Shenzhen Chipscreen Biosciences Co., Ltd.'s (SHSE:688321) Price In Tune With Revenues

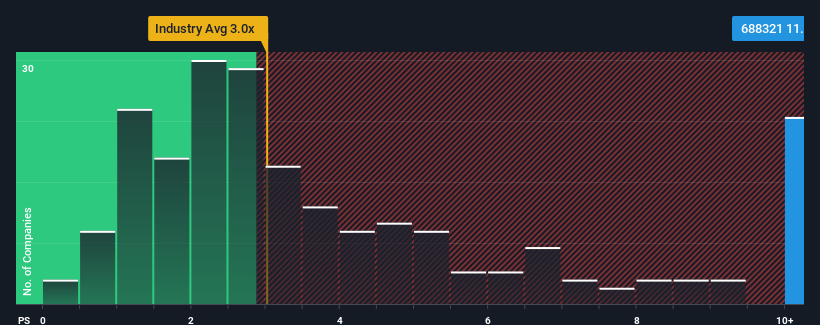

When you see that almost half of the companies in the Pharmaceuticals industry in China have price-to-sales ratios (or "P/S") below 3x, Shenzhen Chipscreen Biosciences Co., Ltd. (SHSE:688321) looks to be giving off strong sell signals with its 11.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Shenzhen Chipscreen Biosciences

How Has Shenzhen Chipscreen Biosciences Performed Recently?

Shenzhen Chipscreen Biosciences could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Shenzhen Chipscreen Biosciences' future stacks up against the industry? In that case, our free report is a great place to start.How Is Shenzhen Chipscreen Biosciences' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Shenzhen Chipscreen Biosciences' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 5.2% gain to the company's revenues. The latest three year period has also seen an excellent 71% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 40% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 17% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Shenzhen Chipscreen Biosciences' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shenzhen Chipscreen Biosciences' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Shenzhen Chipscreen Biosciences shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Shenzhen Chipscreen Biosciences with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688321

Shenzhen Chipscreen Biosciences

Shenzhen Chipscreen Biosciences Co., Ltd.

High growth potential with worrying balance sheet.

Market Insights

Community Narratives