Undiscovered Gems Three Promising Stocks to Watch in February 2025

Reviewed by Simply Wall St

In the midst of geopolitical tensions and consumer spending concerns, global markets have experienced volatility, with major indices like the S&P 500 seeing early gains erased by week's end. As economic indicators such as U.S. Services PMI enter contraction territory and inflation expectations rise, investors are increasingly seeking opportunities in small-cap stocks that may offer resilience amid broader market uncertainties. In this environment, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that can withstand economic pressures.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Formula Systems (1985) | 37.70% | 9.99% | 13.08% | ★★★★★★ |

| Isracard | 69.54% | 9.35% | 3.37% | ★★★★★☆ |

| Polyram Plastic Industries | 45.46% | 11.39% | 10.98% | ★★★★★☆ |

| C. Mer Industries | 131.82% | 12.24% | 75.61% | ★★★★★☆ |

| Terminal X Online | 20.33% | 18.40% | 20.81% | ★★★★★☆ |

| Invest Bank | 126.08% | 12.31% | 20.26% | ★★★★☆☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

China Sports Industry Group (SHSE:600158)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Sports Industry Group Co., Ltd. operates in the real estate and sports sectors both within China and internationally, with a market capitalization of CN¥7.63 billion.

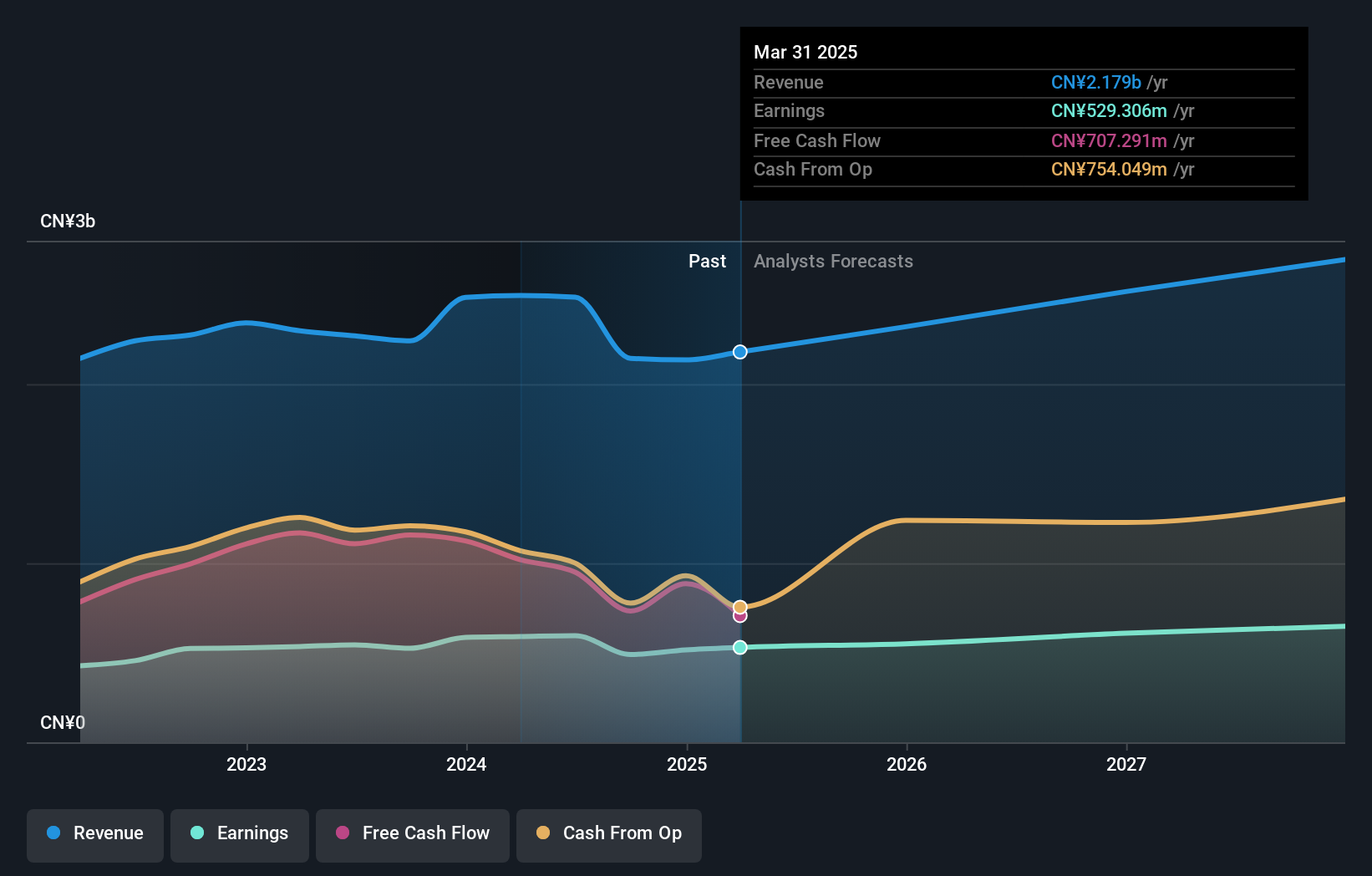

Operations: China Sports Industry Group generates revenue primarily from its real estate and sports business activities. The company's financial performance is highlighted by a net profit margin of 7.5%, reflecting its ability to convert sales into actual profit after expenses.

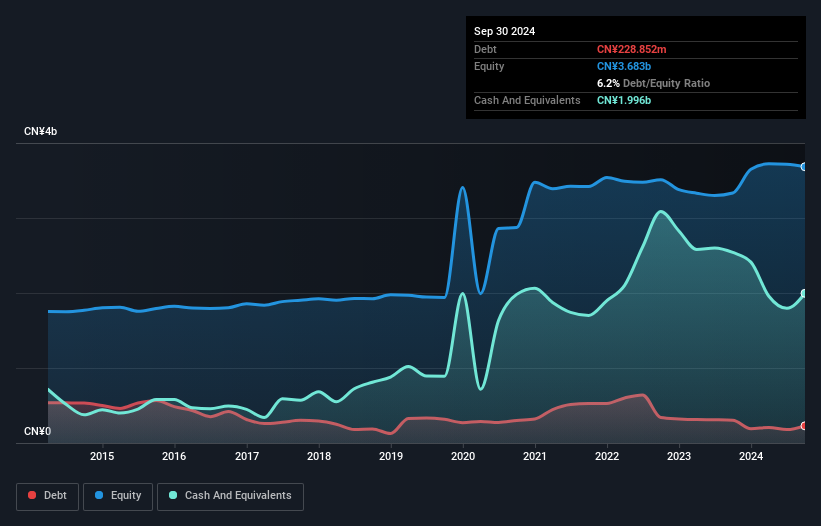

China Sports Industry Group, a smaller player in its sector, has shown significant earnings growth of 841% over the past year, outpacing the Real Estate industry's -38% performance. Despite this impressive surge, its earnings have decreased by an average of 3.9% annually over five years. The company’s debt-to-equity ratio has improved from 16.3 to 6.2 in five years, indicating a stronger balance sheet position now with more cash than total debt. While it doesn't generate positive free cash flow yet, its high level of non-cash earnings and ability to cover interest payments suggest potential for future stability and growth within its industry context.

Shandong Wit Dyne HealthLtd (SZSE:000915)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Wit Dyne Health Co., Ltd. operates in the pharmaceutical industry in China and has a market capitalization of CN¥6.16 billion.

Operations: Shandong Wit Dyne Health Co., Ltd. generates revenue primarily through its pharmaceutical business in China. The company has a market capitalization of CN¥6.16 billion, reflecting its position within the industry.

Shandong Wit Dyne Health Ltd., a nimble player in the pharmaceutical sector, presents an intriguing financial profile. With no debt on its books, the company stands out for its fiscal prudence compared to five years ago when it had a debt-to-equity ratio of 0.8. Despite recent challenges with earnings dropping by 6.7%, it remains a good value proposition, trading at about 44% below estimated fair value and offering high-quality earnings. The company's forecasted annual earnings growth of over 11% suggests potential upside as industry dynamics evolve, bolstered by positive free cash flow trends.

Shenzhen Riland Industry Group (SZSE:300154)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Riland Industry Group Co., Ltd engages in the research, development, manufacturing, sales, and servicing of inverter welding and cutting equipment, along with related products and accessories both in China and internationally, with a market cap of approximately CN¥4.82 billion.

Operations: Riland's revenue streams primarily include the sales of inverter welding and cutting equipment, welding automation products, and related accessories. The company focuses on both domestic and international markets. Gross profit margin trends can provide insights into its cost management effectiveness over time.

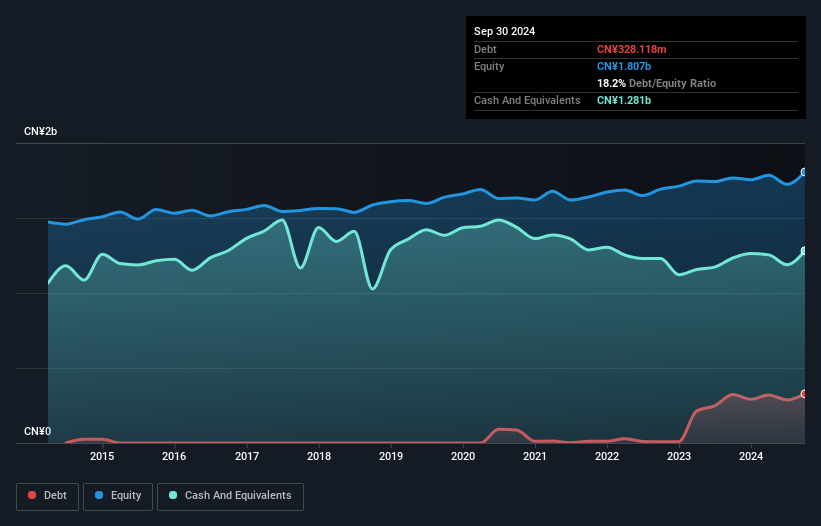

Shenzhen Riland Industry Group, a smaller player in the machinery sector, has recently experienced a notable earnings growth of 19.1%, surpassing the industry average of -0.06%. The company reported a significant one-off gain of CN¥88M in its latest financial results, which seems to have bolstered its earnings quality. Although the debt-to-equity ratio increased to 18.2% over five years, it remains manageable with more cash than total debt and sufficient interest coverage. A price-to-earnings ratio of 34.6x suggests good value compared to the broader CN market at 38.1x, despite recent share price volatility.

Where To Now?

- Navigate through the entire inventory of 4756 Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000915

Shandong Wit Dyne HealthLtd

Engages in the pharmaceutical business in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives