Exploring Three High Growth Tech Stocks in the Global Market

Reviewed by Simply Wall St

In the current global market landscape, the tech-heavy Nasdaq Composite Index has shown resilience amidst a backdrop of new U.S. tariffs and mixed economic signals, with growth stocks generally outperforming their value counterparts. In this environment, identifying high-growth tech stocks involves looking for companies that can navigate these challenges effectively while capitalizing on technological advancements and maintaining strong performance metrics.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Intellego Technologies | 30.26% | 44.76% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Shanghai OPM Biosciences (SHSE:688293)

Simply Wall St Growth Rating: ★★★★★☆

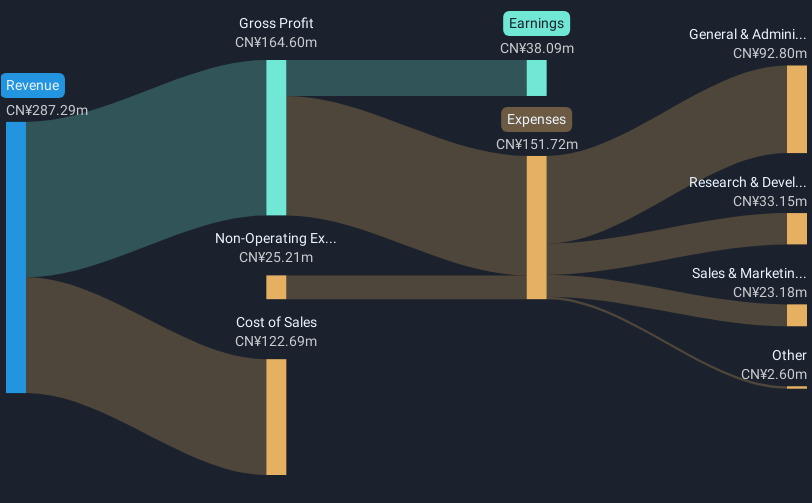

Overview: Shanghai OPM Biosciences Co., Ltd. operates in the biotechnology sector by offering cell culture media and CDMO services both within China and internationally, with a market capitalization of CN¥6.01 billion.

Operations: Shanghai OPM Biosciences focuses on biotechnology, specifically providing cell culture media and CDMO services. The company serves both domestic and international markets.

Shanghai OPM Biosciences has demonstrated a robust trajectory with its revenue climbing to CNY 83.68 million in Q1 2025, marking a 5% year-over-year increase. Despite facing challenges that led to a decrease in net income from CNY 19.58 million to CNY 14.67 million within the same period, the company's forward-looking indicators suggest promising growth prospects. With an anticipated annual earnings growth of 53%, significantly outpacing the CN market average of 23.4%, and revenue expected to grow by 20.8% annually, Shanghai OPM is strategically positioned within the high-growth tech sector. However, it's crucial to note that its profit margins have contracted from last year’s high of 19.4% down to current levels at just over half at approximately 5%. This highlights some volatility and potential risks in profitability despite strong top-line growth forecasts and substantial R&D investments aimed at innovation and maintaining competitive edge in biotechnologies.

- Unlock comprehensive insights into our analysis of Shanghai OPM Biosciences stock in this health report.

Evaluate Shanghai OPM Biosciences' historical performance by accessing our past performance report.

Landis+Gyr Group (SWX:LAND)

Simply Wall St Growth Rating: ★★★★☆☆

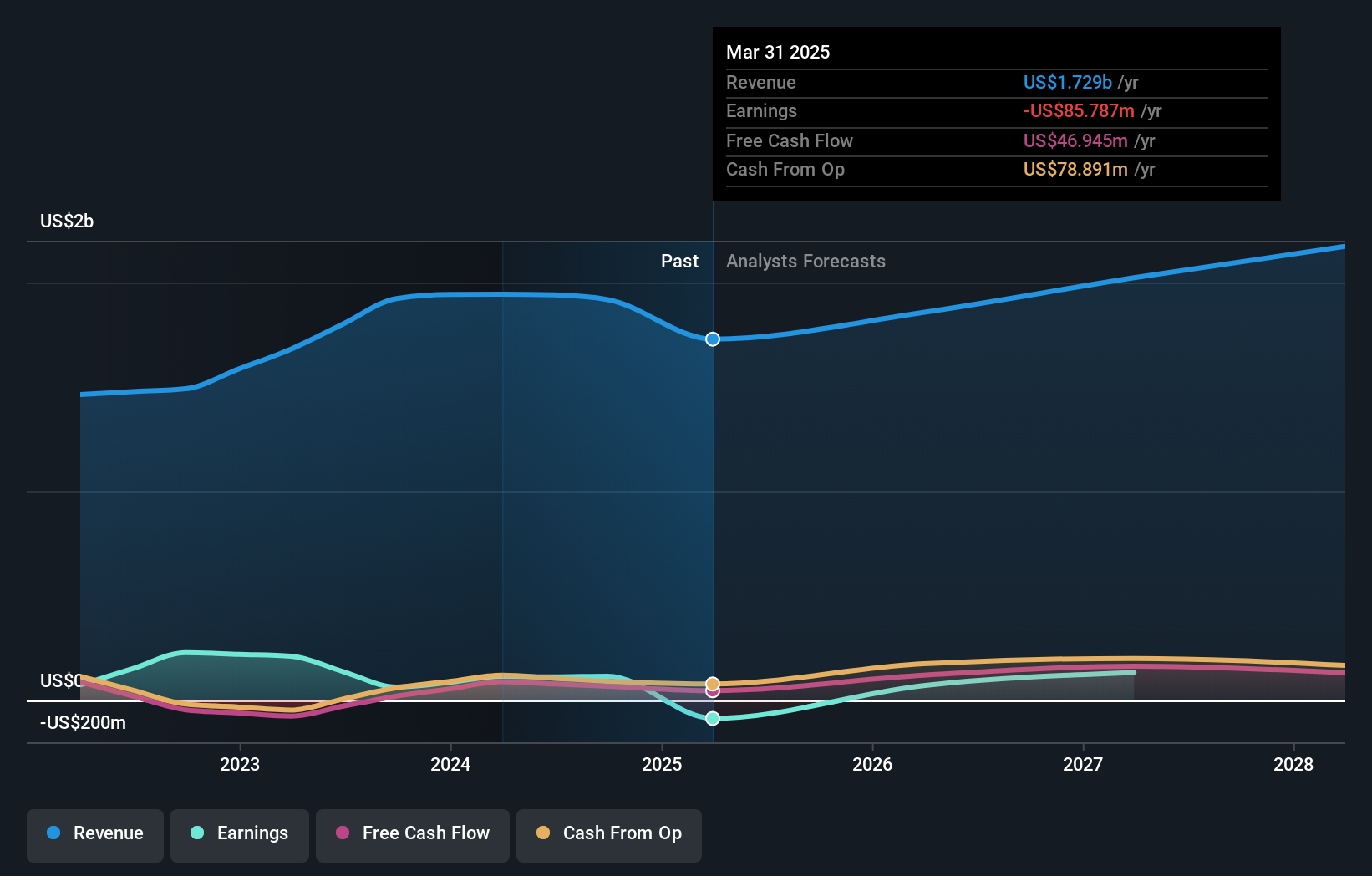

Overview: Landis+Gyr Group AG offers integrated energy management solutions to the utility sector across various regions including the Americas, EMEA, and Asia Pacific, with a market capitalization of CHF1.78 billion.

Operations: The company generates revenue primarily from the Americas and EMEA regions, with $967.49 million and $639.04 million in sales respectively, while the Asia Pacific contributes $158.68 million.

Landis+Gyr Group AG, despite a challenging fiscal year with a net loss of $150.46 million from previous profits, is steering towards recovery with projected revenue growth between 5% and 8%. The company's commitment to innovation is evident in its R&D expenses which consistently align with industry demands for advanced metering infrastructure; this strategic focus supports the anticipated earnings surge of 113.4% annually. Moreover, the recent CTIA Certification for its Revelo E360 and E660 meters underscores Landis+Gyr's prowess in integrating cutting-edge technology to enhance grid reliability and performance, positioning it favorably within the evolving energy sector landscape.

Celestica (TSX:CLS)

Simply Wall St Growth Rating: ★★★★★☆

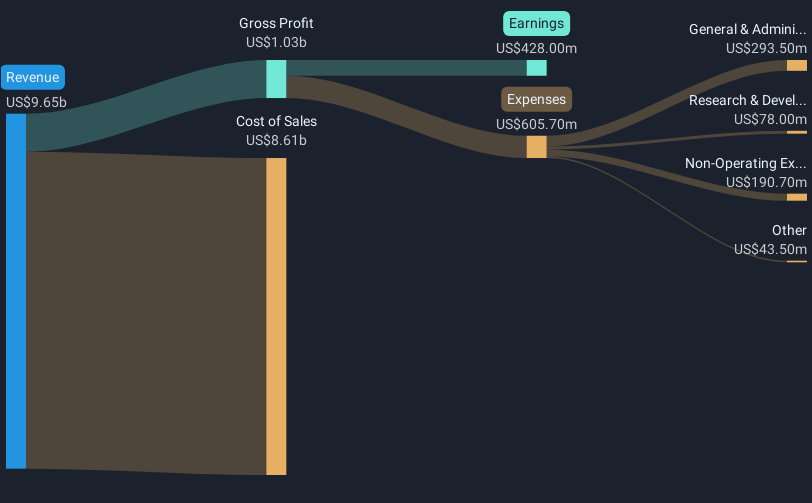

Overview: Celestica Inc. is a company that offers supply chain solutions across Asia, North America, and globally, with a market capitalization of CA$25.34 billion.

Operations: Celestica Inc. generates revenue through two primary segments: Advanced Technology Solutions (ATS) and Connectivity & Cloud Solutions (CCS), with CCS contributing significantly more at $6.89 billion compared to ATS's $3.19 billion.

Celestica's recent strides in tech innovation are underscored by its launch of the ES1500 switch, enhancing enterprise edge capabilities with significant improvements in speed and efficiency. This development aligns with a 13.4% annual revenue growth and an impressive 23.5% rise in earnings per year, signaling robust sector performance. Additionally, the company's strategic R&D investment has effectively supported these advancements, maintaining a competitive edge within the tech sphere. With a recent uptick in share repurchases totaling $73.68 million for 600,000 shares, Celestica is actively bolstering shareholder value while navigating forward with promising financial forecasts for 2025.

- Delve into the full analysis health report here for a deeper understanding of Celestica.

Gain insights into Celestica's past trends and performance with our Past report.

Make It Happen

- Delve into our full catalog of 744 Global High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LAND

Landis+Gyr Group

Provides integrated energy management solutions to utility sector in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives