Undiscovered Gems Three Promising Stocks with Strong Fundamentals

Reviewed by Simply Wall St

As global markets experience a divergence with major indexes like the S&P 500 and Nasdaq Composite reaching record highs, the Russell 2000 Index has seen a decline following its recent outperformance of larger-cap peers. This mixed market environment highlights the importance of identifying stocks with strong fundamentals that can offer resilience and potential growth opportunities. In this context, discovering lesser-known companies with robust financial health becomes crucial for investors seeking to navigate these dynamic conditions effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shanxi Huaxiang Group (SHSE:603112)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanxi Huaxiang Group Co., Ltd. is involved in the research, development, production, and sale of customized metal parts both in China and internationally, with a market cap of CN¥6.06 billion.

Operations: Shanxi Huaxiang Group generates revenue primarily from the sale of customized metal parts. The company focuses on research and development to enhance its product offerings, which impacts its cost structure and profitability.

Shanxi Huaxiang Group has been making waves with its impressive earnings growth of 52.1% over the past year, outpacing the broader Machinery industry, which saw a -0.4% change. The company's price-to-earnings ratio stands at 13.5x, significantly lower than the CN market average of 37.3x, suggesting it's trading at attractive value relative to peers. Additionally, Shanxi Huaxiang's debt is well-managed with interest payments covered 11.9 times by EBIT and more cash on hand than total debt levels indicate financial stability. Recent developments include raising approximately CNY 207 million through a private placement and being added to the S&P Global BMI Index, signaling positive investor sentiment and potential for future growth in its sector.

Jiuzhitang (SZSE:000989)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiuzhitang Co., Ltd. is a company that offers traditional Chinese, chemical, biological, and health medicine products in China with a market cap of CN¥6.64 billion.

Operations: The company generates revenue through the sale of traditional Chinese, chemical, biological, and health medicine products. Its net profit margin is 10.5%, indicating efficiency in converting sales into actual profit.

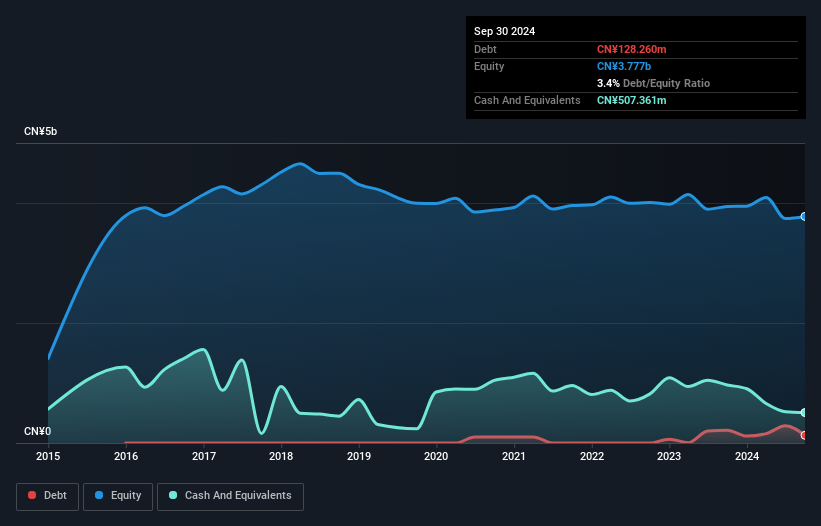

Jiuzhitang, a smaller player in the pharmaceutical sector, has seen its debt to equity ratio rise from 0% to 3.4% over five years, suggesting a cautious approach towards leveraging. Despite negative earnings growth of -2.5%, its price-to-earnings ratio of 26.7x remains attractive compared to the broader CN market at 37.3x, indicating potential undervaluation. The company repurchased 9.41 million shares for CNY 74.32 million in recent months, reflecting confidence in its valuation amidst fluctuating sales and net income figures—CNY 2 billion and CNY 240 million respectively for the latest nine-month period ending September 2024.

- Navigate through the intricacies of Jiuzhitang with our comprehensive health report here.

Gain insights into Jiuzhitang's past trends and performance with our Past report.

Ningbo Exciton Technology (SZSE:300566)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Exciton Technology Co., Ltd. focuses on the research, development, manufacture, and marketing of optical and functional films in China with a market cap of CN¥4.89 billion.

Operations: The primary revenue stream for Ningbo Exciton Technology is its electronic components and parts segment, generating CN¥2.30 billion.

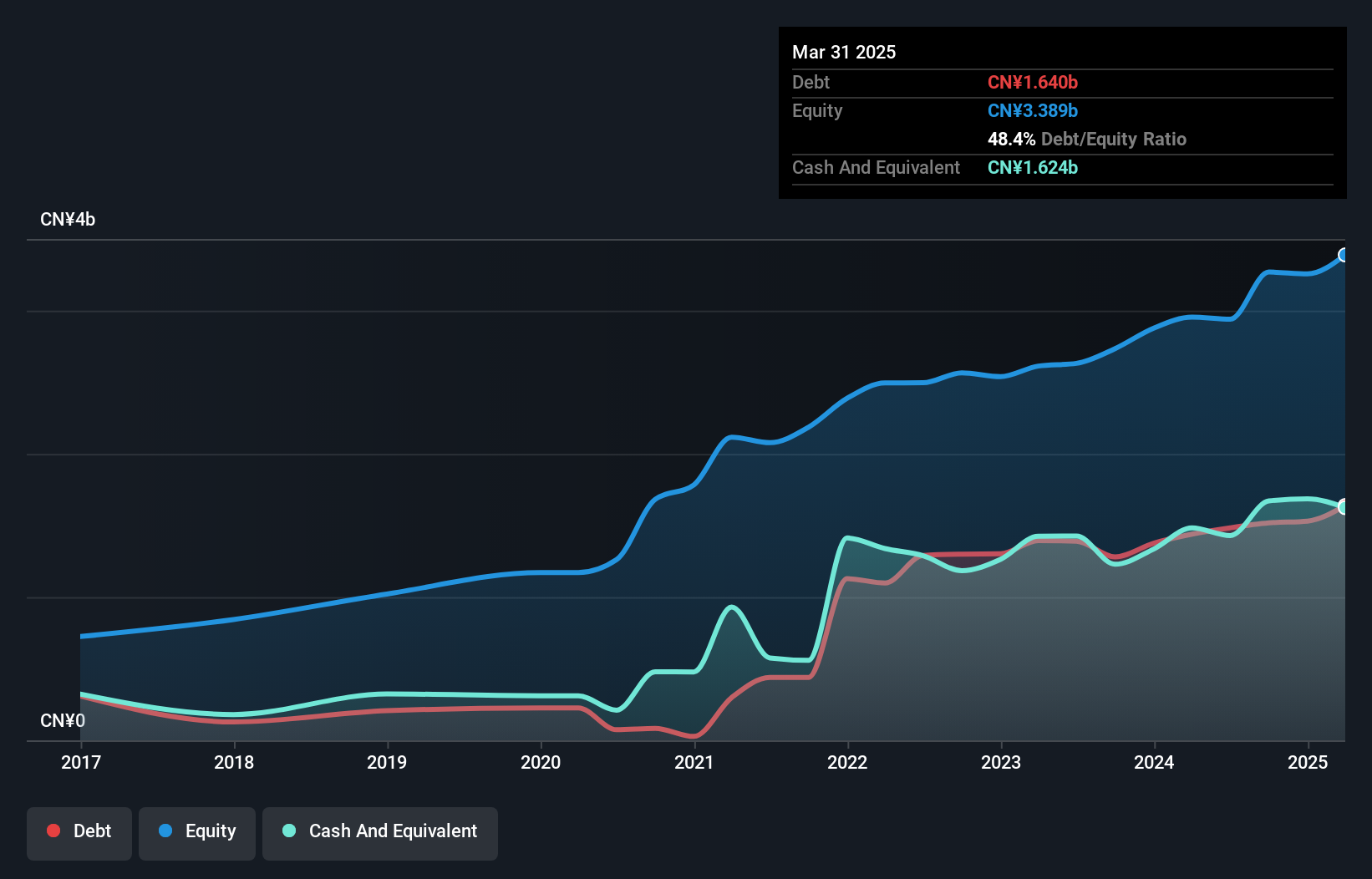

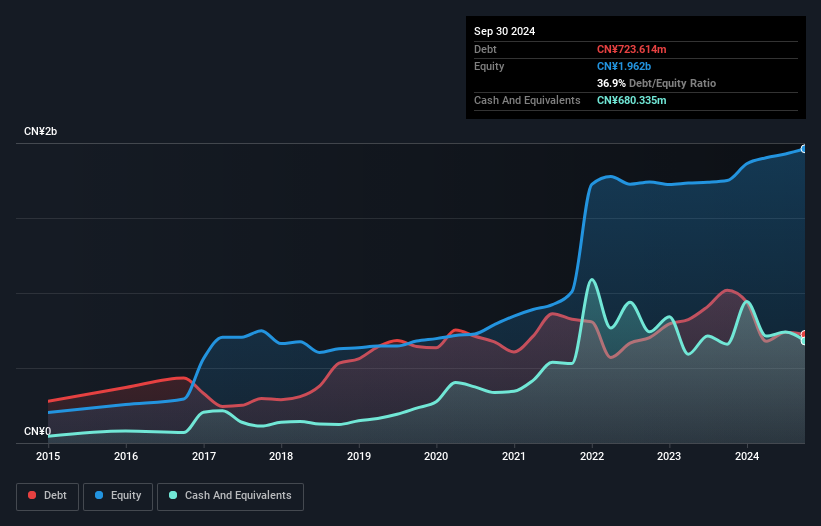

Exciton Technology, a dynamic player in the chemicals sector, has shown impressive earnings growth of 102.3% over the past year, outpacing the industry average. The company's net debt to equity ratio stands at a satisfactory 2.2%, reflecting prudent financial management as it reduced from 94.8% to 36.9% over five years. Despite a slight dip in sales to CN¥1,639 million for the first nine months of 2024 compared to last year, net income surged to CN¥169 million from CN¥88 million, showcasing robust profitability aided by strategic share repurchases totaling CNY30 million this year under its buyback program.

- Click here and access our complete health analysis report to understand the dynamics of Ningbo Exciton Technology.

Learn about Ningbo Exciton Technology's historical performance.

Make It Happen

- Navigate through the entire inventory of 4630 Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000989

Jiuzhitang

Provides traditional Chinese, chemical, biological, and health medicine products in China.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives