- Singapore

- /

- Consumer Finance

- /

- SGX:T6I

Asian Penny Stocks: 3 Picks With Market Caps Below US$2B

Reviewed by Simply Wall St

As global markets continue to navigate complex economic landscapes, Asian equities have shown resilience, with technology and AI sectors capturing investor interest despite broader growth concerns. For those exploring beyond traditional large-cap stocks, penny stocks—typically smaller or newer companies—remain an intriguing segment. While the term may seem dated, these stocks can still offer compelling opportunities when backed by strong financials and clear growth potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.77 | HK$2.26B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.63 | HK$2.18B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.96 | THB2.98B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.46 | SGD13.62B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$3.00 | NZ$252.29M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 958 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

ValueMax Group (SGX:T6I)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ValueMax Group Limited is an investment holding company involved in pawnbroking, moneylending, jewelry and watches retailing, and gold trading primarily in Singapore, with a market cap of SGD940 million.

Operations: The company generates revenue from pawnbroking (SGD85.76 million), moneylending (SGD66.87 million), and retail and trading of jewellery and gold (SGD374.23 million).

Market Cap: SGD940M

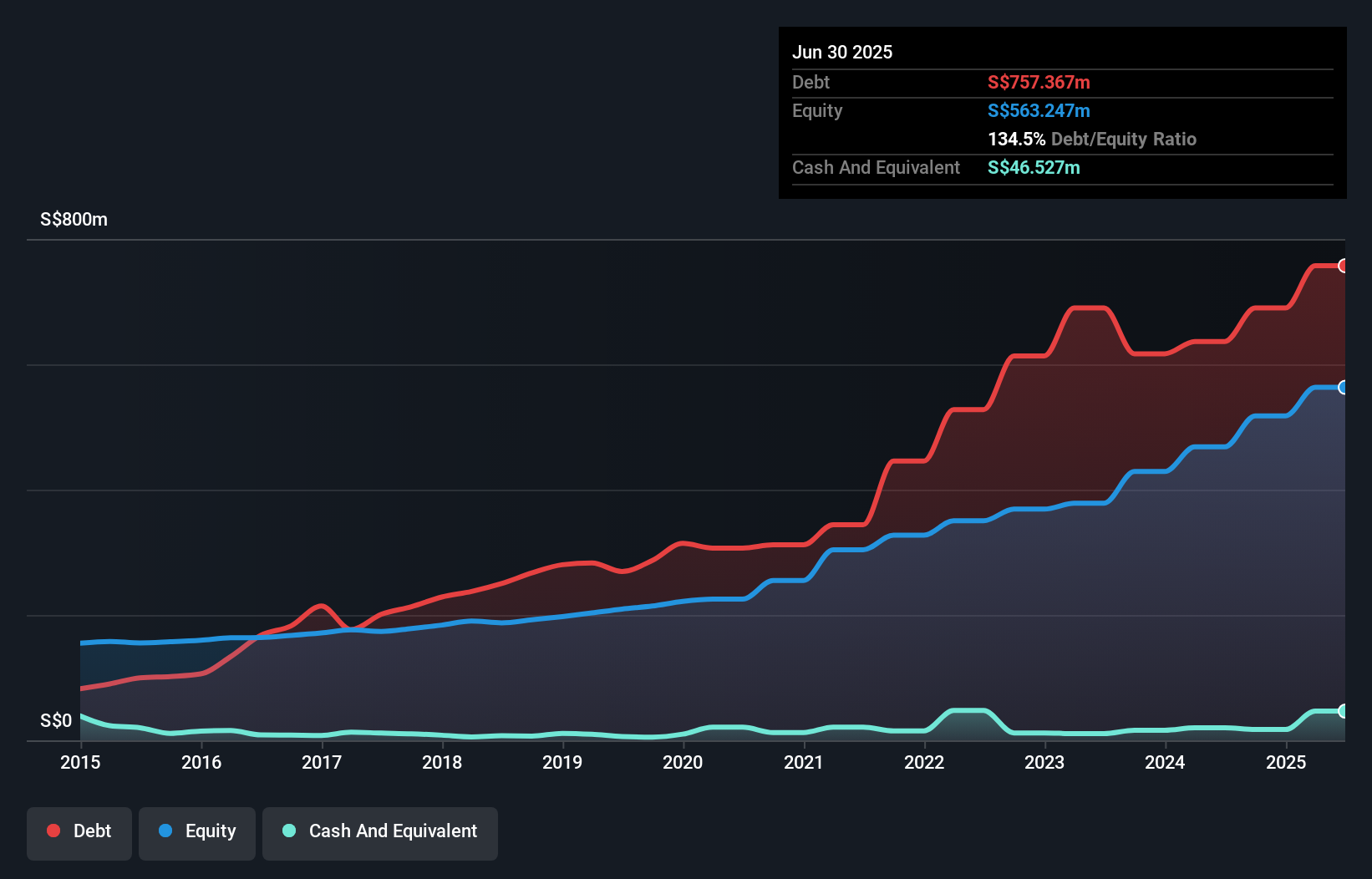

ValueMax Group demonstrates strong revenue streams, particularly from jewelry and gold trading (SGD374.23 million), while maintaining a robust financial position with short-term assets exceeding both short and long-term liabilities. Recent improvements in net profit margins to 19.3% and significant earnings growth of 51% over the past year highlight operational efficiency, although the company's high net debt to equity ratio of 126.2% remains a concern due to negative operating cash flow. The dividend yield of 2.68% is not well covered by free cash flows, suggesting potential sustainability issues despite experienced management and board oversight.

- Navigate through the intricacies of ValueMax Group with our comprehensive balance sheet health report here.

- Evaluate ValueMax Group's historical performance by accessing our past performance report.

Guizhou Xinbang Pharmaceutical (SZSE:002390)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guizhou Xinbang Pharmaceutical Co., Ltd. manufactures and sells traditional Chinese medicine and other pharmaceutical products both in China and internationally, with a market cap of CN¥7.47 billion.

Operations: Revenue Segments: No Revenue Segments Reported.

Market Cap: CN¥7.47B

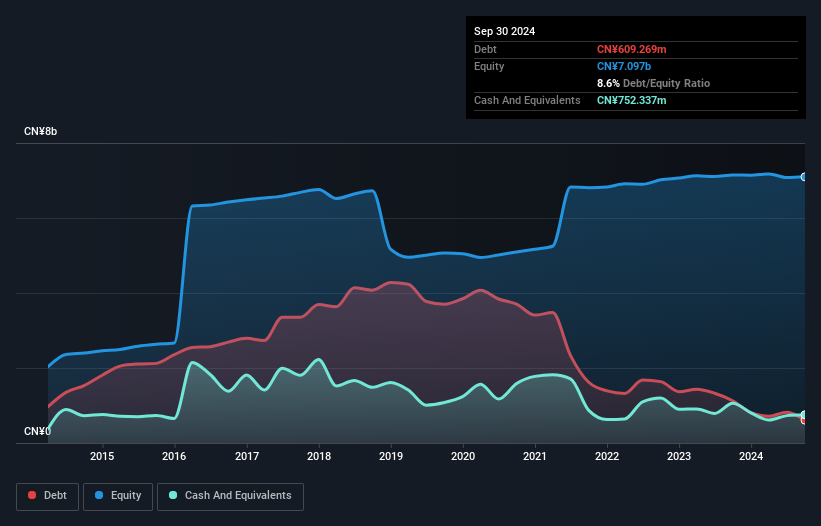

Guizhou Xinbang Pharmaceutical faces challenges with declining earnings, having decreased by 11% annually over the past five years and experiencing a recent negative earnings growth of 64.5%. Despite trading at a significant discount to its estimated fair value, profit margins have contracted from 3.5% to 1.3%. The company's financial stability is supported by short-term assets exceeding liabilities and debt being well-covered by operating cash flow, although dividends are not adequately covered by earnings. Management's experience contrasts with an inexperienced board, while large one-off losses have affected recent financial results.

- Click to explore a detailed breakdown of our findings in Guizhou Xinbang Pharmaceutical's financial health report.

- Assess Guizhou Xinbang Pharmaceutical's previous results with our detailed historical performance reports.

Era (SZSE:002641)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Era Co., Ltd. operates in the plastic pipe and solar energy sectors in China with a market cap of CN¥5.49 billion.

Operations: The company generates revenue primarily from the Manufacturing Industry, amounting to CN¥5.90 billion.

Market Cap: CN¥5.49B

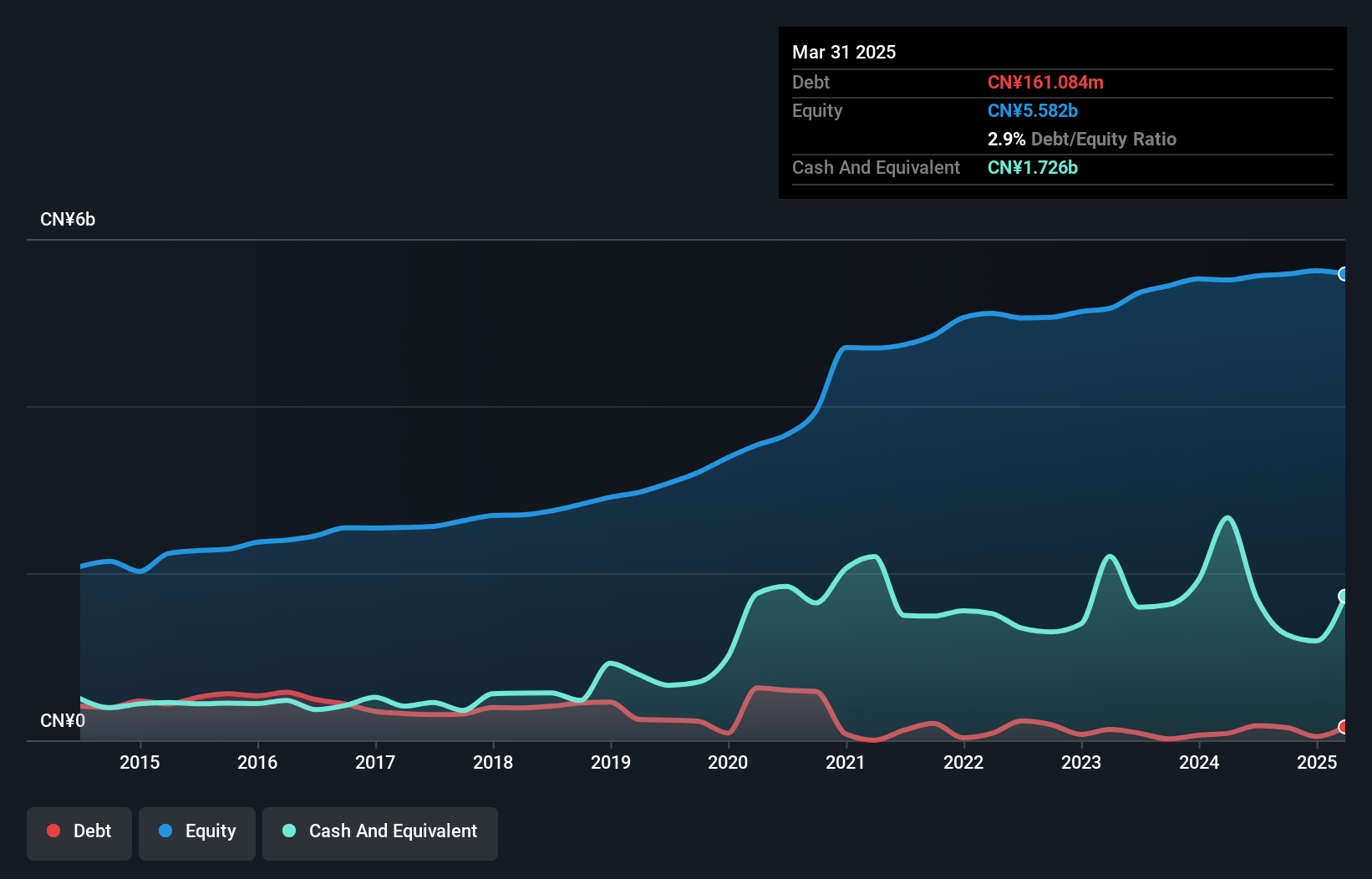

Era Co., Ltd. faces challenges with its declining earnings, having decreased by 36% annually over the past five years and experiencing a recent negative earnings growth of 62.1%. The company's profit margins have contracted from 3.5% to 1.4%, despite having more cash than total debt and operating cash flow well covering its debt obligations. Short-term assets exceed liabilities, ensuring financial stability, although dividends are not well covered by free cash flows. The management team is seasoned with an average tenure of 11.3 years, but large one-off gains have impacted recent financial results significantly.

- Dive into the specifics of Era here with our thorough balance sheet health report.

- Examine Era's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Jump into our full catalog of 958 Asian Penny Stocks here.

- Looking For Alternative Opportunities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:T6I

ValueMax Group

An investment holding company, engages in the pawnbroking, moneylending, jewelry and watches retailing, and gold trading businesses primarily in Singapore.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026