5j Holding Group Co., Ltd. is a company that offers real estate brokerage services both in China and internationally, with a market capitalization of approximately CN¥7.70 billion.

Operations: There are no specific revenue segments reported for 5i5j Holding Group Co., Ltd.

Market Cap: CN¥7.7B

5i5j Holding Group, with a market cap of CN¥7.70 billion, recently reported Q1 2025 revenue of CN¥2.82 billion, slightly up from the previous year. The company has turned profitable over the past year but faced a significant one-off gain of CN¥1.2 billion affecting its recent financial results. Its debt-to-equity ratio has improved to 15.8% over five years, and it holds more cash than total debt, indicating strong liquidity despite low return on equity at 0.6%. However, short-term liabilities exceed short-term assets by CN¥3.8 billion, which could pose financial risks moving forward despite stable earnings growth forecasts.

- Unlock comprehensive insights into our analysis of 5i5j Holding Group stock in this financial health report.

- Gain insights into 5i5j Holding Group's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Unlock our comprehensive list of 1,175 Asian Penny Stocks by clicking here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601619

Jiaze Renewables

Engages in the development, construction, sale, operation, and maintenance of new energy projects.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives