AcrobiosystemsLtd's (SZSE:301080) Weak Earnings Might Be Worse Than They Appear

Shareholders didn't appear too concerned by Acrobiosystems Co.,Ltd.'s (SZSE:301080) weak earnings. Our analysis suggests that they may be missing some concerning details underlying the profit numbers.

Check out our latest analysis for AcrobiosystemsLtd

A Closer Look At AcrobiosystemsLtd's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

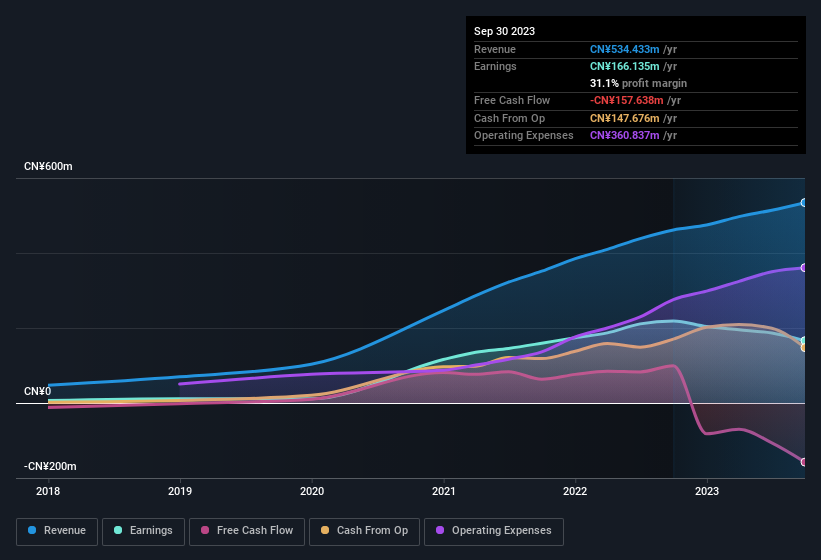

AcrobiosystemsLtd has an accrual ratio of 0.73 for the year to September 2023. As a general rule, that bodes poorly for future profitability. And indeed, during the period the company didn't produce any free cash flow whatsoever. Even though it reported a profit of CN¥166.1m, a look at free cash flow indicates it actually burnt through CN¥158m in the last year. It's worth noting that AcrobiosystemsLtd generated positive FCF of CN¥99m a year ago, so at least they've done it in the past. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that AcrobiosystemsLtd's profit was boosted by unusual items worth CN¥21m in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. If AcrobiosystemsLtd doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On AcrobiosystemsLtd's Profit Performance

AcrobiosystemsLtd had a weak accrual ratio, but its profit did receive a boost from unusual items. Considering all this we'd argue AcrobiosystemsLtd's profits probably give an overly generous impression of its sustainable level of profitability. If you'd like to know more about AcrobiosystemsLtd as a business, it's important to be aware of any risks it's facing. For example, we've found that AcrobiosystemsLtd has 3 warning signs (2 are a bit concerning!) that deserve your attention before going any further with your analysis.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301080

AcrobiosystemsLtd

Engages in the development and manufacture of recombinant proteins, antibodies, and other biological reagents for pharmaceutical and biotechnology companies, and scientific research institutions.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026