- China

- /

- Basic Materials

- /

- SZSE:300737

Top Growth Companies With Strong Insider Ownership October 2024

Reviewed by Simply Wall St

As global markets navigate the pressures of rising U.S. Treasury yields and a cautious Federal Reserve approach, growth stocks have shown resilience, particularly within the tech-heavy Nasdaq Composite Index. In this environment, companies with strong insider ownership often signal confidence in their long-term potential, making them attractive considerations for investors seeking growth opportunities amid broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.5% | 24.6% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

i-SENS (KOSDAQ:A099190)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: i-SENS, Inc. develops, manufactures, and sells chemical and biosensors in South Korea and internationally with a market cap of ₩538.31 billion.

Operations: The company generates revenue primarily from its Diagnostic Kits / Equipment segment, amounting to ₩280.29 billion.

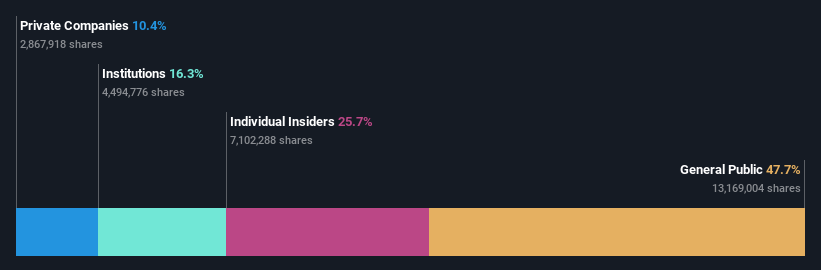

Insider Ownership: 25.7%

i-SENS exhibits characteristics of a growth company with high insider ownership, though recent performance shows challenges. The company reported increased sales for the second quarter at KRW 69,900.13 million but faced a net loss of KRW 2.46 million compared to last year's profit. Despite current losses, i-SENS is expected to become profitable within three years and its revenue growth forecast surpasses the Korean market average, although it remains below 20% annually.

- Click here and access our complete growth analysis report to understand the dynamics of i-SENS.

- Our valuation report here indicates i-SENS may be undervalued.

IIFL Finance (NSEI:IIFL)

Simply Wall St Growth Rating: ★★★★☆☆

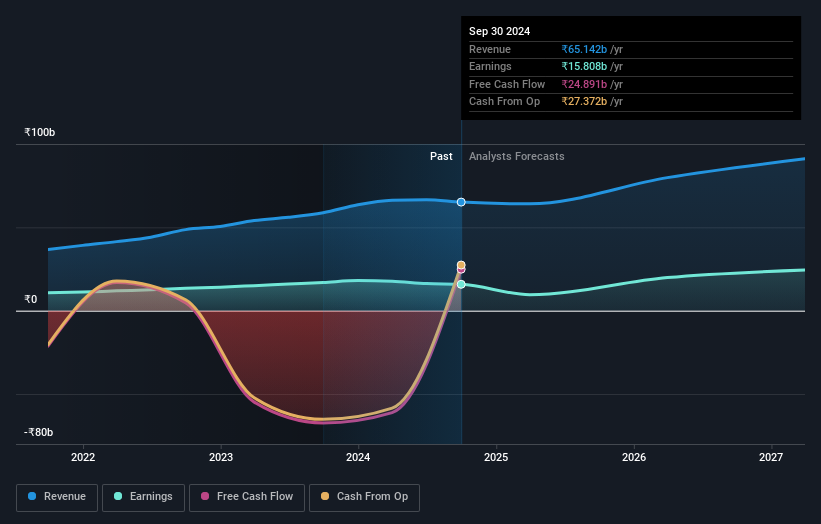

Overview: IIFL Finance Limited is a non-banking financial company involved in financing activities both in India and internationally, with a market capitalization of ₹179.93 billion.

Operations: The company's revenue primarily stems from its financing and investing activities, amounting to ₹65.14 billion.

Insider Ownership: 24.6%

IIFL Finance shows potential as a growth company with significant insider ownership, despite recent earnings challenges. The company reported a net loss of INR 1,576.7 million for the second quarter, contrasting with last year's profit. However, its earnings are forecasted to grow significantly at 25.3% annually over the next three years, outpacing the Indian market average. While trading below analyst price targets and offering good relative value compared to peers, shareholder dilution remains a concern.

- Take a closer look at IIFL Finance's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, IIFL Finance's share price might be too pessimistic.

Keshun Waterproof TechnolgiesLtd (SZSE:300737)

Simply Wall St Growth Rating: ★★★★☆☆

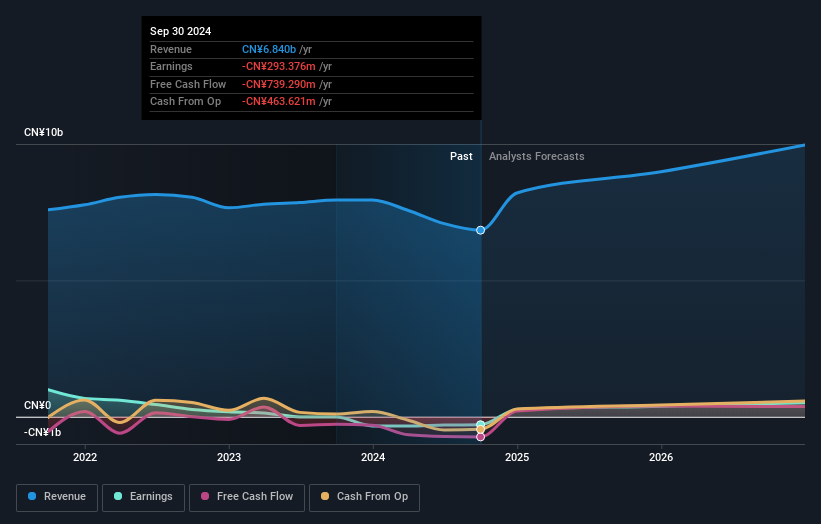

Overview: Keshun Waterproof Technology Co., Ltd. focuses on the research, development, production, and sale of innovative building waterproof materials and has a market capitalization of CN¥5.99 billion.

Operations: Keshun Waterproof Technology Co., Ltd. generates revenue through the research, development, production, and sale of advanced waterproof materials for buildings.

Insider Ownership: 28.0%

Keshun Waterproof Technologies Ltd. demonstrates growth potential with significant insider ownership, despite recent revenue declines from CNY 6.24 billion to CNY 5.14 billion over nine months. Earnings are forecast to grow significantly at 76.93% annually, surpassing market averages and indicating a potential turnaround as profitability is expected within three years. The company offers good relative value compared to peers and has completed a share buyback program, enhancing shareholder value amidst high share price volatility.

- Unlock comprehensive insights into our analysis of Keshun Waterproof TechnolgiesLtd stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Keshun Waterproof TechnolgiesLtd shares in the market.

Taking Advantage

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1466 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Keshun Waterproof TechnolgiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300737

Keshun Waterproof TechnolgiesLtd

Keshun Waterproof Technology Co.,Ltd. engages in the research and development, production, and sale of new building waterproof materials.

Reasonable growth potential and fair value.