- China

- /

- Electronic Equipment and Components

- /

- SHSE:688025

Hangzhou Fortune Gas Cryogenic Group And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, small-cap stocks have faced headwinds, with the Russell 2000 Index reflecting these pressures through a notable decline. Despite this backdrop, investors continue to seek opportunities within lesser-known stocks that exhibit robust fundamentals and potential for growth in a fluctuating market environment. Identifying such "undiscovered gems" often involves looking beyond short-term market sentiment to evaluate companies like Hangzhou Fortune Gas Cryogenic Group that demonstrate strong business models and resilience amidst broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.53% | 54.51% | 76.29% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| DorightLtd | 0.56% | 14.02% | 7.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.21% | 50.35% | 68.60% | ★★★★★☆ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.86% | 64.15% | 63.49% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Hangzhou Fortune Gas Cryogenic Group (SHSE:603173)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou Fortune Gas Cryogenic Group Co., Ltd. operates in the cryogenic equipment industry and has a market cap of CN¥3.65 billion.

Operations: The company generates revenue primarily from its cryogenic equipment offerings. It has a market capitalization of CN¥3.65 billion, reflecting its position within the industry.

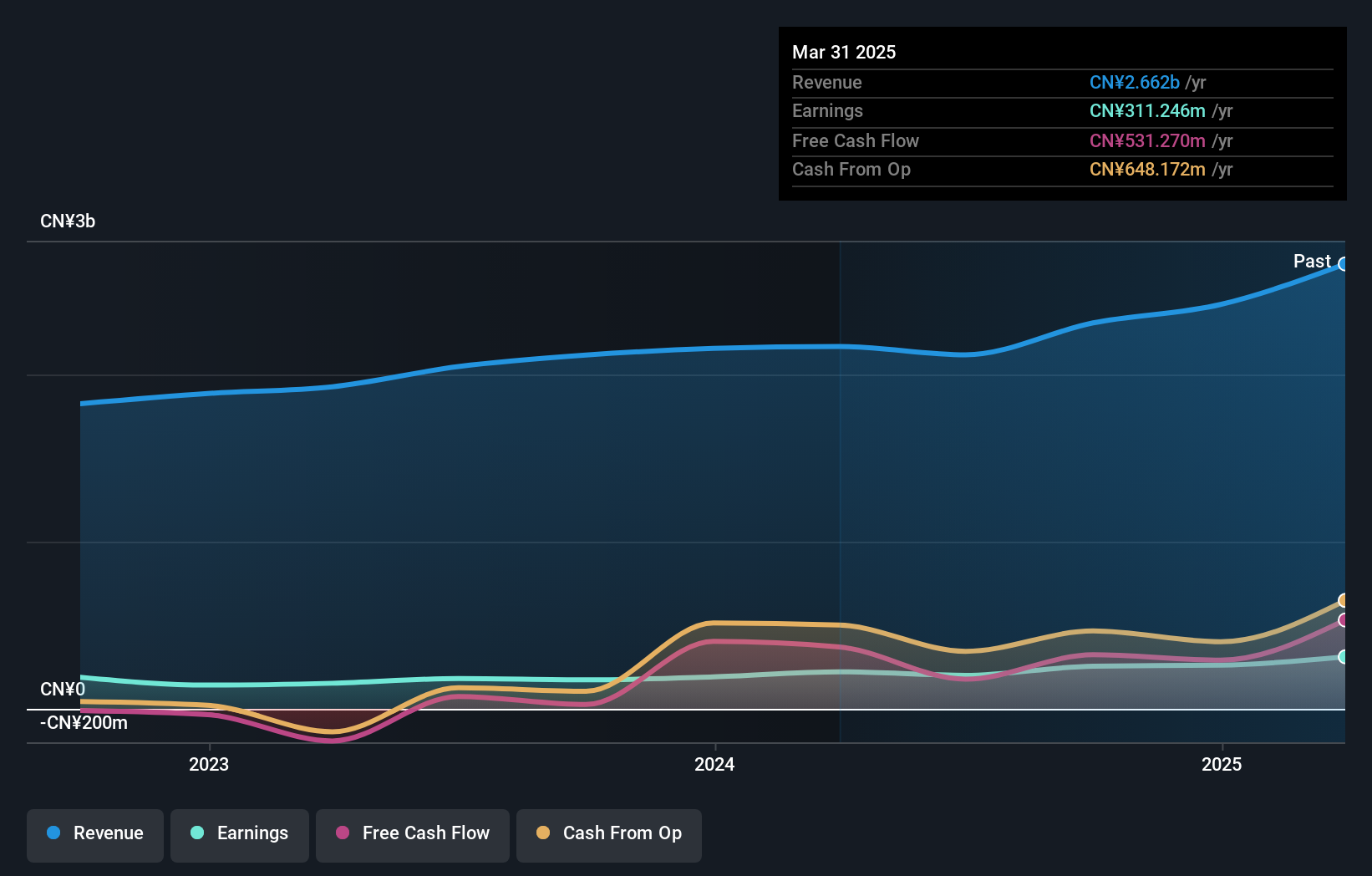

Hangzhou Fortune Gas Cryogenic Group, a relatively small player in the industry, has shown impressive financial performance. Over the past year, earnings surged by 47.4%, significantly outpacing the Machinery industry's -3.9%. The company's debt to equity ratio improved from 42.2% to 2.5% over five years, indicating strong financial management with cash exceeding total debt levels. Recent earnings for nine months ended September 2024 showed sales at CNY 1.65 billion and net income of CNY 207.58 million, with basic earnings per share rising to CNY 1.3 from CNY 0.92 last year—reflecting robust growth and operational efficiency.

Shanghai Kelai Mechatronics EngineeringLtd (SHSE:603960)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Kelai Mechatronics Engineering Co., Ltd. operates in the field of mechatronics engineering and has a market capitalization of CN¥5.38 billion.

Operations: Shanghai Kelai Mechatronics Engineering Co., Ltd. generates revenue primarily from its mechatronics engineering activities. The company's financial performance is characterized by a focus on managing costs effectively, which impacts its overall profitability.

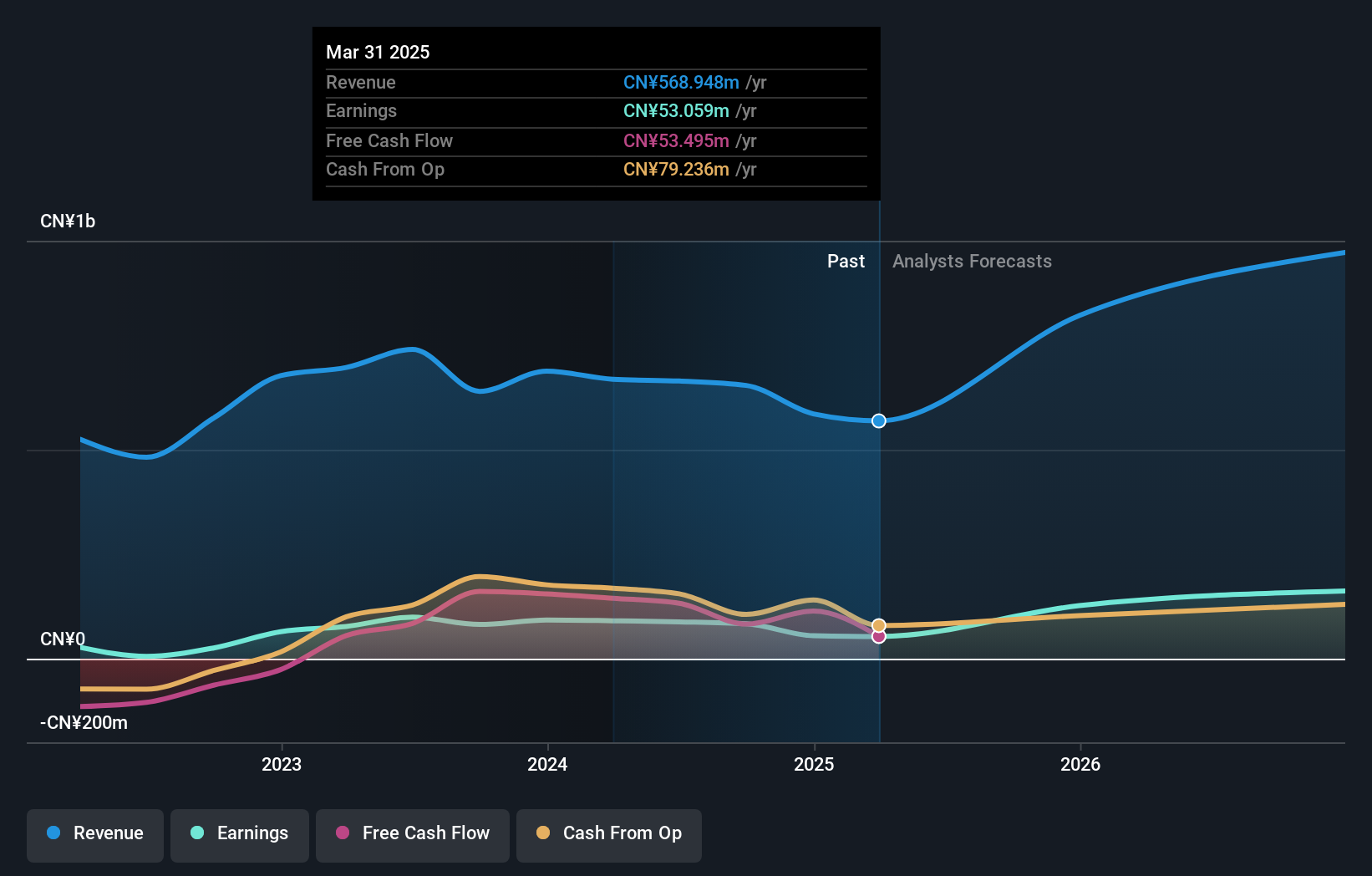

Shanghai Kelai Mechatronics Engineering, a smaller player in the machinery sector, has shown resilience despite recent challenges. Over the past five years, its debt to equity ratio improved significantly from 3.3 to 0.6, indicating better financial management. Earnings grew by 1.8% last year, outperforming the industry average of -3.9%. However, for the nine months ending September 2024, sales dipped to CNY 378 million from CNY 413 million previously, and net income fell to CNY 33 million from CNY 42 million a year ago. The company remains profitable with high-quality earnings and positive free cash flow trends.

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. focuses on the research, development, production, sale, and technical services of lasers, intelligent equipment, and optical devices with a market capitalization of CN¥4.66 billion.

Operations: Shenzhen JPT Opto-Electronics generates revenue primarily from its laser, intelligent equipment, and optical devices segments. The company has a market capitalization of CN¥4.66 billion.

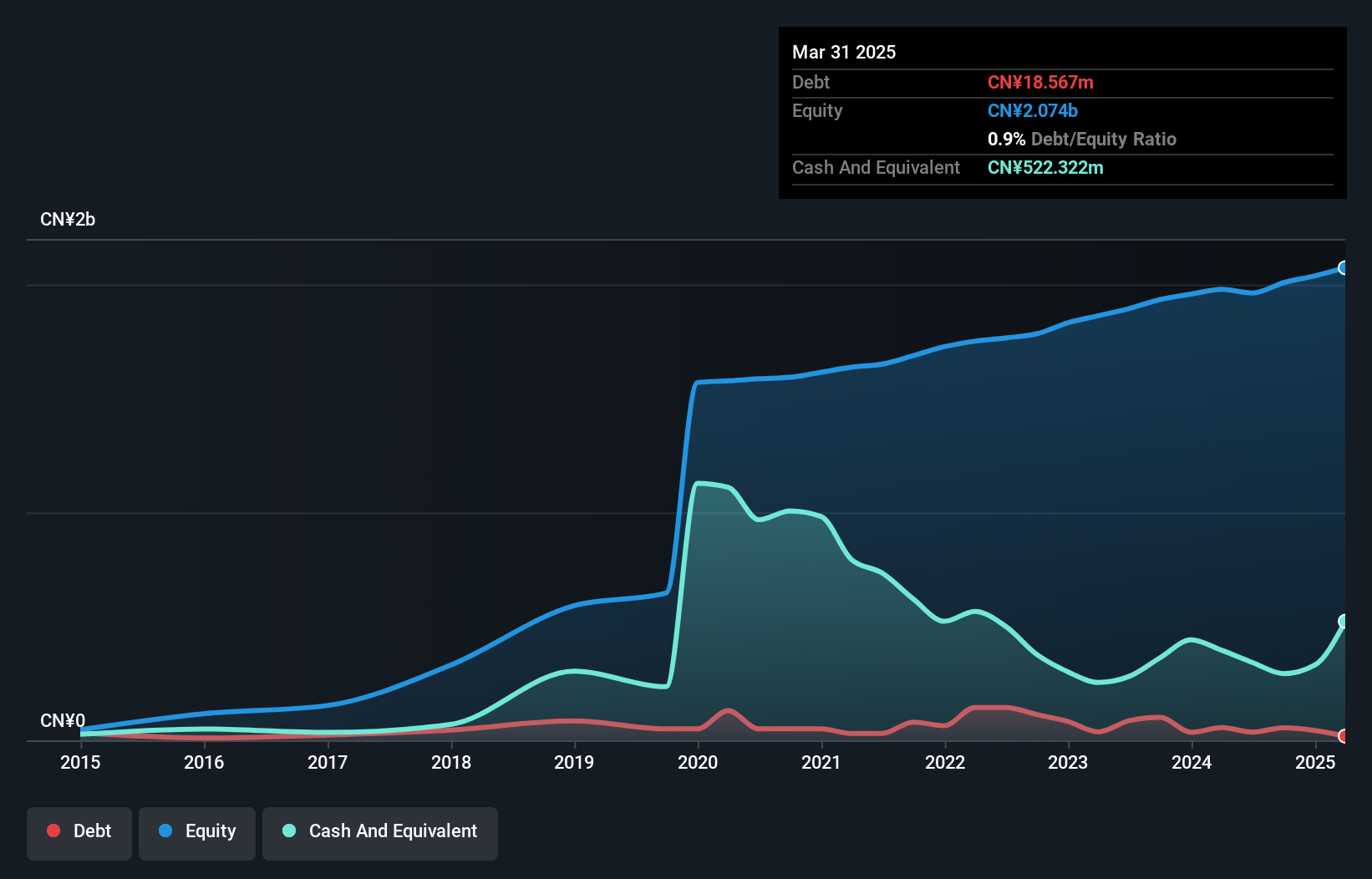

Shenzhen JPT Opto-Electronics, a promising player in the electronics sector, has demonstrated robust financial health over recent years. Its debt to equity ratio impressively dropped from 9.8% to 1.8%, reflecting prudent financial management. Earnings growth of 27.6% outpaced the industry's modest increase of 0.3%, showcasing its competitive edge and operational efficiency with high-quality earnings reported consistently. Recent results for the nine months ending September 2024 showed sales climbing to ¥1,069 million from ¥904 million a year prior, while net income rose to ¥103 million from ¥84 million, indicating strong performance momentum and potential for future value creation within its niche market space.

- Dive into the specifics of Shenzhen JPT Opto-Electronics here with our thorough health report.

Gain insights into Shenzhen JPT Opto-Electronics' past trends and performance with our Past report.

Taking Advantage

- Discover the full array of 4742 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688025

Shenzhen JPT Opto-Electronics

Engages in the research and development, production, sale, and technical services of laser, intelligent equipment, and optical devices.

Flawless balance sheet with high growth potential.