It's A Story Of Risk Vs Reward With Changchun High-Tech Industry (Group) Co., Ltd. (SZSE:000661)

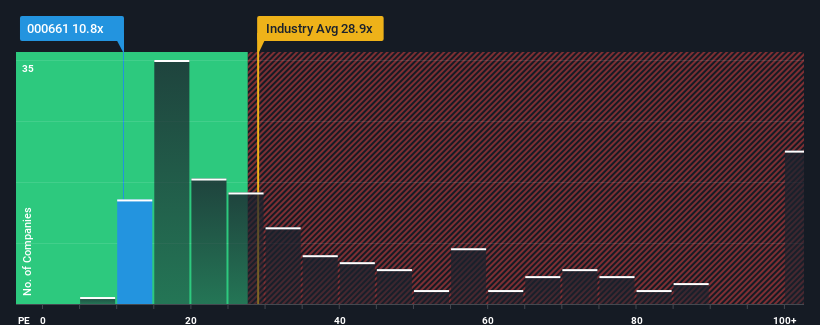

Changchun High-Tech Industry (Group) Co., Ltd.'s (SZSE:000661) price-to-earnings (or "P/E") ratio of 10.8x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 39x and even P/E's above 75x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times haven't been advantageous for Changchun High-Tech Industry (Group) as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Changchun High-Tech Industry (Group)

Is There Any Growth For Changchun High-Tech Industry (Group)?

Changchun High-Tech Industry (Group)'s P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. The last three years don't look nice either as the company has shrunk EPS by 6.0% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 51% over the next year. With the market only predicted to deliver 37%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Changchun High-Tech Industry (Group) is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Changchun High-Tech Industry (Group)'s analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Changchun High-Tech Industry (Group) with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000661

Changchun High-Tech Industry (Group)

Researches, develops, manufactures, and sells biopharmaceuticals and traditional Chinese medicines products in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives