Liaoning Chengda Biotechnology Co.,Ltd.'s (SHSE:688739) Price Is Right But Growth Is Lacking

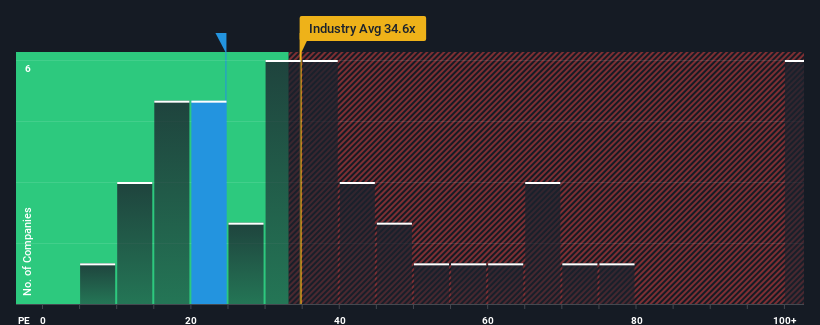

Liaoning Chengda Biotechnology Co.,Ltd.'s (SHSE:688739) price-to-earnings (or "P/E") ratio of 24.6x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 53x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For instance, Liaoning Chengda BiotechnologyLtd's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Liaoning Chengda BiotechnologyLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Liaoning Chengda BiotechnologyLtd would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 54% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 35% shows it's an unpleasant look.

In light of this, it's understandable that Liaoning Chengda BiotechnologyLtd's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Liaoning Chengda BiotechnologyLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Liaoning Chengda BiotechnologyLtd (at least 1 which can't be ignored), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688739

Liaoning Chengda BiotechnologyLtd

A biotechnology company, engages in the research and development, production, and sales of vaccines for human use in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives