- China

- /

- Food and Staples Retail

- /

- SHSE:600113

Undiscovered Gems with Promising Potential for October 2024

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields, small-cap stocks have faced increased pressure, with indices like the Russell 2000 showing declines amid broader market challenges. In this environment, identifying undiscovered gems—stocks that exhibit strong fundamentals and resilience—can offer investors potential opportunities for growth despite prevailing economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.53% | 54.51% | 76.29% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| DorightLtd | 0.56% | 14.02% | 7.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.21% | 50.35% | 68.60% | ★★★★★☆ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.86% | 64.15% | 63.49% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Türkiye Sigorta (IBSE:TURSG)

Simply Wall St Value Rating: ★★★★★★

Overview: Türkiye Sigorta A.S. is a non-life insurance company in Turkey with a market capitalization of TRY64.30 billion.

Operations: The company generates revenue primarily from segments including Motor Vehicles (TRY9.55 billion), Motor Vehicles Liability (TRY10.72 billion), Fire (TRY5.15 billion), and Health (TRY5.84 billion).

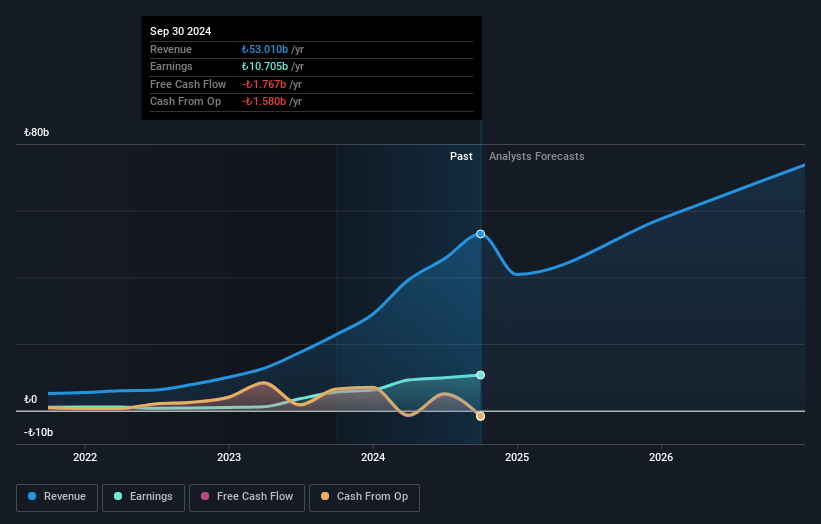

Türkiye Sigorta, a notable player in the insurance sector, showcases impressive financial health with no debt on its books, a marked improvement from five years ago when its debt-to-equity ratio was 0.1%. The company reported significant earnings growth of 92.2% over the past year, outpacing the industry average of 52.2%. Recent earnings announcements reveal net income for Q3 at TRY 3.08 billion compared to TRY 2.24 billion last year, with basic EPS increasing to TRY 0.95 from TRY 0.45. Despite not being free cash flow positive recently, its low price-to-earnings ratio of 6x suggests potential value against the broader market's 15x.

- Unlock comprehensive insights into our analysis of Türkiye Sigorta stock in this health report.

Assess Türkiye Sigorta's past performance with our detailed historical performance reports.

Zhejiang Dongri Limited (SHSE:600113)

Simply Wall St Value Rating: ★★★★★☆

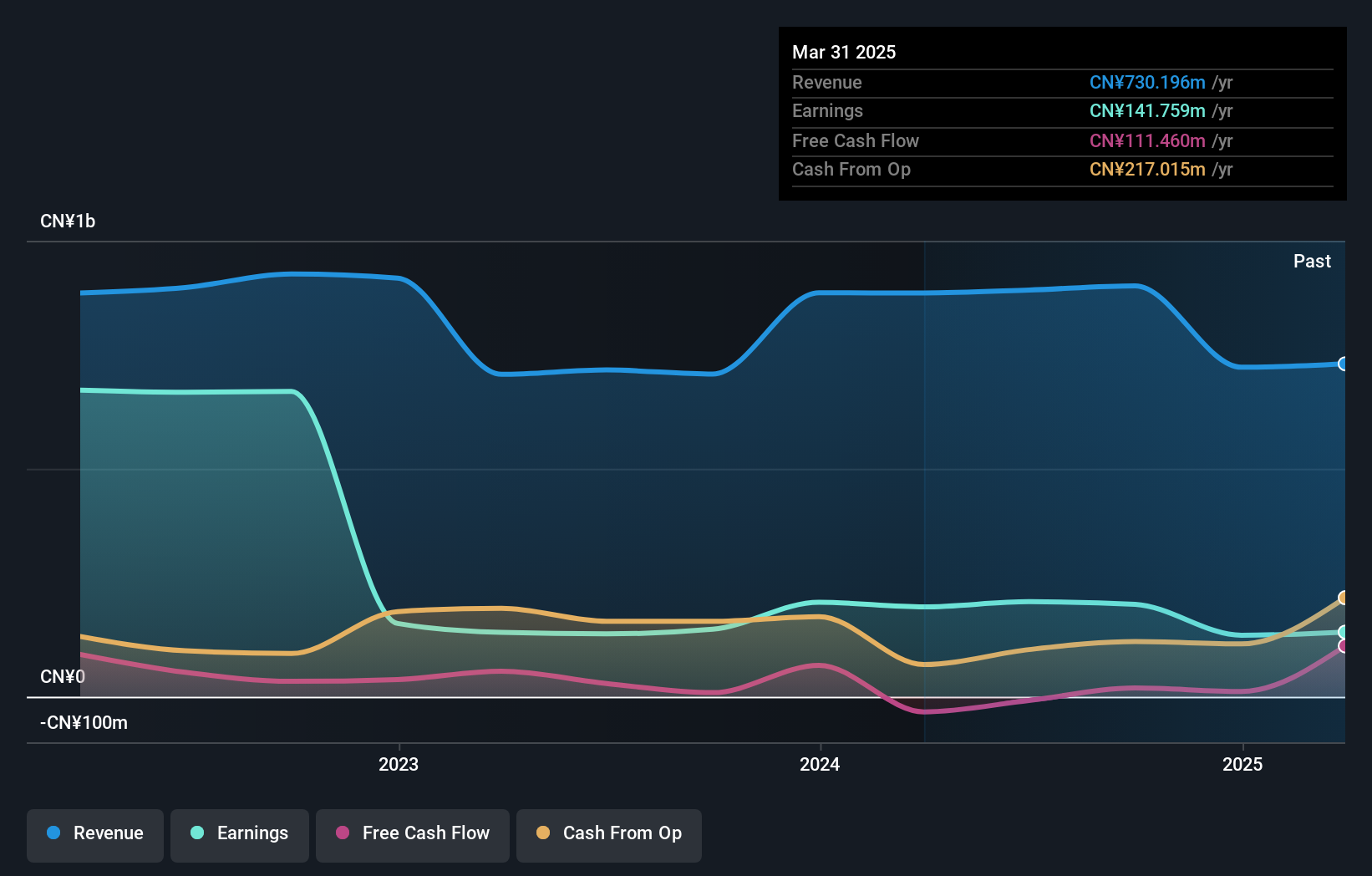

Overview: Zhejiang Dongri Limited Company operates in the marketing of lamps and accessories as well as the wholesale of agricultural products, with a market capitalization of CN¥4.71 billion.

Operations: Zhejiang Dongri Limited generates revenue primarily from marketing lamps and accessories, alongside the wholesale of agricultural products. The company's net profit margin is 12.5%, indicating its profitability after accounting for expenses.

Earnings for Zhejiang Dongri Limited have shown a positive trend, with net income rising to CNY 61.39 million from CNY 56.66 million over the past year, and revenue reaching CNY 351.56 million compared to last year's CNY 345.52 million. The company seems well-positioned in its industry, with earnings growth of 53.7% outpacing the Consumer Retailing sector's average of 7.9%. Despite a slight increase in debt-to-equity ratio from 9.6% to 9.9%, it remains manageable due to more cash than total debt, indicating financial stability and potential for continued growth in profitability and market presence.

Advanced Echem Materials (TPEX:4749)

Simply Wall St Value Rating: ★★★★★☆

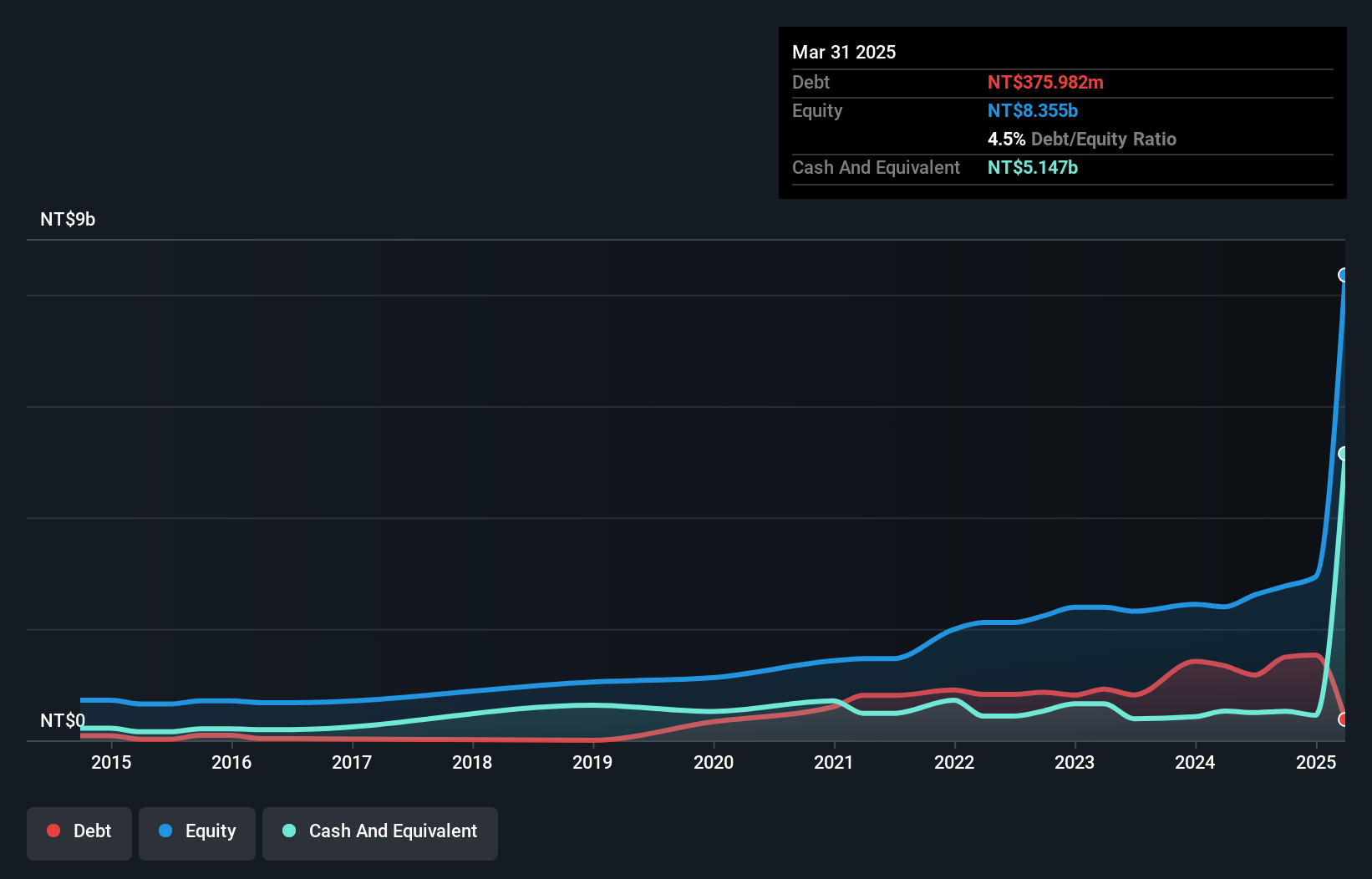

Overview: Advanced Echem Materials Company Limited specializes in developing and manufacturing special chemical materials for semiconductor and display applications in Taiwan, with a market cap of NT$62.37 billion.

Operations: The company's primary revenue stream is from electronic components and parts, generating NT$2.71 billion.

Advanced Echem Materials, a smaller player in the semiconductor space, has shown impressive growth. Recent earnings reports reveal sales of TWD 857.85 million for Q2 2024, up from TWD 599.67 million the previous year, with net income reaching TWD 195.7 million compared to TWD 91.51 million last year. Basic EPS rose to TWD 2.39 from TWD 1.13 over the same period, reflecting strong performance despite industry challenges. Earnings grew by 14% over the past year and outpaced industry averages significantly, suggesting robust operational efficiency and market positioning that could offer potential value for investors seeking growth opportunities in this sector.

Where To Now?

- Discover the full array of 4742 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Dongri Limited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600113

Zhejiang Dongri Limited

Engages in the marketing of lamps and accessories, and wholesale of agricultural products.

Solid track record with excellent balance sheet.