- China

- /

- Semiconductors

- /

- SHSE:688599

3 High-Yield Dividend Stocks On The Chinese Exchange With Yields Up To 3.7%

Reviewed by Simply Wall St

As global markets navigate through a mix of challenges and opportunities, Chinese equities have shown resilience with the Shanghai Composite Index witnessing modest gains. In this context, high-yield dividend stocks on the Chinese exchange present a compelling aspect for investors looking for potential income in a fluctuating economic landscape.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 4.71% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 4.13% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.56% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.03% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.60% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.97% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.63% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.78% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.70% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.78% | ★★★★★★ |

Click here to see the full list of 257 stocks from our Top Chinese Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

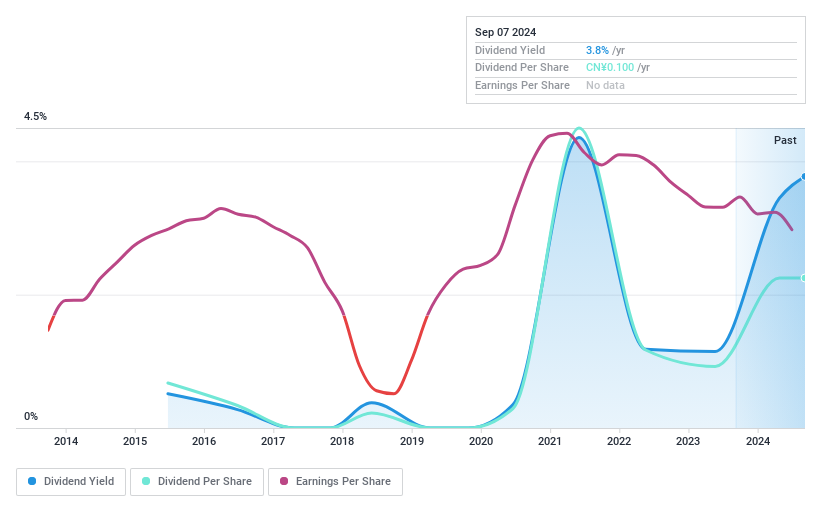

Jiangsu JIXIN Wind Energy Technology (SHSE:601218)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu JIXIN Wind Energy Technology Co., Ltd. is a company that specializes in the development and manufacturing of wind energy technologies, with a market capitalization of approximately CN¥2.76 billion.

Operations: Jiangsu JIXIN Wind Energy Technology Co., Ltd. does not have detailed revenue segment information available.

Dividend Yield: 3.5%

Jiangsu JIXIN Wind Energy Technology offers a dividend yield of 3.51%, ranking in the top 25% in the Chinese market. However, its dividend history is marked by volatility with significant annual fluctuations over less than a decade of payouts. Despite this, both earnings (payout ratio: 72.6%) and cash flows (cash payout ratio: 27%) adequately cover dividends, suggesting sustainability from a financial perspective. Recent earnings show growth with net income rising to CNY 12.34 million from CNY 10.22 million year-over-year, supporting potential stability in future dividends.

- Navigate through the intricacies of Jiangsu JIXIN Wind Energy Technology with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Jiangsu JIXIN Wind Energy Technology is trading behind its estimated value.

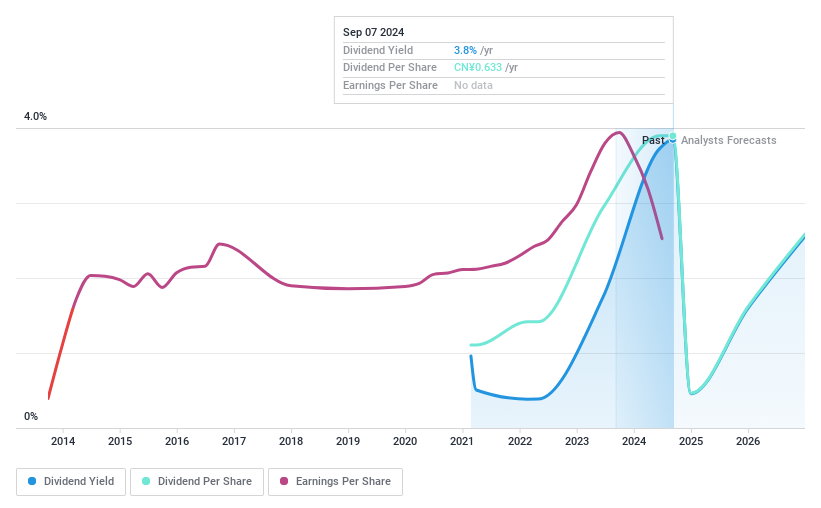

Trina Solar (SHSE:688599)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Trina Solar Co., Ltd. is a company that focuses on the research, development, production, and sales of photovoltaic (PV) modules across various global regions including China, Europe, and North America, with a market capitalization of approximately CN¥36.91 billion.

Operations: Trina Solar Co., Ltd. generates its revenue primarily through the production and sales of photovoltaic modules, with operations spanning China, Europe, North America, and several other regions globally.

Dividend Yield: 3.7%

Trina Solar's recent strategic expansion into Thailand and share repurchase program highlight its proactive approach in the renewable sector and financial management. With a CNY 1.2 billion buyback, capped at CNY 31 per share, it aims to convert corporate bonds into shares, enhancing shareholder value. Despite a less than decade-long dividend history, its dividends are supported by earnings with a payout ratio of 31.8% and cash flows with a cash payout ratio of 27.2%, indicating potential sustainability amid high debt levels.

- Click to explore a detailed breakdown of our findings in Trina Solar's dividend report.

- According our valuation report, there's an indication that Trina Solar's share price might be on the cheaper side.

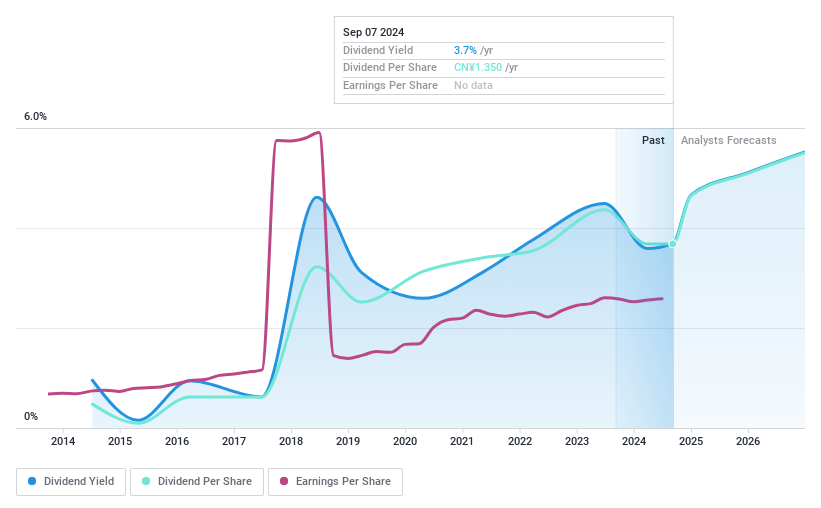

Livzon Pharmaceutical Group (SZSE:000513)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Livzon Pharmaceutical Group Inc., operating in the People's Republic of China, focuses on researching, developing, producing, exporting, and selling pharmaceutical products along with active pharmaceutical ingredients and intermediates, with a market capitalization of approximately CN¥30.49 billion.

Operations: Livzon Pharmaceutical Group Inc. generates its revenue primarily from pharmaceutical manufacturing, which amounted to approximately CN¥12.26 billion.

Dividend Yield: 3.5%

Livzon Pharmaceutical Group Inc. offers a dividend yield of 3.54%, ranking in the top 25% in the Chinese market, supported by earnings and cash flows with payout ratios of 63.3% and 40.9%, respectively. Despite this, the company has experienced unstable and unreliable dividend payments over the past decade, reflecting volatility with annual drops over 20%. Recent events include a decrease in dividends announced on June 28, 2024, setting a new rate at CNY13.50 per share for A shares payable on July 8, highlighting ongoing challenges in maintaining consistent shareholder returns.

- Click here and access our complete dividend analysis report to understand the dynamics of Livzon Pharmaceutical Group.

- Our valuation report unveils the possibility Livzon Pharmaceutical Group's shares may be trading at a discount.

Key Takeaways

- Delve into our full catalog of 257 Top Chinese Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trina Solar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688599

Trina Solar

Engages in the research and development, production, and sales of photovoltaic (PV) modules in China, Europe, North America, South America, Japan, the Asia Pacific, the Middle East, and North Africa.

Undervalued with moderate growth potential.