- China

- /

- Real Estate

- /

- SHSE:600568

Asian Market Gems: Zhongzhu Healthcare HoldingLtd And 2 More Penny Stocks To Watch

Reviewed by Simply Wall St

Amidst the backdrop of easing trade tensions between the U.S. and China, Asian markets are navigating a complex landscape marked by mixed economic signals and cautious optimism. Penny stocks, often seen as relics of past market trends, continue to offer intriguing opportunities for investors seeking growth at accessible price points. By focusing on companies with robust financial health and potential for stability, these stocks can present compelling investment prospects in today's evolving market environment.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.93 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.96 | THB1.24B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.58 | HK$2.14B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.15 | SGD466.08M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.74 | THB2.84B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.27 | SGD12.87B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.10 | HK$2.97B | ✅ 4 ⚠️ 1 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.32 | THB8.73B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 948 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Zhongzhu Healthcare HoldingLtd (SHSE:600568)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhongzhu Healthcare Holding Co., Ltd is involved in the research, development, production, and sale of drugs in China with a market cap of CN¥3.71 billion.

Operations: The company generates revenue of CN¥572.47 million from its operations in China.

Market Cap: CN¥3.71B

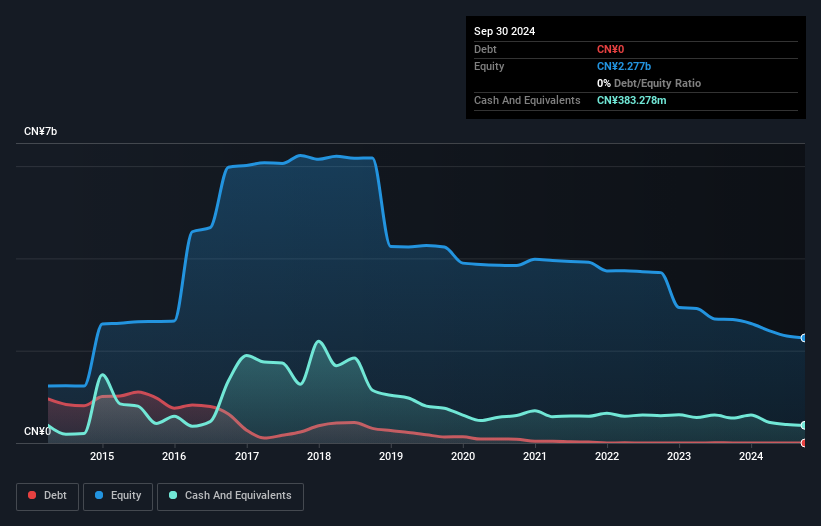

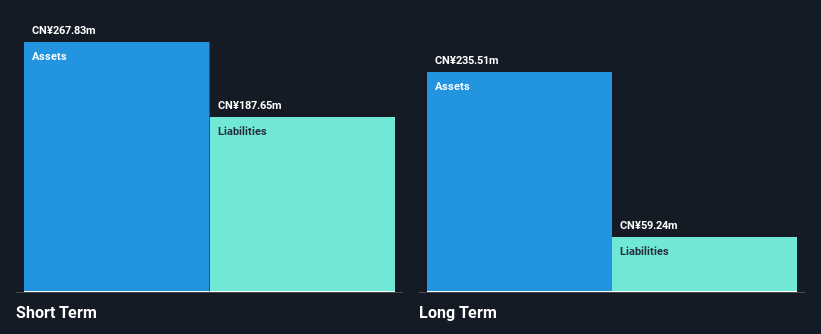

Zhongzhu Healthcare Holding Co., Ltd, with a market cap of CN¥3.71 billion and revenue of CN¥572.47 million, is currently unprofitable but shows some resilience in its financial structure. The company has no debt and possesses short-term assets that significantly exceed both its short- and long-term liabilities, indicating strong liquidity. Despite a negative return on equity and increasing losses over the past five years, it maintains a stable cash runway for over three years due to positive free cash flow growth. Recent earnings reports show reduced net losses compared to the previous year, suggesting potential operational improvements.

- Get an in-depth perspective on Zhongzhu Healthcare HoldingLtd's performance by reading our balance sheet health report here.

- Examine Zhongzhu Healthcare HoldingLtd's past performance report to understand how it has performed in prior years.

CnlightLtd (SZSE:002076)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cnlight Co., Ltd specializes in the manufacturing and sale of lighting products in China, with a market capitalization of CN¥2.20 billion.

Operations: The company's revenue is primarily derived from Electrical Machinery and Equipment Manufacturing, which accounts for CN¥120.52 million, alongside contributions from Other Industries totaling CN¥94.24 million.

Market Cap: CN¥2.2B

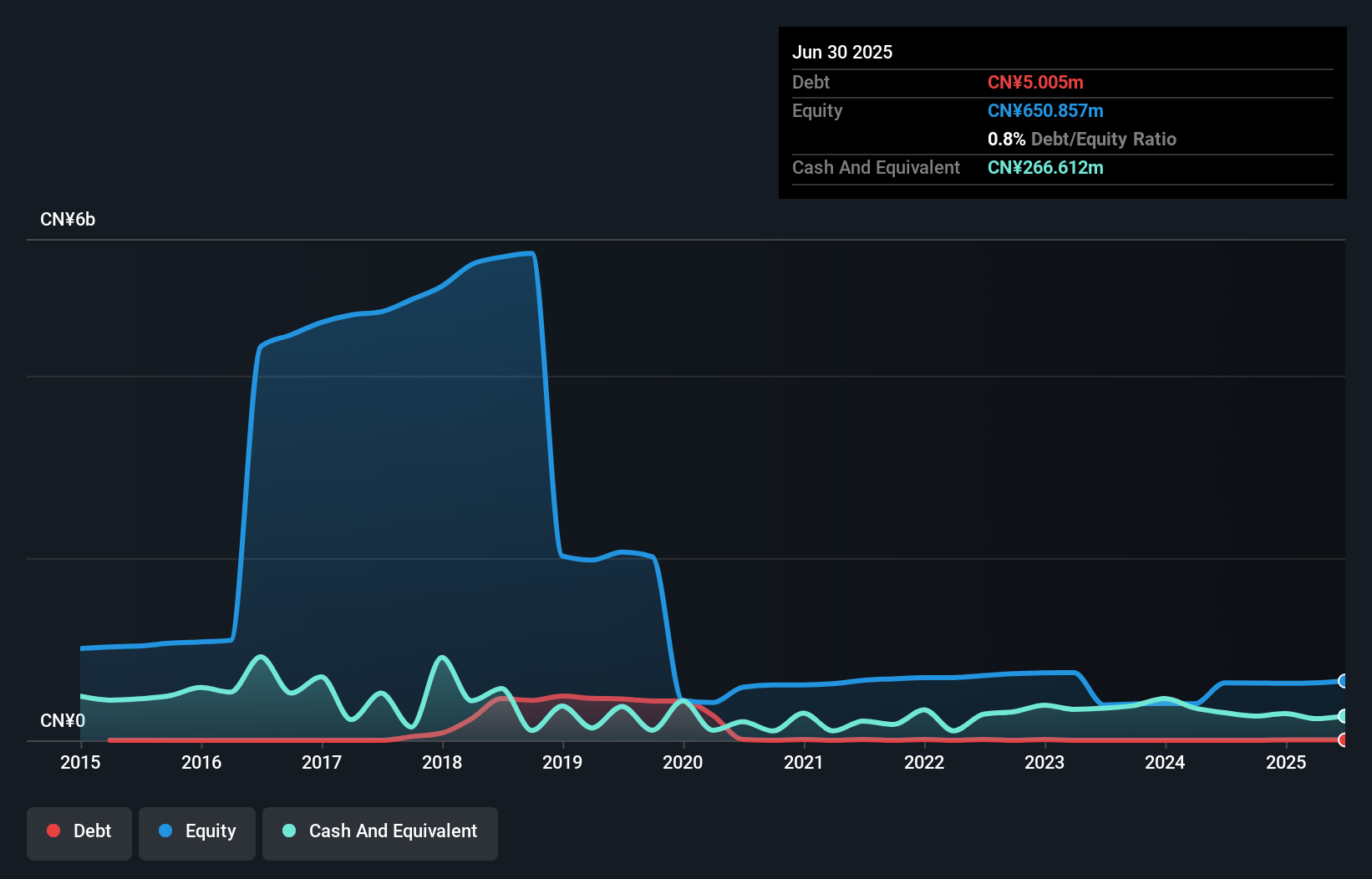

Cnlight Co., Ltd, with a market cap of CN¥2.20 billion, is currently unprofitable but has shown improvement by reducing losses over the past five years. The company reported half-year sales of CN¥88.17 million and revenue of CN¥92.96 million, yet ended with a net loss of CN¥2.66 million. Despite this, Cnlight's financial position is robust; its short-term assets significantly exceed both short- and long-term liabilities, suggesting strong liquidity management. Additionally, it holds more cash than total debt and maintains a sufficient cash runway for over three years based on current free cash flow levels.

- Unlock comprehensive insights into our analysis of CnlightLtd stock in this financial health report.

- Explore historical data to track CnlightLtd's performance over time in our past results report.

Zhejiang Juli Culture DevelopmentLtd (SZSE:002247)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Juli Culture Development Co., Ltd. operates in the cultural and entertainment industry, with a market cap of CN¥2.51 billion.

Operations: The company generates revenue from its Building Materials Industry segment, amounting to CN¥788.82 million.

Market Cap: CN¥2.51B

Zhejiang Juli Culture Development Ltd., with a market cap of CN¥2.51 billion, faces challenges despite its experienced management and board. The company reported a significant drop in net income for the first half of 2025, down to CN¥23.65 million from CN¥221.84 million a year earlier, impacted by large one-off gains in prior periods. While it boasts strong liquidity with short-term assets exceeding liabilities and reduced debt levels over time, profit margins have contracted sharply to 2.5%. Despite being profitable over the past five years, recent negative earnings growth highlights volatility within its financial performance.

- Navigate through the intricacies of Zhejiang Juli Culture DevelopmentLtd with our comprehensive balance sheet health report here.

- Understand Zhejiang Juli Culture DevelopmentLtd's track record by examining our performance history report.

Where To Now?

- Unlock our comprehensive list of 948 Asian Penny Stocks by clicking here.

- Seeking Other Investments? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongzhu Healthcare HoldingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600568

Zhongzhu Healthcare HoldingLtd

Engages in the research and development, production, and sale of drugs in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives