Sino Biological,Inc.'s (SZSE:301047) P/E Is Still On The Mark Following 26% Share Price Bounce

The Sino Biological,Inc. (SZSE:301047) share price has done very well over the last month, posting an excellent gain of 26%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 14% in the last twelve months.

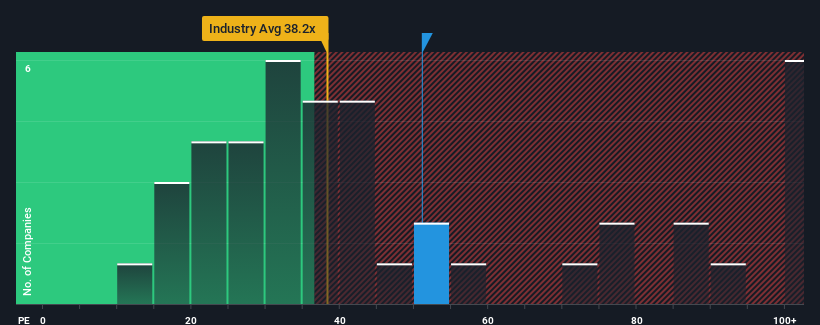

Since its price has surged higher, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 32x, you may consider Sino BiologicalInc as a stock to avoid entirely with its 51.1x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Sino BiologicalInc could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Sino BiologicalInc

How Is Sino BiologicalInc's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Sino BiologicalInc's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 29%. The last three years don't look nice either as the company has shrunk EPS by 88% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 55% over the next year. With the market only predicted to deliver 38%, the company is positioned for a stronger earnings result.

With this information, we can see why Sino BiologicalInc is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Sino BiologicalInc's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Sino BiologicalInc's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Sino BiologicalInc you should know about.

If these risks are making you reconsider your opinion on Sino BiologicalInc, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301047

Sino BiologicalInc

Provides recombinant protein and antibody reagents for life science researchers worldwide.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives