- China

- /

- Real Estate

- /

- SHSE:600376

There's No Escaping Beijing Capital Development Co., Ltd.'s (SHSE:600376) Muted Revenues Despite A 35% Share Price Rise

Beijing Capital Development Co., Ltd. (SHSE:600376) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Looking further back, the 10% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

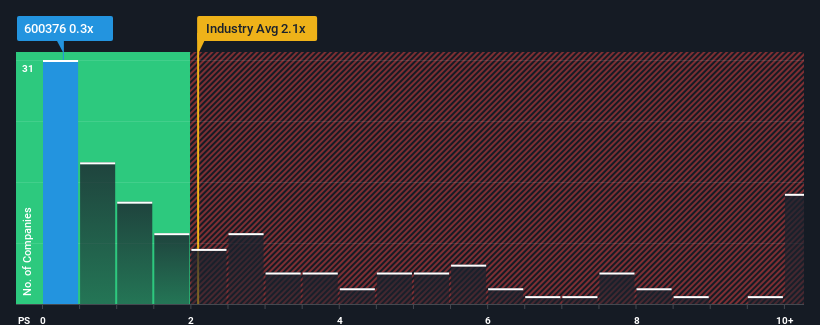

In spite of the firm bounce in price, Beijing Capital Development's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the Real Estate industry in China, where around half of the companies have P/S ratios above 2.1x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Beijing Capital Development

What Does Beijing Capital Development's P/S Mean For Shareholders?

Recent times haven't been great for Beijing Capital Development as its revenue has been falling quicker than most other companies. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Capital Development.How Is Beijing Capital Development's Revenue Growth Trending?

Beijing Capital Development's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 52%. The last three years don't look nice either as the company has shrunk revenue by 54% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 7.0% as estimated by the lone analyst watching the company. That's not great when the rest of the industry is expected to grow by 11%.

In light of this, it's understandable that Beijing Capital Development's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

The latest share price surge wasn't enough to lift Beijing Capital Development's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Beijing Capital Development's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Beijing Capital Development's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You should always think about risks. Case in point, we've spotted 1 warning sign for Beijing Capital Development you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Capital Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600376

Beijing Capital Development

Operates as a real estate development company in China.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives