Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:300657

Exploring High Growth Tech Stocks In October 2024

Reviewed by Simply Wall St

As global markets grapple with the implications of rising U.S. Treasury yields, small-cap stocks have faced more pressure than their large-cap counterparts, with the S&P 500 Index posting a decline after six weeks of gains. In this environment where growth stocks are outperforming value stocks, particularly in tech-heavy indices like the Nasdaq Composite, identifying high-growth tech companies requires a focus on those that can navigate economic headwinds and leverage innovation to sustain momentum.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Pharma Mar | 20.17% | 55.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 29.32% | 70.79% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1247 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Shanghai OPM Biosciences (SHSE:688293)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai OPM Biosciences Co., Ltd. specializes in providing cell culture media and CDMO services both in China and internationally, with a market cap of CN¥4.18 billion.

Operations: The company generates revenue primarily through its cell culture media and CDMO services, catering to both domestic and international markets. With a market capitalization of CN¥4.18 billion, it operates in a niche sector that supports the biopharmaceutical industry.

Shanghai OPM Biosciences is navigating a complex landscape with its recent revenue growth of 35.8% per year, outpacing the CN market's 13.7%. Despite a challenging past with earnings declining by 55.2%, forecasts are optimistic, projecting an annual earnings increase of 53.9%. The company has also actively engaged in share repurchases, completing the buyback of over 1.22 million shares for CNY 51 million as part of its strategy to enhance shareholder value. These financial maneuvers are set against a backdrop where R&D expenses and strategic investments remain pivotal, though specific figures on these expenditures were not disclosed in the recent updates.

Shenzhen Genvict Technologies (SZSE:002869)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Genvict Technologies Co., Ltd. and its subsidiaries focus on the research, development, and industrialization of smart transportation technology in China, with a market cap of CN¥5.98 billion.

Operations: Genvict Technologies generates revenue primarily from its Intelligent Traffic Industry segment, totaling CN¥518.02 million. The company is involved in the smart transportation sector within China.

Shenzhen Genvict Technologies has demonstrated robust performance with a 32.1% annual revenue growth, outstripping the broader Chinese market's average of 13.7%. This surge is bolstered by a significant earnings increase of 36.54% per year, reflecting strong operational efficiency and market demand. The company's commitment to innovation is evident in its R&D spending, crucial for maintaining competitive edge in the tech sector, though specific expenditure figures were not disclosed in the recent updates. With recent earnings reports showing continued financial health — CNY 352.44 million in sales and CNY 31.09 million in net income over nine months — Genvict's strategic focus on expanding its technological capabilities while enhancing shareholder returns through strategic financial management positions it well for sustained growth within the high-tech industry.

XiaMen HongXin Electron-tech GroupLtd (SZSE:300657)

Simply Wall St Growth Rating: ★★★★★★

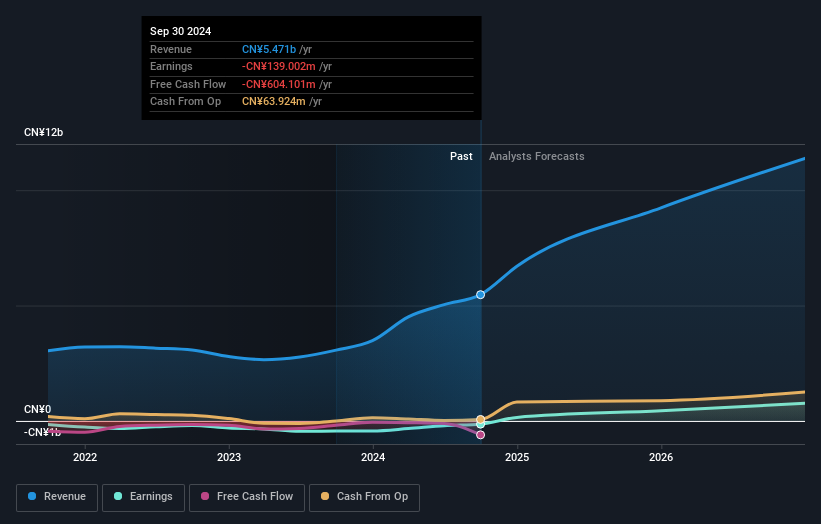

Overview: XiaMen HongXin Electron-tech Group Co.,Ltd specializes in the research, development, design, manufacture, and sale of flexible printed circuit boards (FPCs) in China and has a market capitalization of approximately CN¥8.97 billion.

Operations: The company generates revenue primarily from the electronics manufacturing industry, amounting to CN¥4.97 billion. It focuses on flexible printed circuit boards (FPCs) and is involved in their research, development, design, manufacture, and sale within China.

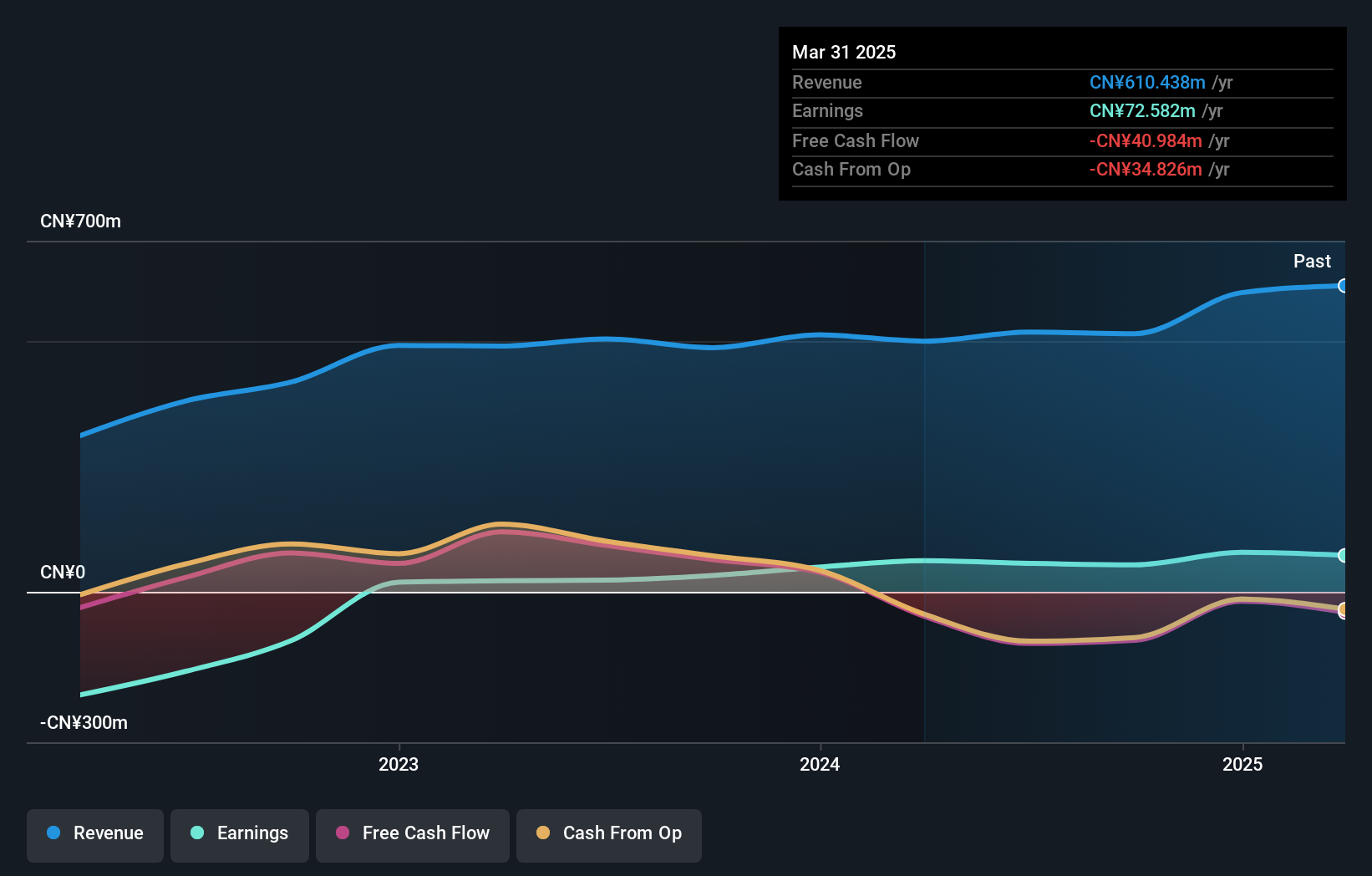

XiaMen HongXin Electron-tech GroupLtd has pivoted impressively, with revenue soaring to CNY 3.04 billion, up from CNY 1.48 billion year-over-year, showcasing a remarkable growth rate of 31%. This surge is underpinned by a strategic focus on R&D, which is evident in their substantial investment in innovation; however, specific R&D expenditure figures are not disclosed. Despite previous losses, the company reported a net income of CNY 49.15 million for the first half of 2024, reversing a significant loss from the previous year and reflecting potential profitability ahead. Their recent shareholder meetings suggest an ongoing commitment to governance and strategic planning which could further stabilize their financial trajectory and foster sustained growth in the tech sector.

- Dive into the specifics of XiaMen HongXin Electron-tech GroupLtd here with our thorough health report.

Learn about XiaMen HongXin Electron-tech GroupLtd's historical performance.

Seize The Opportunity

- Access the full spectrum of 1247 High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300657

XiaMen HongXin Electron-tech GroupLtd

Engages in the research and development, design, manufacture, and sale of flexible printed circuit boards (FPCs) in China.