- South Korea

- /

- Auto Components

- /

- KOSE:A004490

Exploring Undiscovered Gems In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are navigating a complex landscape marked by tariff uncertainties and mixed economic signals. While major indices like the S&P 500 have experienced slight declines amid these challenges, small-cap stocks present unique opportunities for investors seeking growth potential in an evolving economic environment. In this context, identifying promising stocks involves looking beyond immediate market fluctuations to find companies with strong fundamentals and resilience in their respective sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Golden House | 32.13% | -0.58% | 14.32% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Terminal X Online | 20.33% | 18.40% | 20.81% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sebang Global Battery (KOSE:A004490)

Simply Wall St Value Rating: ★★★★★☆

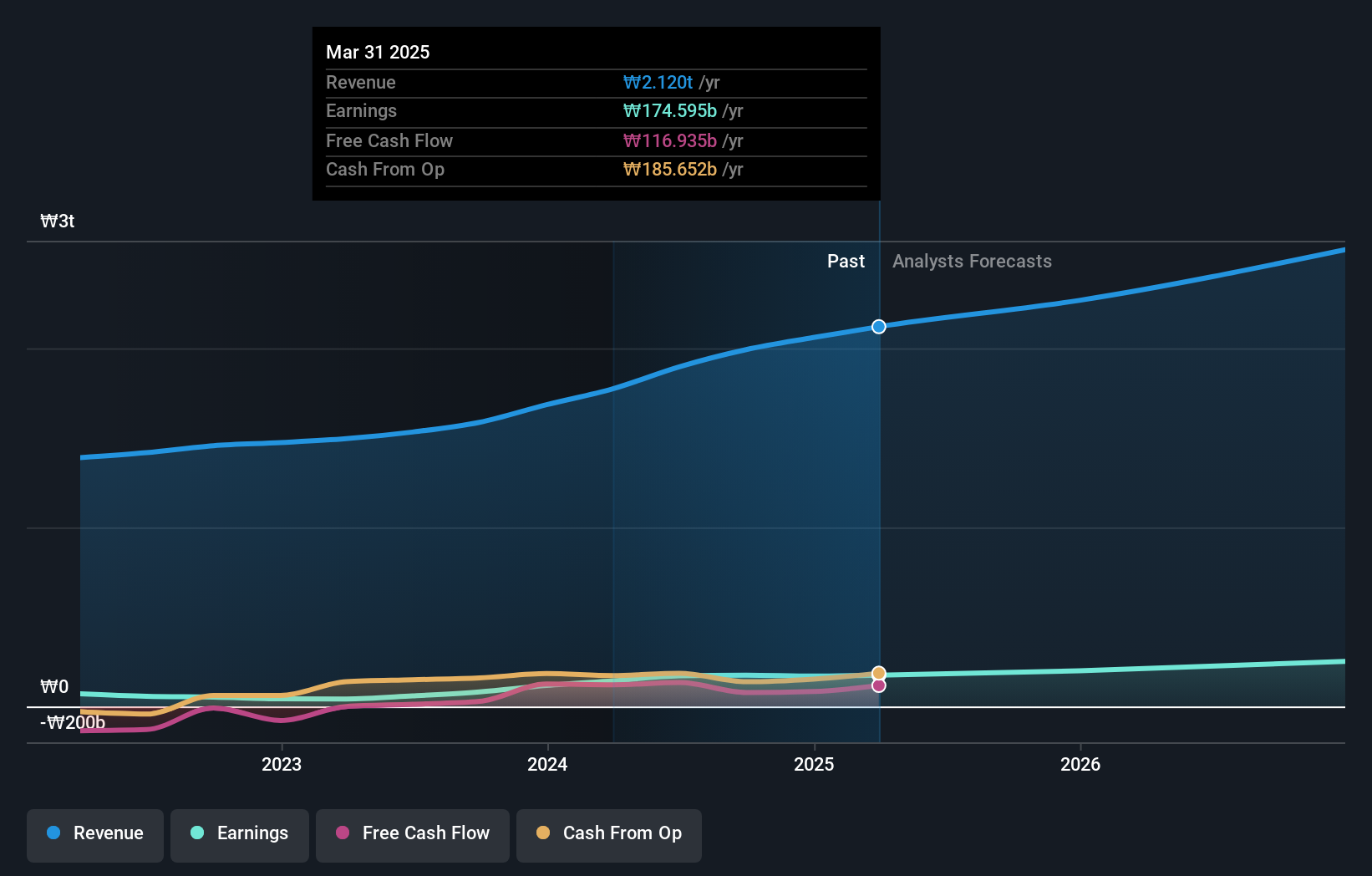

Overview: Sebang Global Battery Co., Ltd. and its subsidiaries focus on manufacturing and selling lead acid batteries both domestically in South Korea and internationally, with a market capitalization of approximately ₩1.12 trillion.

Operations: Sebang Global Battery generates revenue primarily from the manufacture and sale of automotive and industrial storage batteries, amounting to approximately ₩1.99 trillion.

Sebang Global Battery, a nimble player in the battery sector, showcases impressive financial health with cash surpassing total debt. Over the past year, earnings surged by 114%, outpacing the Auto Components industry's 10% growth rate. Despite a slight increase in its debt-to-equity ratio from 13.4 to 14.1 over five years, it remains profitable and free cash flow positive. Trading at about 75% below estimated fair value suggests potential undervaluation. With earnings projected to grow by nearly 12% annually and a recent dividend announcement of KRW700 set for December, Sebang seems poised for continued interest from investors seeking value opportunities.

- Unlock comprehensive insights into our analysis of Sebang Global Battery stock in this health report.

Evaluate Sebang Global Battery's historical performance by accessing our past performance report.

Beijing Sun-Novo Pharmaceutical Research (SHSE:688621)

Simply Wall St Value Rating: ★★★★★☆

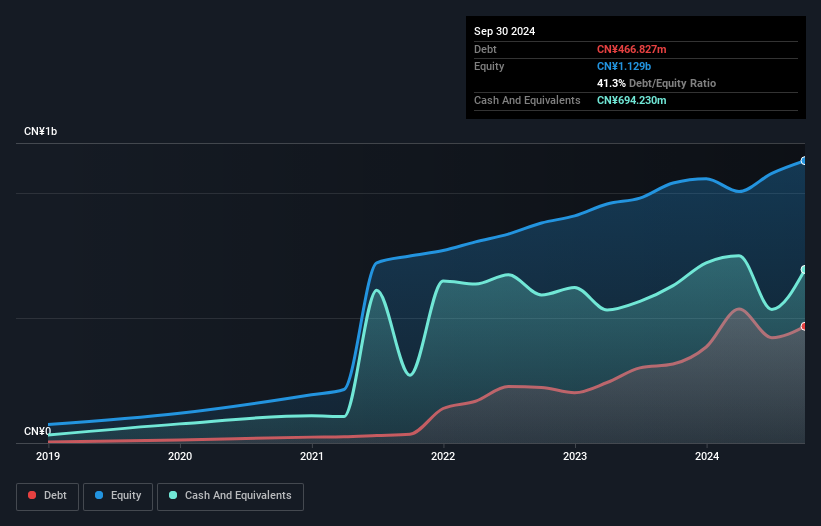

Overview: Beijing Sun-Novo Pharmaceutical Research Co., Ltd. is a contract research organization focused on drug research and development in China, with a market cap of CN¥4.18 billion.

Operations: Sun-Novo generates revenue primarily through its contract research services in drug development. The company has experienced fluctuations in its net profit margin, which was 12.5% in the most recent period.

Beijing Sun-Novo Pharmaceutical Research, a small cap player in the life sciences sector, has shown notable financial resilience. Over the past year, its earnings grew by 11.4%, outpacing the industry which saw a -13.5% change. The company's debt to equity ratio rose from 9.3% to 41.3% over five years, yet it remains well-positioned with more cash than total debt and high-quality earnings supporting interest payments comfortably. Its price-to-earnings ratio of 19.9x suggests good value against the broader CN market at 36.3x, indicating potential for future growth despite recent buyback inactivity.

Khgears International (TWSE:4571)

Simply Wall St Value Rating: ★★★★★★

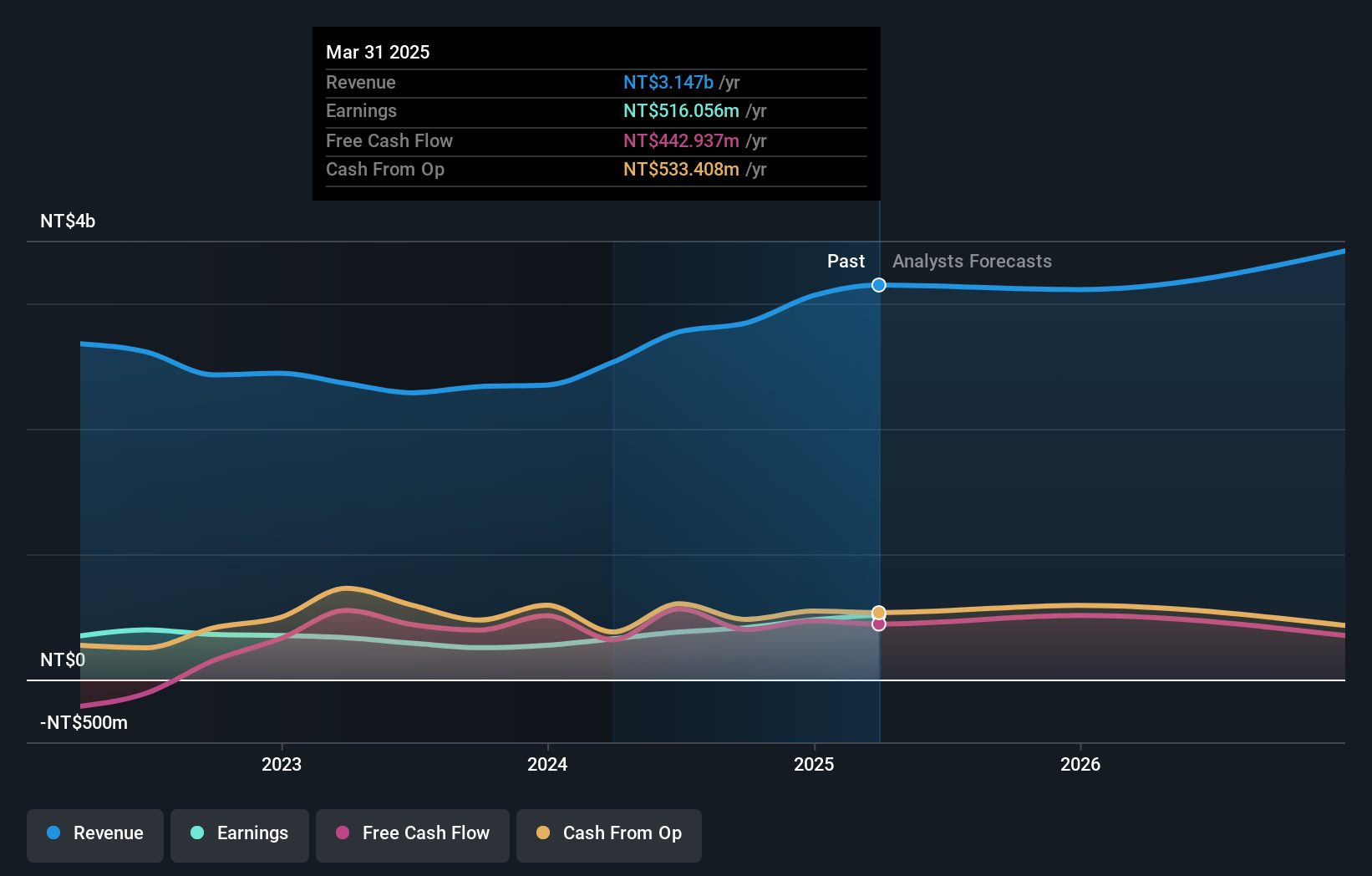

Overview: Khgears International Limited, along with its subsidiaries, is engaged in the manufacturing and sales of gears and gearboxes across Asia, the United States, and Europe, with a market capitalization of NT$11.14 billion.

Operations: Khgears International generates revenue primarily from its gear manufacturing and sales segment, amounting to NT$2.84 billion.

Khgears International, a compact player in the machinery industry, has been making waves with its impressive financial performance. Over the past year, earnings surged by 62.5%, outpacing the industry's growth of 14.6%. The company reported third-quarter sales of TWD 719.61 million and net income of TWD 97.57 million, both up from last year’s figures. Basic earnings per share rose to TWD 1.89 from TWD 1.19 a year ago, reflecting strong operational efficiency and high-quality earnings despite recent volatility in share price movements over three months, which might concern some investors looking for stability amidst growth potential.

Key Takeaways

- Investigate our full lineup of 4717 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A004490

Sebang Global Battery

Manufactures and sells lead acid batteries in South Korea and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives