- Brazil

- /

- Transportation

- /

- BOVESPA:RAIL3

Rumo And Two Other Companies That May Be Trading Below Fair Value

Reviewed by Simply Wall St

Global markets have recently faced a downturn, with major benchmarks closing lower due to disappointing economic data and earnings reports. Amid this volatility, the search for undervalued stocks becomes even more crucial as investors seek opportunities that may offer resilience and potential growth. In such an environment, identifying stocks that are trading below their fair value can be particularly rewarding. These stocks often possess strong fundamentals but are temporarily overlooked or undervalued by the market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Best Pacific International Holdings (SEHK:2111) | HK$2.17 | HK$4.33 | 49.9% |

| Maire (BIT:MAIRE) | €6.87 | €13.66 | 49.7% |

| LaserBond (ASX:LBL) | A$0.69 | A$1.37 | 49.8% |

| Changsha DIALINE New Material Sci.&Tech (SZSE:300700) | CN¥6.73 | CN¥13.36 | 49.6% |

| Avidbank Holdings (OTCPK:AVBH) | US$18.50 | US$36.98 | 50% |

| Stille (OM:STIL) | SEK224.00 | SEK446.03 | 49.8% |

| Global Tax Free (KOSDAQ:A204620) | ₩3440.00 | ₩6857.71 | 49.8% |

| Zscaler (NasdaqGS:ZS) | US$165.23 | US$329.47 | 49.9% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | US$476.91 | US$949.62 | 49.8% |

| Sandfire Resources (ASX:SFR) | A$8.38 | A$16.67 | 49.7% |

Let's explore several standout options from the results in the screener.

Rumo (BOVESPA:RAIL3)

Overview: Rumo S.A., with a market cap of R$41.97 billion, operates through its subsidiaries to provide rail transportation services.

Operations: The company's revenue segments are comprised of R$8.96 billion from North Operations, R$2.15 billion from South Operations, and R$597.42 million from Container Operations.

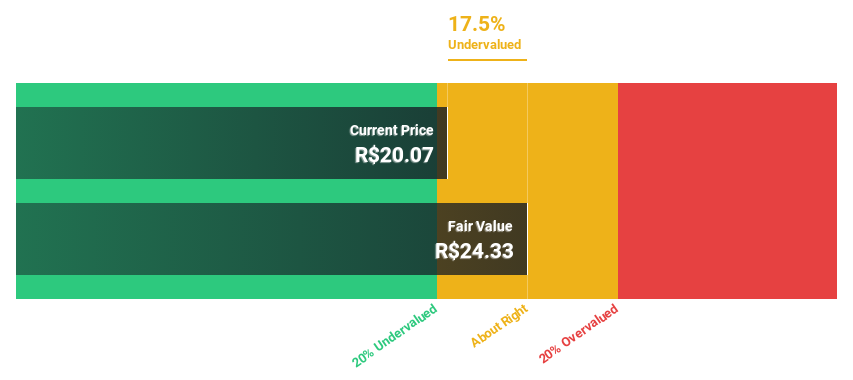

Estimated Discount To Fair Value: 13%

Rumo S.A. appears undervalued based on cash flows, trading at R$22.69, below the estimated fair value of R$26.09. Recent earnings show net income surged to BRL 368.98 million from BRL 73.39 million a year ago, with basic EPS rising significantly to BRL 0.1995 from BRL 0.03962. Despite high earnings growth forecasts (25% annually), interest payments are not well covered by earnings, and Return on Equity is expected to remain low at 14.6%.

- Our growth report here indicates Rumo may be poised for an improving outlook.

- Dive into the specifics of Rumo here with our thorough financial health report.

Sinomine Resource Group (SZSE:002738)

Overview: Sinomine Resource Group Co., Ltd. operates as a geological exploration technology services company with a market cap of CN¥18.98 billion.

Operations: Sinomine Resource Group Co., Ltd. generates revenue through geological exploration technology services, with a market cap of CN¥18.98 billion.

Estimated Discount To Fair Value: 10.2%

Sinomine Resource Group is trading at CN¥27.05, slightly below its estimated fair value of CN¥30.11 and 10.2% under analysts' price targets, suggesting it is undervalued based on cash flows. Despite a recent decline in profit margins to 27%, revenue growth is forecasted at 24.7% annually, outpacing the market's 13.5%. However, the dividend yield of 3.7% isn't well covered by free cash flows, and future Return on Equity remains modest at 14%.

- Upon reviewing our latest growth report, Sinomine Resource Group's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Sinomine Resource Group with our detailed financial health report.

Zhejiang Wolwo Bio-Pharmaceutical (SZSE:300357)

Overview: Zhejiang Wolwo Bio-Pharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, production, and sale of pharmaceutical products for diagnosing and treating allergic diseases, with a market cap of CN¥10.02 billion.

Operations: Revenue from the research, development, production, and sales of pharmaceuticals for Zhejiang Wolwo Bio-Pharmaceutical Co., Ltd. stands at CN¥881.30 million.

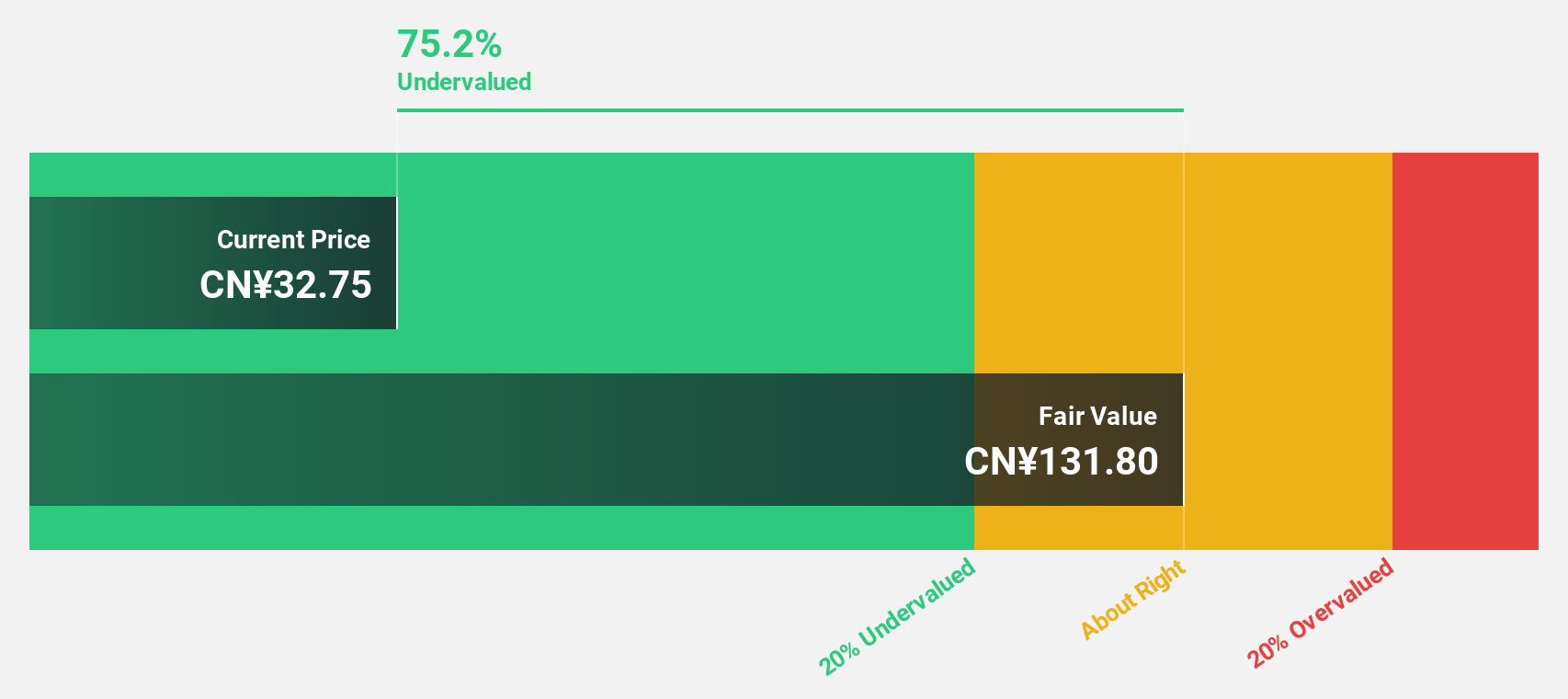

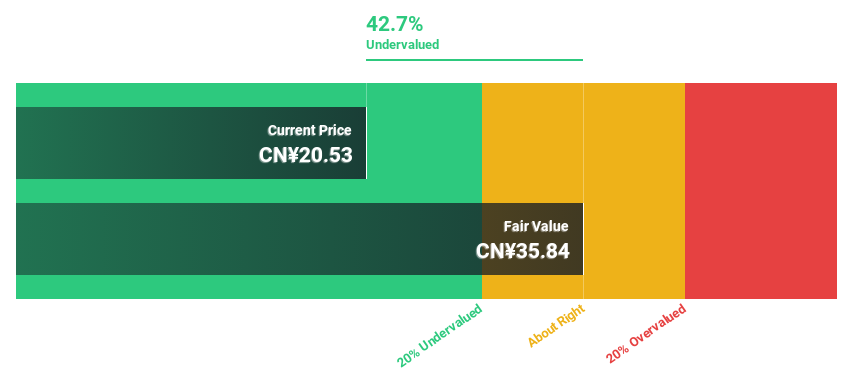

Estimated Discount To Fair Value: 44.5%

Zhejiang Wolwo Bio-Pharmaceutical is trading at CN¥19.88, significantly below its estimated fair value of CN¥35.84, indicating it is undervalued based on cash flows. Despite an unstable dividend track record and a forecasted low Return on Equity of 16.8% in three years, the company’s revenue and earnings are expected to grow over 21% annually, outpacing the broader Chinese market's growth rates. This suggests strong potential for future profitability despite recent dividend decreases.

- In light of our recent growth report, it seems possible that Zhejiang Wolwo Bio-Pharmaceutical's financial performance will exceed current levels.

- Get an in-depth perspective on Zhejiang Wolwo Bio-Pharmaceutical's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Dive into all 899 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:RAIL3

Reasonable growth potential with mediocre balance sheet.