There's Reason For Concern Over Jenkem Technology Co., Ltd.'s (SHSE:688356) Massive 26% Price Jump

Those holding Jenkem Technology Co., Ltd. (SHSE:688356) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 51% share price drop in the last twelve months.

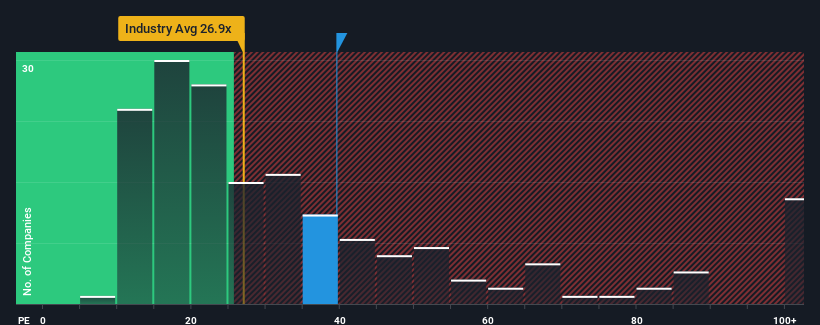

Following the firm bounce in price, Jenkem Technology may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 39.5x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Jenkem Technology has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Jenkem Technology

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Jenkem Technology's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 35%. Regardless, EPS has managed to lift by a handy 18% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 31% during the coming year according to the two analysts following the company. With the market predicted to deliver 41% growth , the company is positioned for a weaker earnings result.

In light of this, it's alarming that Jenkem Technology's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

The large bounce in Jenkem Technology's shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Jenkem Technology currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Jenkem Technology that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688356

Jenkem Technology

Develops and manufactures polyethylene glycol derivative (PEG) products in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives