- China

- /

- Real Estate

- /

- SHSE:600376

Beijing Capital Development Co., Ltd. (SHSE:600376) Stock Rockets 31% But Many Are Still Ignoring The Company

Beijing Capital Development Co., Ltd. (SHSE:600376) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

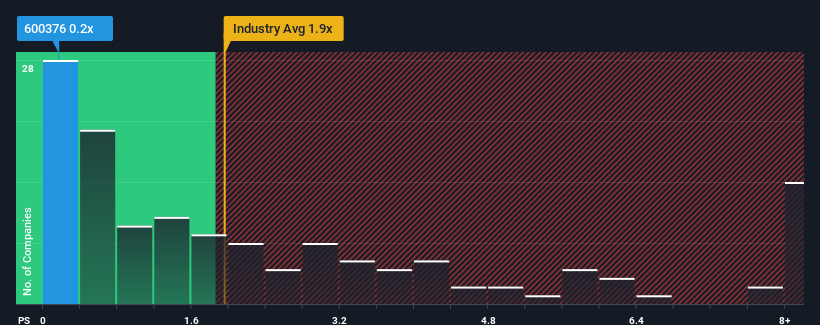

Even after such a large jump in price, Beijing Capital Development may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Real Estate industry in China have P/S ratios greater than 1.9x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Beijing Capital Development

How Has Beijing Capital Development Performed Recently?

While the industry has experienced revenue growth lately, Beijing Capital Development's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Capital Development will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Beijing Capital Development would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.3%. The last three years don't look nice either as the company has shrunk revenue by 7.3% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.7% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 5.3%, which is not materially different.

With this in consideration, we find it intriguing that Beijing Capital Development's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Despite Beijing Capital Development's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Beijing Capital Development's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Beijing Capital Development that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Capital Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600376

Beijing Capital Development

Operates as a real estate development company in China.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives