- China

- /

- Real Estate

- /

- SHSE:600052

Revenues Tell The Story For Zhejiang Dongwang Times Technology Co., Ltd. (SHSE:600052)

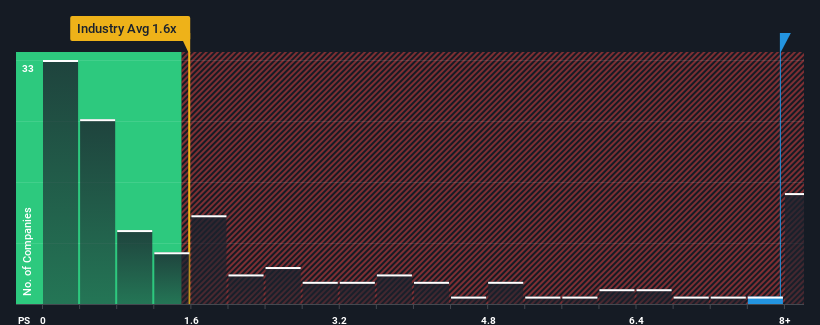

When close to half the companies in the Real Estate industry in China have price-to-sales ratios (or "P/S") below 1.6x, you may consider Zhejiang Dongwang Times Technology Co., Ltd. (SHSE:600052) as a stock to avoid entirely with its 7.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Zhejiang Dongwang Times Technology

What Does Zhejiang Dongwang Times Technology's Recent Performance Look Like?

Zhejiang Dongwang Times Technology has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhejiang Dongwang Times Technology's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Zhejiang Dongwang Times Technology?

In order to justify its P/S ratio, Zhejiang Dongwang Times Technology would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. Pleasingly, revenue has also lifted 78% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 9.3% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why Zhejiang Dongwang Times Technology's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Zhejiang Dongwang Times Technology can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Zhejiang Dongwang Times Technology you should know about.

If you're unsure about the strength of Zhejiang Dongwang Times Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Dongwang Times Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600052

Zhejiang Dongwang Times Technology

Engages in the provision of energy-saving services, and film and television culture solutions in China.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives