Investors Appear Satisfied With Shenzhen Chipscreen Biosciences Co., Ltd.'s (SHSE:688321) Prospects As Shares Rocket 26%

Shenzhen Chipscreen Biosciences Co., Ltd. (SHSE:688321) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

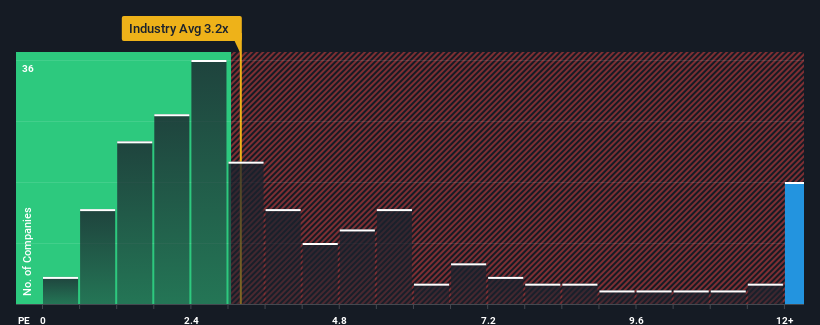

Since its price has surged higher, you could be forgiven for thinking Shenzhen Chipscreen Biosciences is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 16.4x, considering almost half the companies in China's Pharmaceuticals industry have P/S ratios below 3.2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Shenzhen Chipscreen Biosciences

What Does Shenzhen Chipscreen Biosciences' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Shenzhen Chipscreen Biosciences' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenzhen Chipscreen Biosciences.Is There Enough Revenue Growth Forecasted For Shenzhen Chipscreen Biosciences?

Shenzhen Chipscreen Biosciences' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.2%. Even so, admirably revenue has lifted 94% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 33% per annum during the coming three years according to the sole analyst following the company. With the industry only predicted to deliver 19% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Shenzhen Chipscreen Biosciences is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The strong share price surge has lead to Shenzhen Chipscreen Biosciences' P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Shenzhen Chipscreen Biosciences shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Shenzhen Chipscreen Biosciences is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Shenzhen Chipscreen Biosciences, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688321

Shenzhen Chipscreen Biosciences

Shenzhen Chipscreen Biosciences Co., Ltd.

Limited growth and overvalued.

Market Insights

Community Narratives