- China

- /

- Life Sciences

- /

- SZSE:301257

3 High Growth Companies With Significant Insider Stakes

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, investors are keenly observing the performance of growth stocks, which have recently outperformed their value counterparts. In such an environment, companies with high insider ownership can be particularly appealing as they often signal confidence in the company's long-term potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.5% | 24.6% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Pharma Mar (BME:PHM) | 11.8% | 49% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

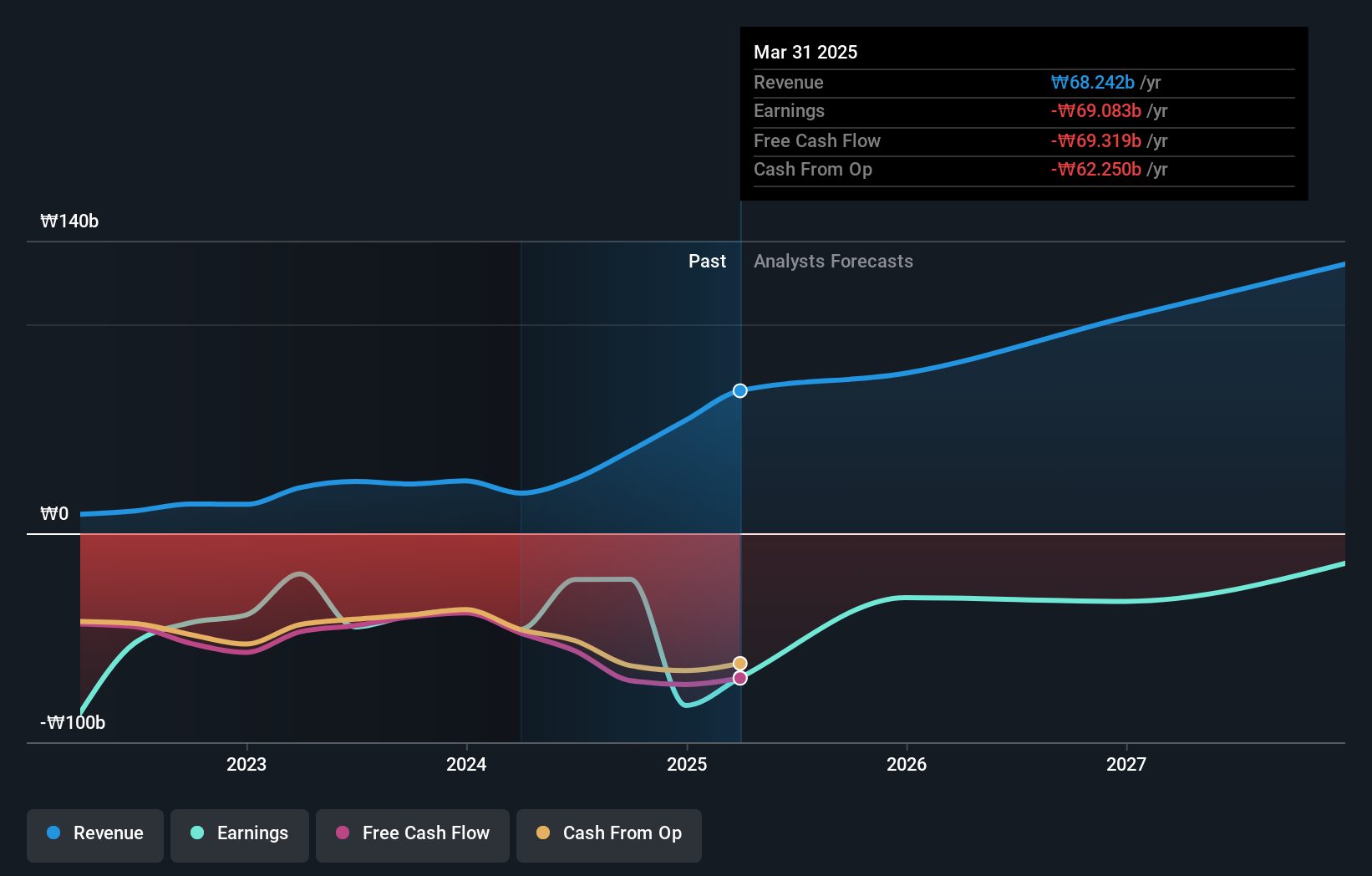

Lunit (KOSDAQ:A328130)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lunit Inc. develops AI-based software solutions for cancer screening, diagnosis, and treatment, with a market cap of ₩1.13 trillion.

Operations: The company generates revenue from its healthcare software segment, amounting to ₩26.03 billion.

Insider Ownership: 21%

Revenue Growth Forecast: 51.8% p.a.

Lunit's growth potential is underscored by its forecasted revenue increase of 51.8% annually, outpacing the Korean market average. Despite past shareholder dilution and share price volatility, Lunit's earnings are expected to grow significantly at 104.93% per year. Recent advancements in AI technology, particularly with Lunit INSIGHT CXR for TB detection, highlight its innovative edge and potential impact in healthcare settings globally, supporting its trajectory toward profitability within three years.

- Get an in-depth perspective on Lunit's performance by reading our analyst estimates report here.

- The analysis detailed in our Lunit valuation report hints at an inflated share price compared to its estimated value.

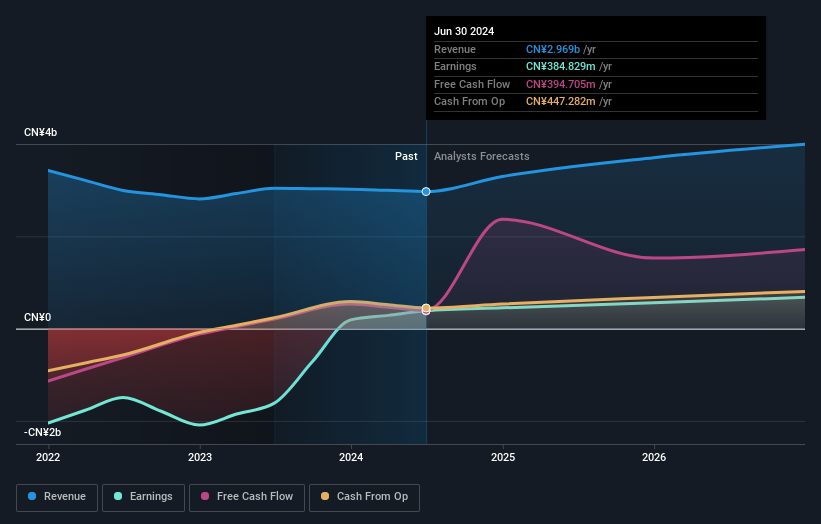

Fenbi (SEHK:2469)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fenbi Ltd. is an investment holding company that offers non-formal vocational education and training services in the People’s Republic of China, with a market cap of HK$5.53 billion.

Operations: The company's revenue is primarily derived from tutoring services, which account for CN¥2.47 billion, and sales of books, totaling CN¥648.46 million.

Insider Ownership: 31.3%

Revenue Growth Forecast: 11.3% p.a.

Fenbi Ltd. demonstrates strong growth potential with its earnings forecasted to grow significantly at 22.4% per year, outpacing the Hong Kong market average. The company reported a substantial increase in net income for the first half of 2024, reaching CNY 277.74 million from CNY 81.48 million a year ago, despite a slight dip in sales to CNY 1,630.47 million. Insider confidence is evident as more shares were bought than sold recently, enhancing its appeal among growth-focused investors.

- Dive into the specifics of Fenbi here with our thorough growth forecast report.

- According our valuation report, there's an indication that Fenbi's share price might be on the cheaper side.

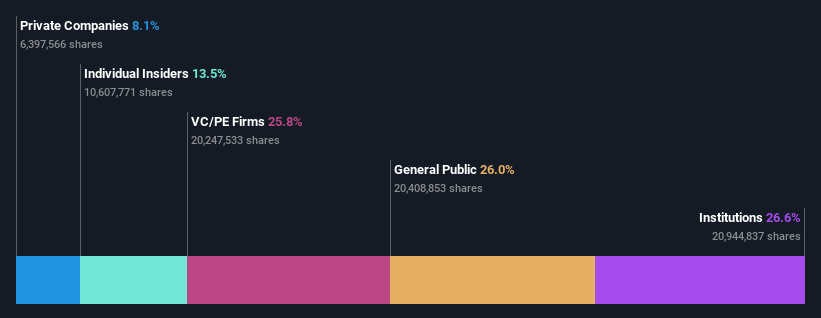

SMO ClinPlusLTD (SZSE:301257)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SMO ClinPlus CO., LTD. offers site management services for research and development in pharmaceuticals, medical devices, and health-related products in China, with a market cap of CN¥2.31 billion.

Operations: Revenue Segments (in millions of CN¥): [No revenue data provided in the text].

Insider Ownership: 13.5%

Revenue Growth Forecast: 16.9% p.a.

SMO ClinPlus LTD. shows potential for growth with earnings forecasted to increase by 26.6% annually, surpassing the CN market average. Despite a volatile share price and recent declines in net income to CNY 72.26 million from CNY 100.91 million, the company remains valued attractively with a P/E ratio of 21.7x below the market average of 34.3x, and revenue growth expected at 16.9% per year, above the CN market rate of 13.7%.

- Click to explore a detailed breakdown of our findings in SMO ClinPlusLTD's earnings growth report.

- The valuation report we've compiled suggests that SMO ClinPlusLTD's current price could be quite moderate.

Turning Ideas Into Actions

- Gain an insight into the universe of 1466 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301257

SMO ClinPlusLTD

Provides site management services in research development in pharmaceuticals, medical devices, and health-related products in China.

Excellent balance sheet with reasonable growth potential.