- China

- /

- Electronic Equipment and Components

- /

- SZSE:003015

Undiscovered Gems Featuring Shenzhen Kingkey Smart Agriculture TimesLtd And 2 Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating consumer confidence and mixed economic indicators, small-cap stocks like those in the S&P 600 have shown resilience amid broader market movements. In this context, identifying promising small-cap companies requires a focus on innovative potential and adaptability to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intelligent Wave | NA | 7.39% | 15.42% | ★★★★★★ |

| Jih Lin Technology | 56.44% | 4.23% | 3.89% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 31.26% | 0.80% | 0.71% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Shenzhen Kingkey Smart Agriculture TimesLtd (SZSE:000048)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Kingkey Smart Agriculture Times Co., Ltd operates in the real estate and breeding sectors in China with a market cap of CN¥9.25 billion.

Operations: Shenzhen Kingkey Smart Agriculture Times Co., Ltd generates revenue primarily from its real estate and breeding operations in China. The company has a market cap of CN¥9.25 billion, reflecting its significant presence in these sectors.

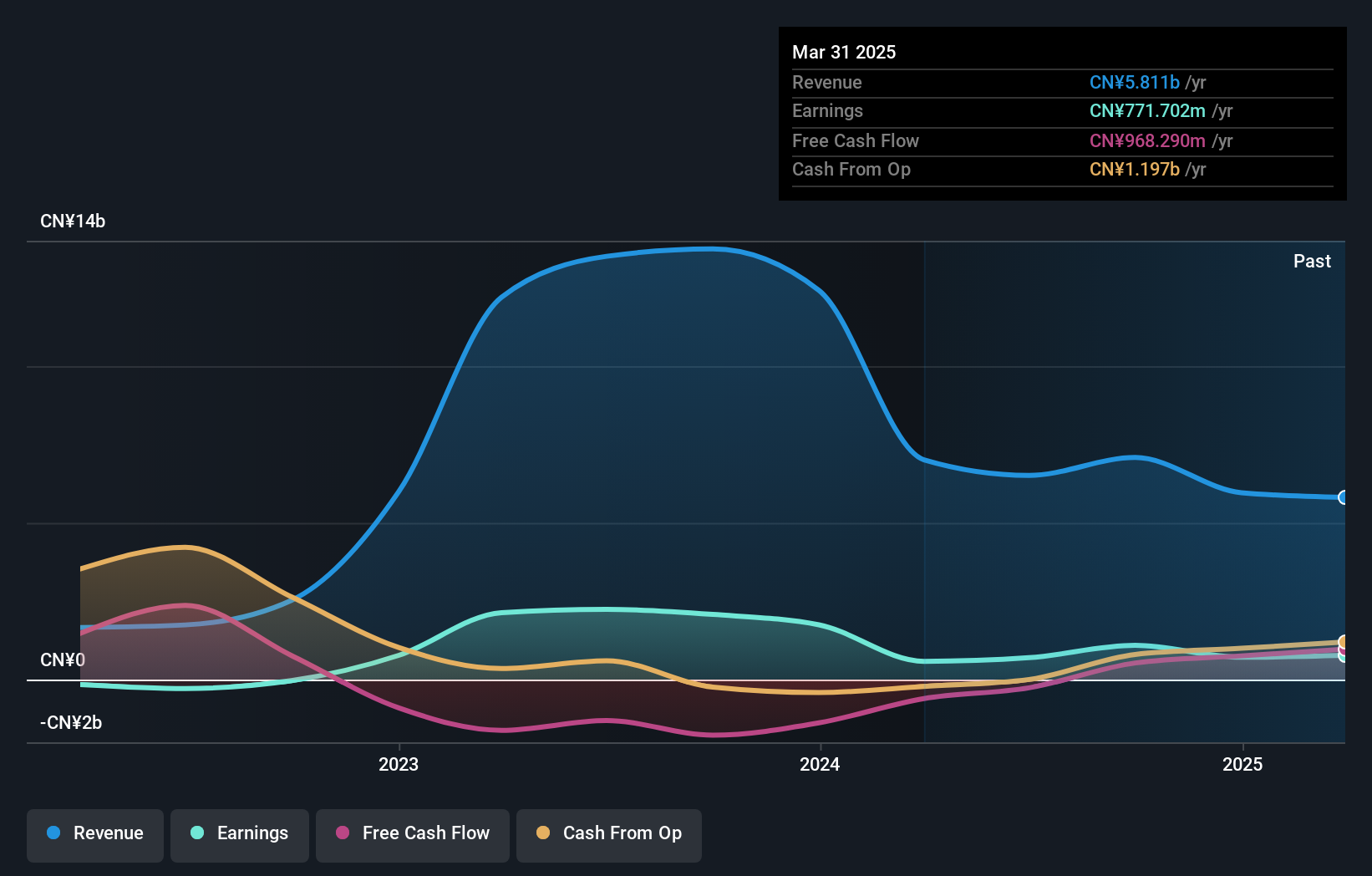

Shenzhen Kingkey Smart Agriculture Times Ltd, a smaller player in its sector, has been navigating financial challenges with a notable decrease in revenue to CNY 4.60 billion from CNY 9.93 billion over nine months. Its net income also fell to CNY 601.8 million compared to the previous year's CNY 1.26 billion, reflecting tighter margins and market conditions. Despite these hurdles, the company repurchased approximately 11 million shares for CNY 153 million as part of a strategic buyback plan initiated in June 2024, indicating confidence in its long-term value proposition amidst fluctuating earnings per share figures of around CNY 1.15 from continuing operations this year compared to last year's higher numbers.

Alpha Group (SZSE:002292)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group operates as an animation and entertainment company in China and internationally, with a market cap of CN¥14.03 billion.

Operations: Alpha Group's primary revenue stream comes from its Games & Toys segment, generating CN¥2.73 billion. The company's financial performance is highlighted by its net profit margin, which reflects the efficiency of its operations and profitability.

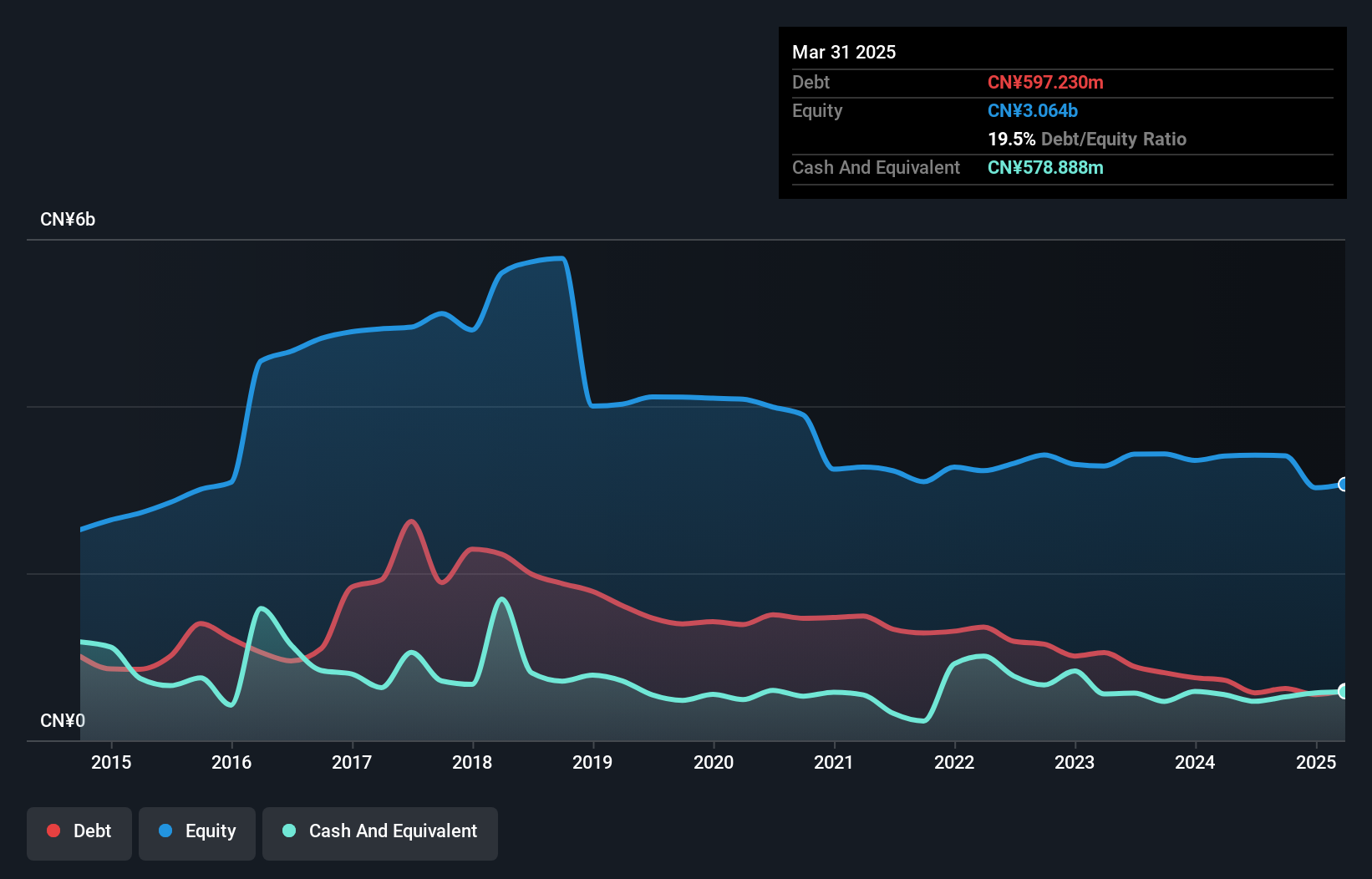

Alpha Group, a nimble player in its sector, has seen its net debt to equity ratio improve from 33.9% to a satisfactory 18.2% over five years, suggesting prudent financial management. The company's interest payments are well covered by EBIT at 8.7 times, showcasing robust earnings quality and fiscal health. However, recent financials show sales slightly dipped to CNY 2 billion from CNY 2.02 billion last year with net income at CNY 71 million compared to CNY 81 million previously; basic earnings per share also saw a decrease from CNY 0.0551 to CNY 0.0482, reflecting challenges in maintaining growth momentum amidst market volatility.

- Unlock comprehensive insights into our analysis of Alpha Group stock in this health report.

Understand Alpha Group's track record by examining our Past report.

Jiangsu Rijiu Optoelectronics (SZSE:003015)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Rijiu Optoelectronics Jointstock Co., Ltd. operates in the optoelectronics industry, focusing on touch display materials, with a market cap of CN¥3.65 billion.

Operations: Rijiu Optoelectronics generates revenue primarily from its touch display materials segment, amounting to CN¥559.18 million.

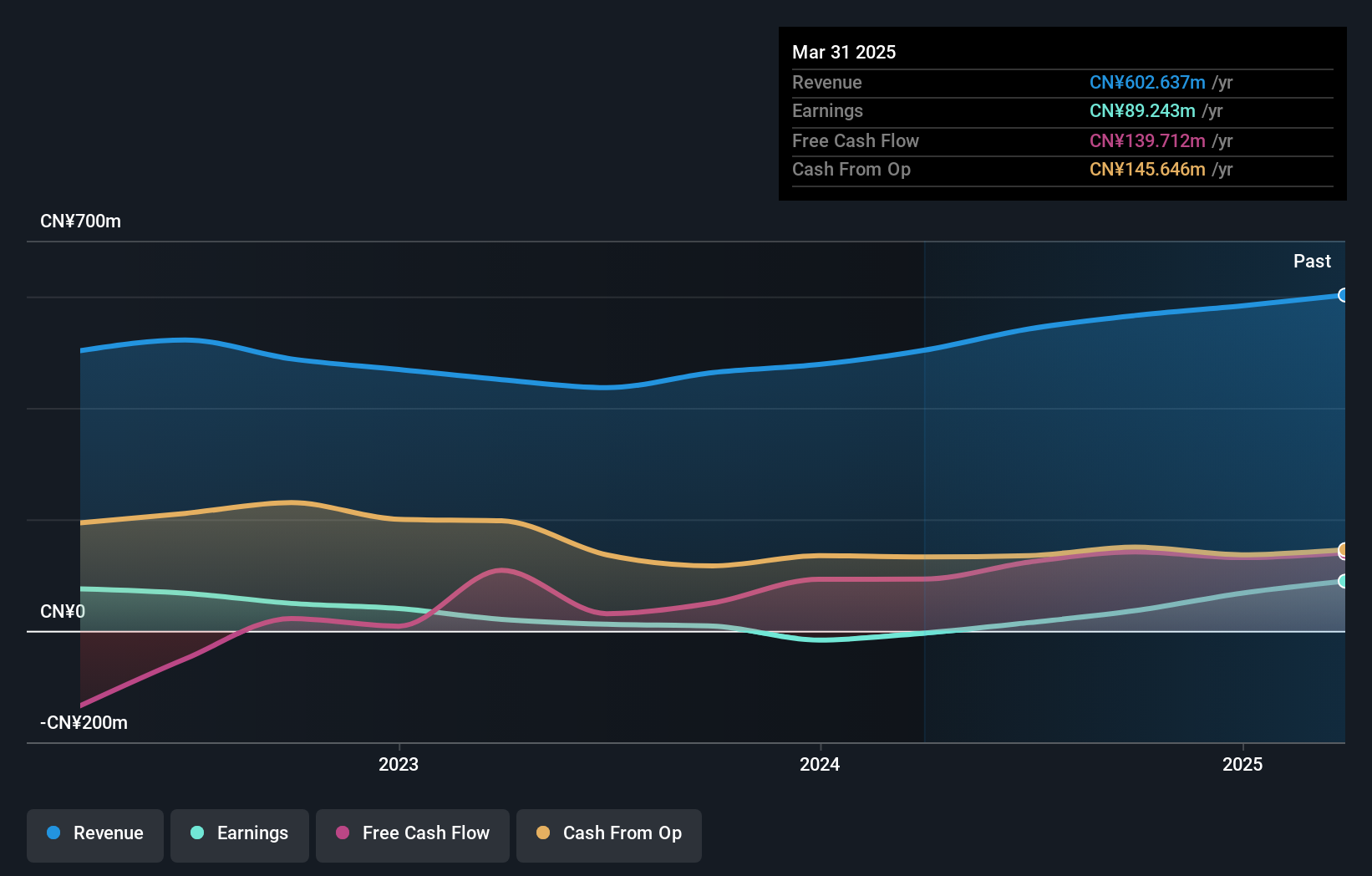

Jiangsu Rijiu Optoelectronics stands out with impressive earnings growth of 330% over the past year, significantly outperforming the Electronic industry's 1.9%. The company's debt to equity ratio has impressively reduced from 37.2% to just 5.9% in five years, reflecting strong financial management. Recent reports for the nine months ending September 2024 show sales at CN¥443 million, up from CN¥355 million last year, while net income surged to CN¥56 million from CN¥3.64 million previously. Despite a large one-off gain of CN¥8.7M affecting recent results, Jiangsu Rijiu's profitability and positive free cash flow indicate robust operational health.

Taking Advantage

- Delve into our full catalog of 4629 Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003015

Jiangsu Rijiu Optoelectronics

Jiangsu Rijiu Optoelectronics Jointstock Co., Ltd.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives