- China

- /

- Real Estate

- /

- SZSE:000002

China Vanke (SZSE:000002) shareholders have endured a 62% loss from investing in the stock five years ago

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. To wit, the China Vanke Co., Ltd. (SZSE:000002) share price managed to fall 69% over five long years. We certainly feel for shareholders who bought near the top.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for China Vanke

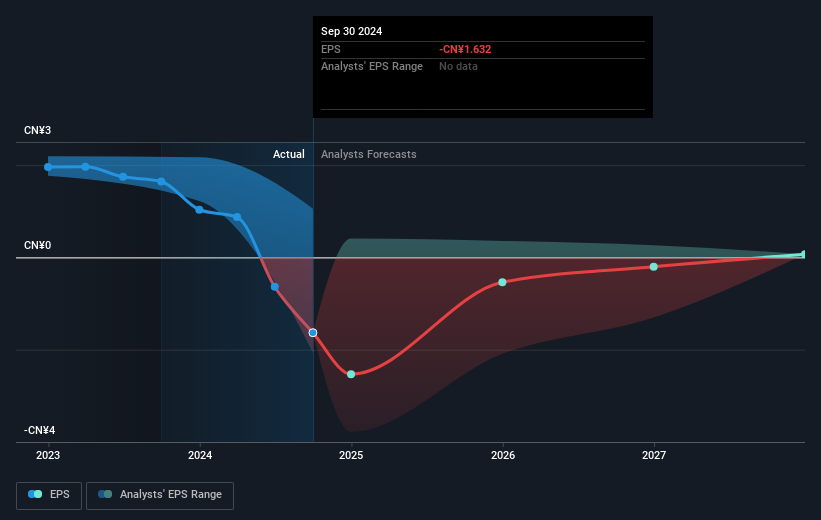

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over five years China Vanke's earnings per share dropped significantly, falling to a loss, with the share price also lower. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into China Vanke's key metrics by checking this interactive graph of China Vanke's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We've already covered China Vanke's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. China Vanke's TSR of was a loss of 62% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Investors in China Vanke had a tough year, with a total loss of 20%, against a market gain of about 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for China Vanke that you should be aware of.

Of course China Vanke may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000002

China Vanke

Engages in the development and sale of properties in the Mainland China, Hong Kong, and internationally.

Fair value with imperfect balance sheet.

Market Insights

Community Narratives