- China

- /

- Electronic Equipment and Components

- /

- SZSE:300161

High Growth Tech Stocks To Watch This November 2024

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and economic uncertainties, major indices like the Nasdaq Composite and S&P MidCap 400 have experienced notable volatility, with small-cap stocks demonstrating resilience compared to their larger counterparts. In this environment, identifying high growth tech stocks involves looking for companies that can maintain strong fundamentals and adapt to shifting market dynamics while capitalizing on emerging technological trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 34.69% | 57.41% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.49% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 71.73% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Bloomage BioTechnology (SHSE:688363)

Simply Wall St Growth Rating: ★★★★☆☆

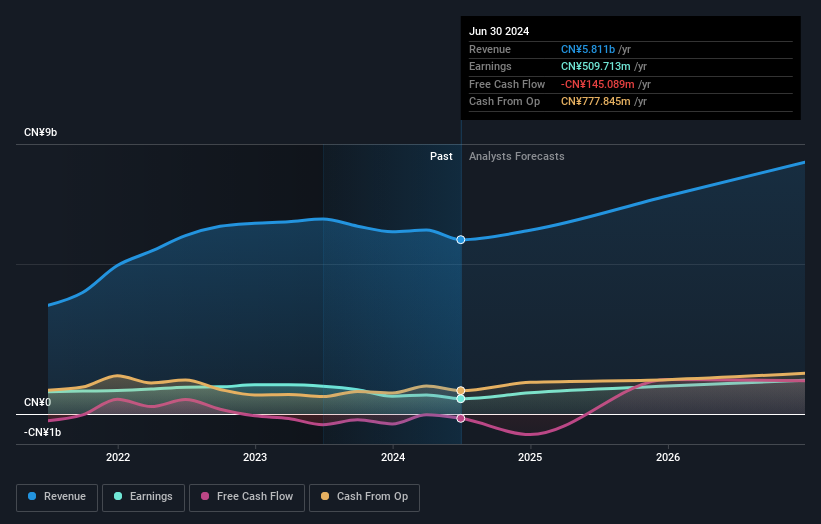

Overview: Bloomage BioTechnology Corporation Limited focuses on the research, development, production, and sale of bioactive materials with a market capitalization of CN¥28.40 billion.

Operations: The company generates revenue primarily through its pharmaceutical manufacturing segment, which contributes CN¥5.73 billion.

Bloomage BioTechnology's recent strategic moves underscore its commitment to innovation and market expansion, particularly in the functional foods sector. The company's R&D focus is evident from its introduction of products like MitoPQQ and ACTIVENAG at HI Japan 2024, aimed at enhancing health through bioactive substances. Despite a downturn in earnings with net income dropping to CNY 362.02 million from CNY 514.4 million year-over-year, Bloomage maintains robust growth forecasts with revenue expected to increase by 17% annually and earnings projected to surge by 39.3% per year. This growth trajectory is supported by the company’s targeted expansions into international markets such as South Korea, showcasing a clear strategy to leverage high-quality ingredients for global health needs.

- Take a closer look at Bloomage BioTechnology's potential here in our health report.

Evaluate Bloomage BioTechnology's historical performance by accessing our past performance report.

Wuhan Huazhong Numerical ControlLtd (SZSE:300161)

Simply Wall St Growth Rating: ★★★★★☆

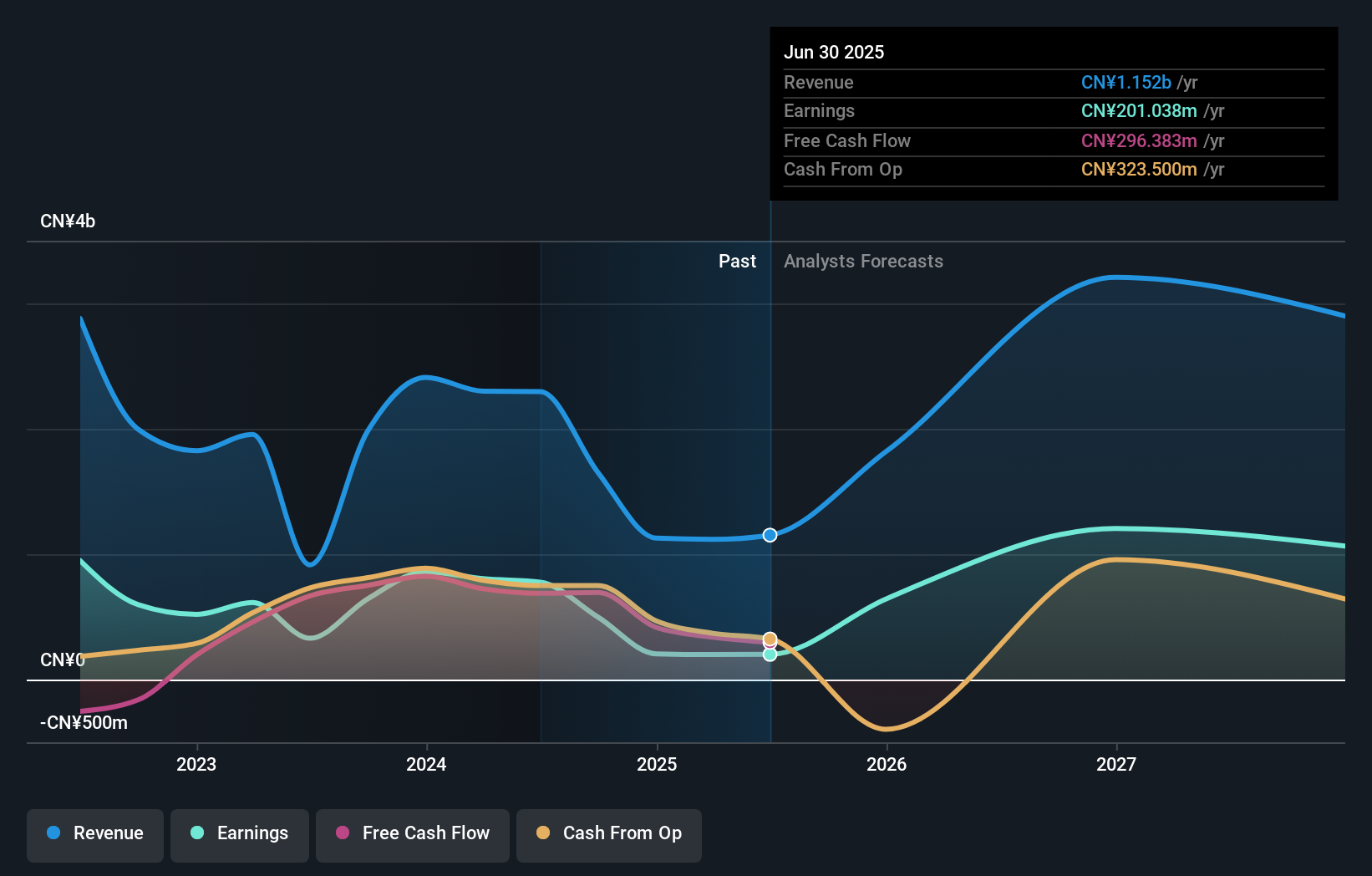

Overview: Wuhan Huazhong Numerical Control Co., Ltd. specializes in the development and manufacturing of numerical control systems and related products, with a market cap of CN¥5.54 billion.

Operations: The company generates revenue primarily through the sale of numerical control systems and related products. Its market cap stands at CN¥5.54 billion, indicating its significant presence in the industry.

Wuhan Huazhong Numerical Control Co., Ltd. faces challenges with a net loss widening to CNY 67.06 million from CNY 33.62 million year-over-year as of September 2024, reflecting a tough period for the firm. Despite these setbacks, the company's commitment to innovation is evident in its R&D spending, crucial for staying competitive in precision control technologies. Notably, its revenue growth forecast at an impressive 31.5% annually suggests potential recovery and expansion in its market presence. Moreover, earnings are expected to surge by 73.4% annually over the next three years, indicating optimism for profitability and strategic resilience amidst financial volatilities.

Hualan Biological Vaccine (SZSE:301207)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hualan Biological Vaccine Inc. focuses on the research, development, production, and sale of vaccines in China and has a market capitalization of CN¥11.73 billion.

Operations: Hualan Biological Vaccine Inc. generates revenue primarily through the sale of vaccines developed and produced in China. The company emphasizes research and development to support its vaccine portfolio, contributing to its market presence within the region.

Hualan Biological Vaccine has navigated a challenging fiscal period with revenue dropping to CNY 957.36 million from CNY 1,718.27 million year-over-year as of September 2024, alongside a significant reduction in net income to CNY 267.36 million from CNY 629.71 million. Despite these financial headwinds, the company's strategic commitment to research and development remains robust, underpinning its potential for recovery and future growth in the biotech sector. This dedication is mirrored in their recent share repurchase initiative, where they bought back over 3.8 million shares for CNY 66.83 million, signaling confidence in their operational resilience and market position.

Where To Now?

- Delve into our full catalog of 1291 High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Huazhong Numerical ControlLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300161

Wuhan Huazhong Numerical ControlLtd

Wuhan Huazhong Numerical Control Co.,Ltd.

Slightly overvalued with imperfect balance sheet.