Global Market's Elite Value Stocks Priced Below Estimated Worth

Reviewed by Simply Wall St

As global markets navigate a complex landscape characterized by steady U.S. inflation and mixed performances across major indices, investors are increasingly focused on identifying opportunities that might be undervalued amid these fluctuations. In this context, a good stock is often one that presents solid fundamentals and potential for growth despite current market pressures, making it an attractive option for those seeking value in uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.58 | SEK86.14 | 49.4% |

| Star Micronics (TSE:7718) | ¥1682.00 | ¥3330.99 | 49.5% |

| SKAN Group (SWX:SKAN) | CHF60.70 | CHF120.14 | 49.5% |

| Pluxee (ENXTPA:PLX) | €17.06 | €33.90 | 49.7% |

| Norconsult (OB:NORCO) | NOK45.80 | NOK90.65 | 49.5% |

| Hanza (OM:HANZA) | SEK111.40 | SEK220.59 | 49.5% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.53 | CN¥78.38 | 49.6% |

| BHG Group (OM:BHG) | SEK25.08 | SEK49.92 | 49.8% |

| AIMECHATEC (TSE:6227) | ¥3900.00 | ¥7721.86 | 49.5% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €35.80 | €70.87 | 49.5% |

Here we highlight a subset of our preferred stocks from the screener.

iFAST (SGX:AIY)

Overview: iFAST Corporation Ltd. is a digital banking and wealth management platform operating in Singapore, Hong Kong, Malaysia, China, and the United Kingdom with a market capitalization of SGD2.62 billion.

Operations: iFAST generates revenue primarily through its operations as a digital banking and wealth management platform across Singapore, Hong Kong, Malaysia, China, and the United Kingdom.

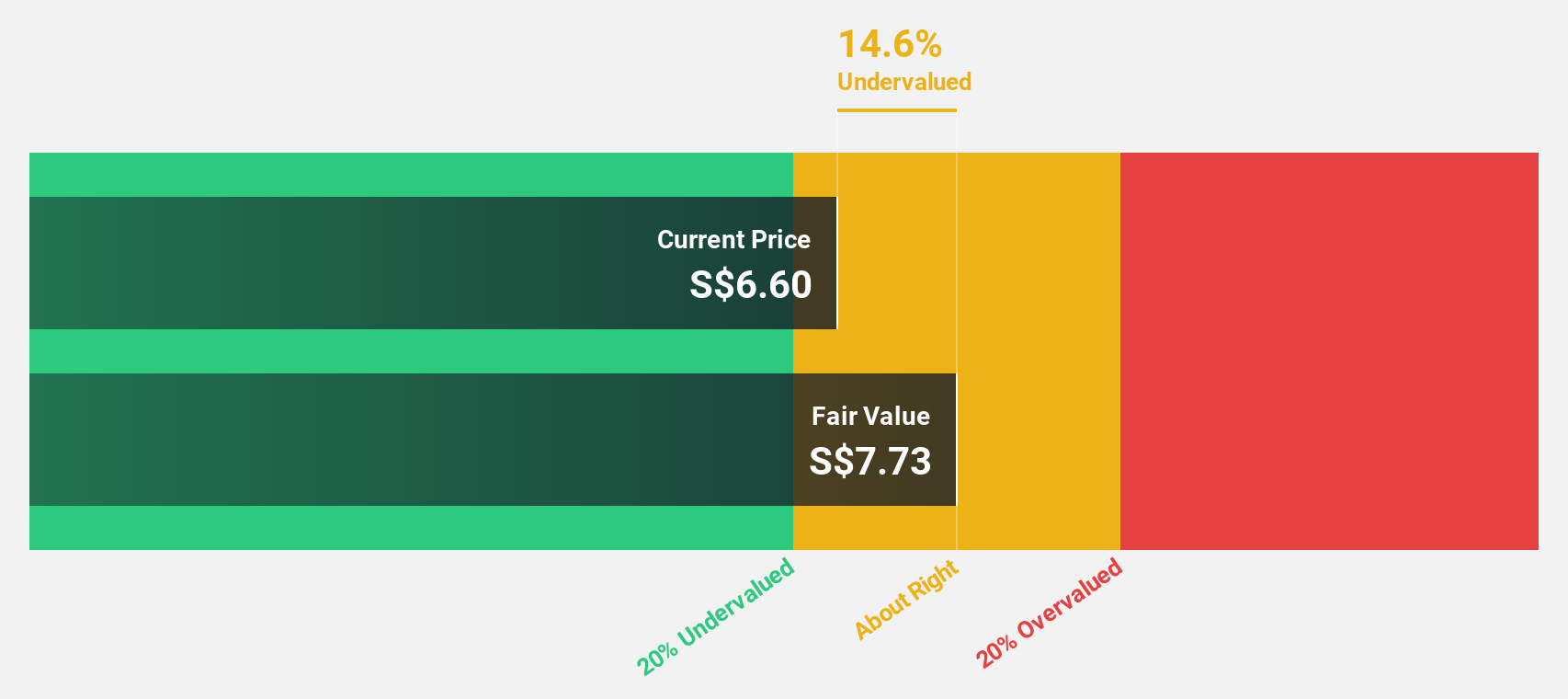

Estimated Discount To Fair Value: 12.9%

iFAST Corporation Ltd. is trading at S$8.64, below its estimated fair value of S$9.92, indicating potential undervaluation based on cash flows. Recent earnings growth of 47.8% and a forecasted annual profit increase of over 20% suggest strong financial performance, although insider selling in the past quarter raises caution. Revenue is expected to grow faster than the Singapore market, yet slower than 20% annually, highlighting moderate growth prospects amidst dividend increases and robust net income results.

- Our earnings growth report unveils the potential for significant increases in iFAST's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of iFAST.

Q & M Dental Group (Singapore) (SGX:QC7)

Overview: Q & M Dental Group (Singapore) Limited is an investment holding company that offers private dental healthcare services across Singapore, Malaysia, China, and internationally, with a market cap of SGD476.36 million.

Operations: The company generates revenue primarily from its core dental business, which amounted to SGD176.77 million.

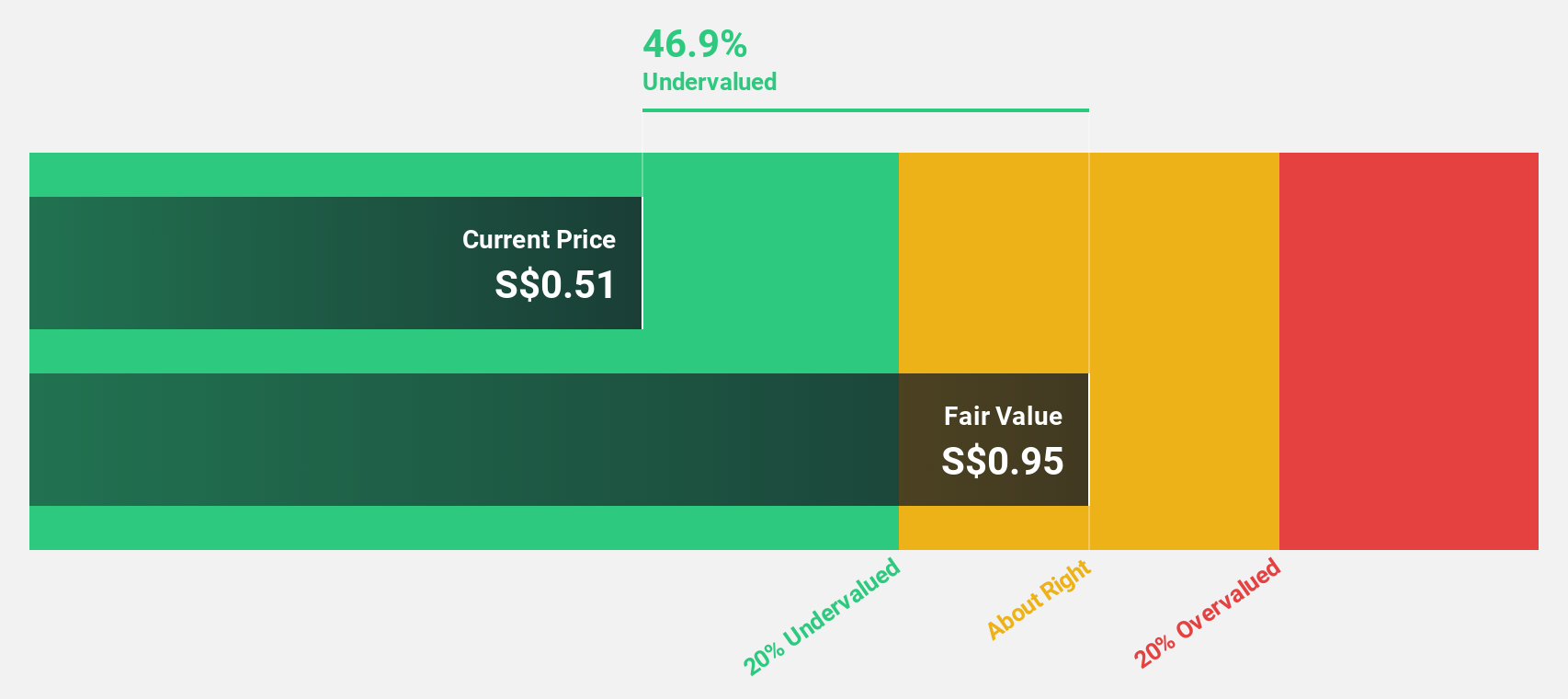

Estimated Discount To Fair Value: 47.7%

Q & M Dental Group (Singapore) is trading at S$0.51, significantly below its estimated fair value of S$0.97, highlighting potential undervaluation based on cash flows. Despite a recent drop in net income to S$3.86 million, earnings are forecasted to grow 26.61% annually over the next three years, outpacing the Singapore market's growth rate of 6.4%. However, profit margins have decreased from last year’s 8.6% to 4.9%, reflecting some financial challenges amidst promising revenue growth prospects.

- Our growth report here indicates Q & M Dental Group (Singapore) may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Q & M Dental Group (Singapore)'s balance sheet health report.

Xiamen Amoytop Biotech (SHSE:688278)

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs in China with a market cap of CN¥34.42 billion.

Operations: The company's revenue is primarily derived from its biologics segment, which generated CN¥3.14 billion.

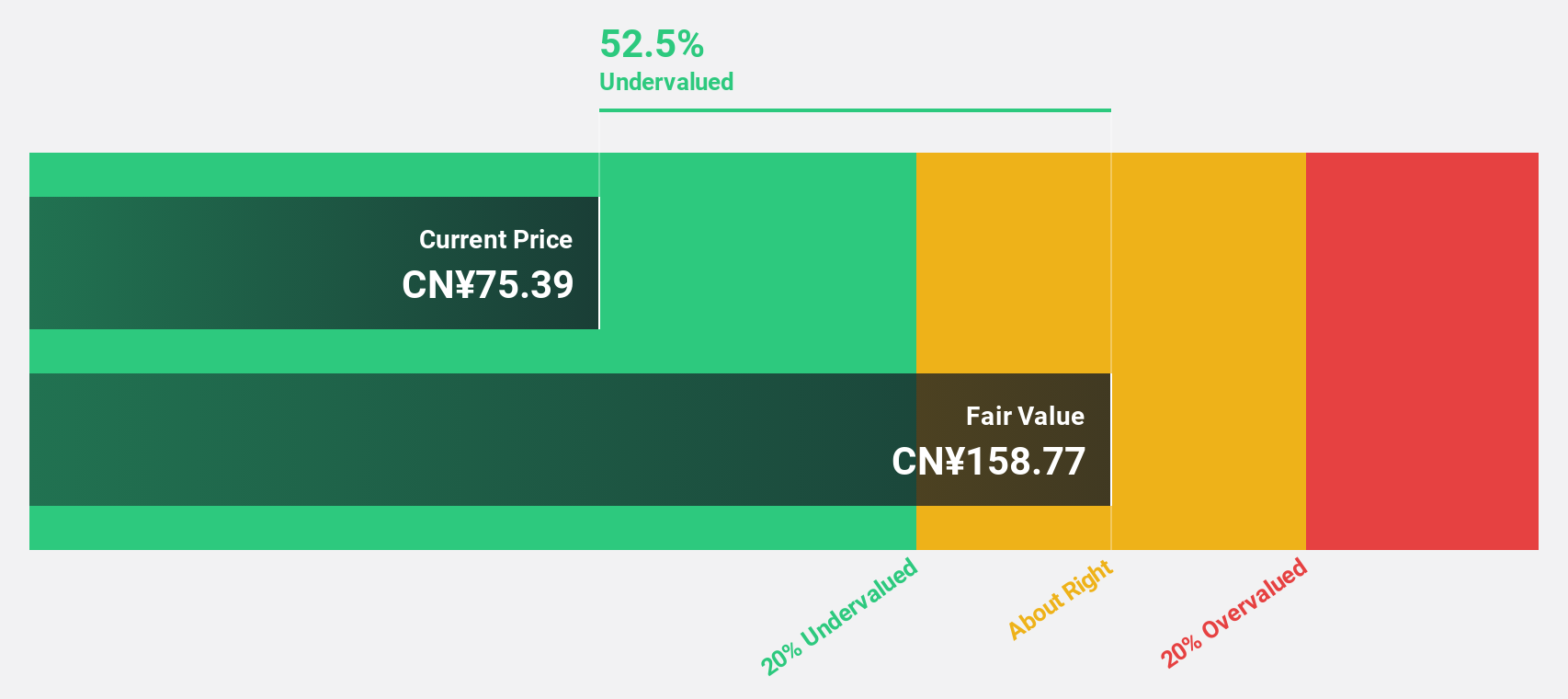

Estimated Discount To Fair Value: 48.8%

Xiamen Amoytop Biotech is trading at CNY 84.6, significantly below its estimated fair value of CNY 165.09, indicating potential undervaluation based on cash flows. Recent earnings showed a strong performance with net income rising to CNY 427.89 million from the previous year’s CNY 304.34 million, and earnings per share increasing to CNY 1.05 from CNY 0.75. Revenue growth forecasts exceed market averages, supported by high-quality earnings and robust return on equity projections.

- Upon reviewing our latest growth report, Xiamen Amoytop Biotech's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Xiamen Amoytop Biotech stock in this financial health report.

Summing It All Up

- Get an in-depth perspective on all 534 Undervalued Global Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688278

Xiamen Amoytop Biotech

Engages in research, development, production, and sale of recombinant protein drugs in China and internationally.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives