- China

- /

- Real Estate

- /

- SHSE:600895

Shanghai Zhangjiang Hi-Tech Park Development Co., Ltd. (SHSE:600895) Stock Rockets 37% As Investors Are Less Pessimistic Than Expected

Shanghai Zhangjiang Hi-Tech Park Development Co., Ltd. (SHSE:600895) shareholders are no doubt pleased to see that the share price has bounced 37% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 74% in the last year.

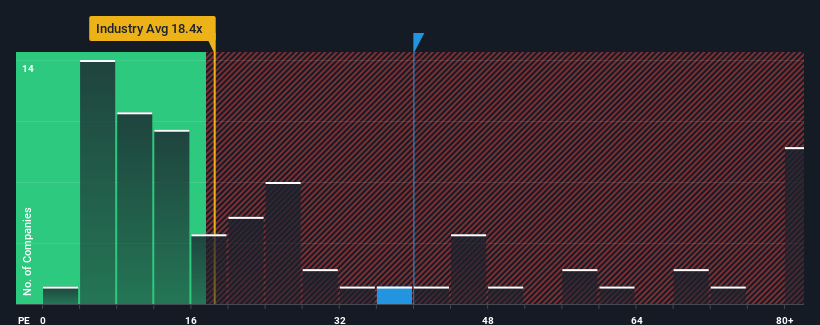

Since its price has surged higher, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Shanghai Zhangjiang Hi-Tech Park Development as a stock to potentially avoid with its 39.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Shanghai Zhangjiang Hi-Tech Park Development has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Shanghai Zhangjiang Hi-Tech Park Development

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Shanghai Zhangjiang Hi-Tech Park Development's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 35% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 26% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 30% during the coming year according to the only analyst following the company. Meanwhile, the rest of the market is forecast to expand by 41%, which is noticeably more attractive.

In light of this, it's alarming that Shanghai Zhangjiang Hi-Tech Park Development's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Shanghai Zhangjiang Hi-Tech Park Development's P/E?

Shanghai Zhangjiang Hi-Tech Park Development's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shanghai Zhangjiang Hi-Tech Park Development's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Shanghai Zhangjiang Hi-Tech Park Development (1 is concerning) you should be aware of.

If these risks are making you reconsider your opinion on Shanghai Zhangjiang Hi-Tech Park Development, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600895

Shanghai Zhangjiang Hi-Tech Park Development

Engages in the investment, development, management, and operation of real estate properties in the People's Republic of China.

Unattractive dividend payer very low.

Market Insights

Community Narratives