A Piece Of The Puzzle Missing From Yifan Pharmaceutical Co., Ltd.'s (SZSE:002019) Share Price

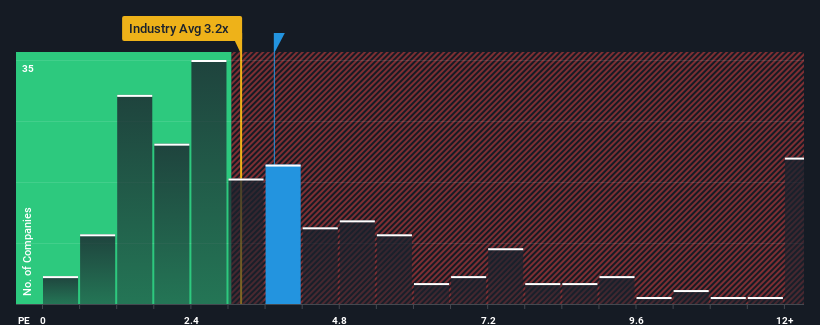

It's not a stretch to say that Yifan Pharmaceutical Co., Ltd.'s (SZSE:002019) price-to-sales (or "P/S") ratio of 3.7x right now seems quite "middle-of-the-road" for companies in the Pharmaceuticals industry in China, where the median P/S ratio is around 3.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Yifan Pharmaceutical

How Yifan Pharmaceutical Has Been Performing

With revenue growth that's inferior to most other companies of late, Yifan Pharmaceutical has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Yifan Pharmaceutical will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Yifan Pharmaceutical would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 8.0%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 27% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 30% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 17%, which is noticeably less attractive.

In light of this, it's curious that Yifan Pharmaceutical's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Yifan Pharmaceutical's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 2 warning signs we've spotted with Yifan Pharmaceutical.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002019

Yifan Pharmaceutical

Engages in the researches and develops, produces, and sells macromolecules, biosimilars, generic drugs, small molecules, synthetic biologics, and special traditional Chinese medicines in China Southeast Asia, Europe, North America, Singapore, South Korea, Italy, Germany, and the United States, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives