- China

- /

- Real Estate

- /

- SHSE:600848

Why Investors Shouldn't Be Surprised By Shanghai Lingang Holdings Co.,Ltd.'s (SHSE:600848) 29% Share Price Surge

Shanghai Lingang Holdings Co.,Ltd. (SHSE:600848) shareholders have had their patience rewarded with a 29% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

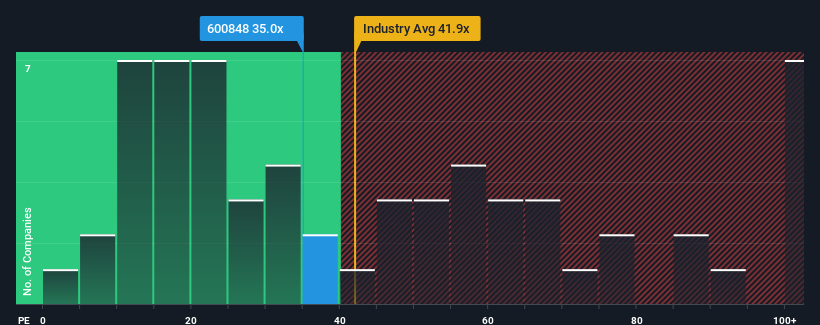

After such a large jump in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Shanghai Lingang HoldingsLtd as a stock to potentially avoid with its 35x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Shanghai Lingang HoldingsLtd has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Shanghai Lingang HoldingsLtd

Does Growth Match The High P/E?

In order to justify its P/E ratio, Shanghai Lingang HoldingsLtd would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. This means it has also seen a slide in earnings over the longer-term as EPS is down 49% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 21% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 19% per annum, which is noticeably less attractive.

With this information, we can see why Shanghai Lingang HoldingsLtd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in Shanghai Lingang HoldingsLtd's shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Shanghai Lingang HoldingsLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Shanghai Lingang HoldingsLtd has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you're unsure about the strength of Shanghai Lingang HoldingsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600848

Shanghai Lingang HoldingsLtd

Develops and sells industrial carriers in China.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives