- Singapore

- /

- Commercial Services

- /

- SGX:WJP

3 Penny Stocks With Market Caps As Low As US$100M To Watch

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with U.S. stocks closing out a strong 2024 despite recent volatility, investors are exploring diverse opportunities across various sectors. Penny stocks, though an older term, continue to capture attention as they represent smaller or less-established companies that could offer significant value. By focusing on those with robust financials and growth potential, investors can uncover promising opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.54 | MYR2.69B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £434.2M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.045 | £770.58M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,806 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

APAC Realty (SGX:CLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: APAC Realty Limited is an investment holding company offering real estate services in Singapore, Indonesia, Vietnam, and internationally with a market cap of SGD141.88 million.

Operations: The company generates revenue primarily from real estate brokerage income amounting to SGD554.50 million and rental income of SGD2.35 million.

Market Cap: SGD141.88M

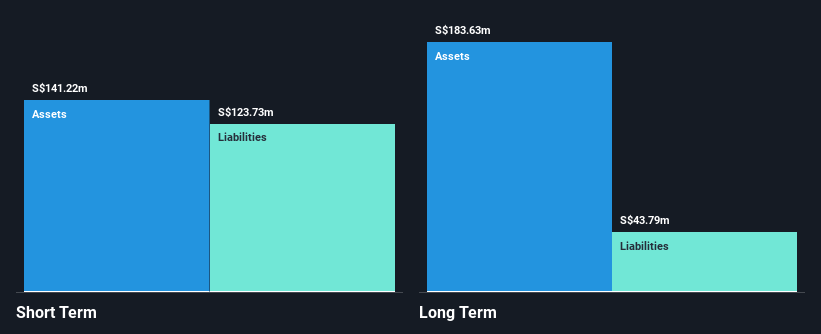

APAC Realty Limited, with a market cap of SGD141.88 million, generates substantial revenue from real estate brokerage and rental income. Despite a decline in earnings over the past year, its debt is well-managed, with operating cash flow covering 42.2% of debt and interest payments covered 8.5 times by EBIT. The company has reduced its debt-to-equity ratio significantly over five years and maintains strong short-term asset coverage for liabilities. However, recent board changes could impact strategic direction, as Andrew Scobie Hawkyard resigned for personal reasons after serving on key committees. Earnings are forecast to grow annually by 20.28%.

- Get an in-depth perspective on APAC Realty's performance by reading our balance sheet health report here.

- Learn about APAC Realty's future growth trajectory here.

VICOM (SGX:WJP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VICOM Ltd is an investment holding company that provides motor vehicle inspection and non-vehicle testing, inspection, and consultancy services in Singapore and internationally, with a market cap of SGD468.03 million.

Operations: The company generates revenue of SGD112.33 million from its vehicle inspection and non-vehicle testing services.

Market Cap: SGD468.03M

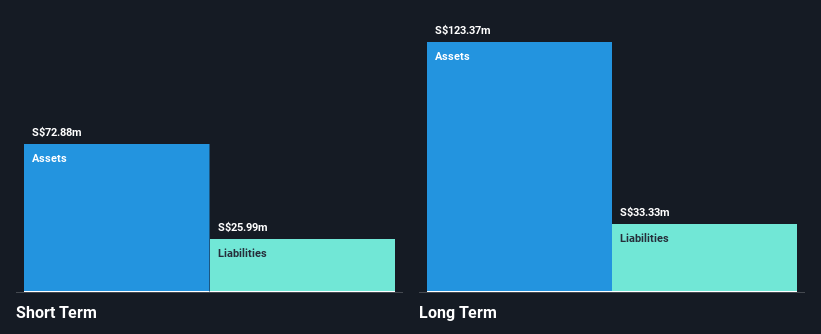

VICOM Ltd, with a market cap of SGD468.03 million, derives significant revenue from its vehicle inspection and non-vehicle testing services. The company boasts high-quality earnings and a strong financial position with no debt, supported by short-term assets exceeding both short- and long-term liabilities. While the dividend yield of 4.17% is not well covered by free cash flows, the return on equity remains high at 20.5%. Recent board changes include the appointment of Professor Karina Yew-Hoong Gin as an Independent Non-Executive Director, potentially enhancing governance and strategic oversight in technology-focused areas.

- Take a closer look at VICOM's potential here in our financial health report.

- Review our historical performance report to gain insights into VICOM's track record.

Shanghai MicuRx Pharmaceutical (SHSE:688373)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai MicuRx Pharmaceutical Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing drugs for unmet medical needs, with a market cap of CN¥3.26 billion.

Operations: The company generates its revenue primarily from the research and development of drugs and other related businesses, amounting to CN¥120.07 million.

Market Cap: CN¥3.26B

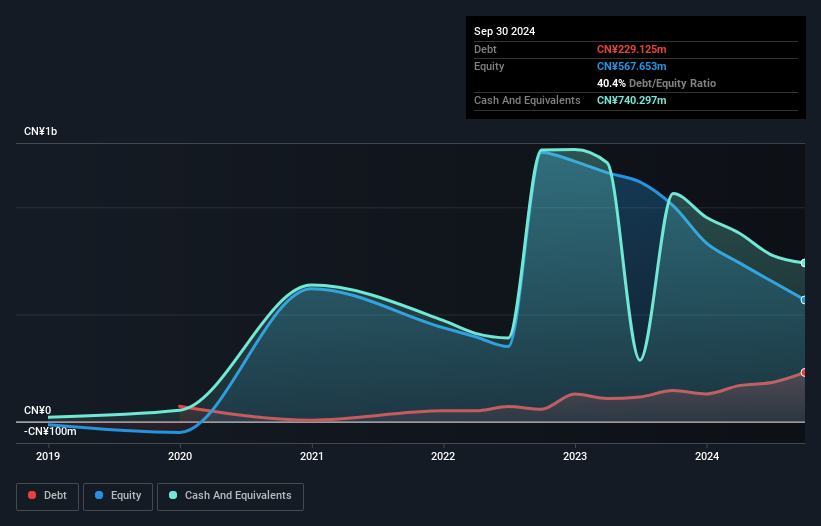

Shanghai MicuRx Pharmaceutical, with a market cap of CN¥3.26 billion, is focused on drug development for unmet medical needs. Despite being unprofitable and reporting a net loss of CN¥291.3 million for the first nine months of 2024, its short-term assets exceed both short- and long-term liabilities, indicating sound financial management. The company recently completed a successful Phase I trial for MRX-5, an oral antibacterial agent targeting nontuberculous mycobacterial infections. This advancement supports further development and highlights its potential in addressing increasing global NTM infection rates with innovative treatment strategies.

- Click to explore a detailed breakdown of our findings in Shanghai MicuRx Pharmaceutical's financial health report.

- Understand Shanghai MicuRx Pharmaceutical's earnings outlook by examining our growth report.

Summing It All Up

- Embark on your investment journey to our 5,806 Penny Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:WJP

VICOM

An investment holding company, engages in the provision of motor vehicle inspection, as well as non-vehicle testing, inspection, and consultancy services in Singapore and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives