December 2024's Top Stocks Estimated To Be Below Intrinsic Value

Reviewed by Simply Wall St

As 2024 draws to a close, global markets have experienced moderate gains despite fluctuations in consumer confidence and mixed economic indicators. With major indices like the Nasdaq Composite leading early-week rallies before facing declines, investors are increasingly focused on identifying stocks that may be trading below their intrinsic value amid these volatile conditions. In such an environment, a good stock is often characterized by strong fundamentals and resilience to market shifts, offering potential opportunities for those looking to invest in undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$631.28 | MX$1257.07 | 49.8% |

| SKS Technologies Group (ASX:SKS) | A$1.935 | A$3.85 | 49.7% |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.45 | CN¥30.82 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1130.65 | ₹2253.01 | 49.8% |

| Lindab International (OM:LIAB) | SEK228.20 | SEK452.08 | 49.5% |

| S Foods (TSE:2292) | ¥2757.00 | ¥5472.35 | 49.6% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Infomart (TSE:2492) | ¥290.00 | ¥574.47 | 49.5% |

| Surgical Science Sweden (OM:SUS) | SEK159.60 | SEK317.20 | 49.7% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.89 | 49.8% |

Let's dive into some prime choices out of the screener.

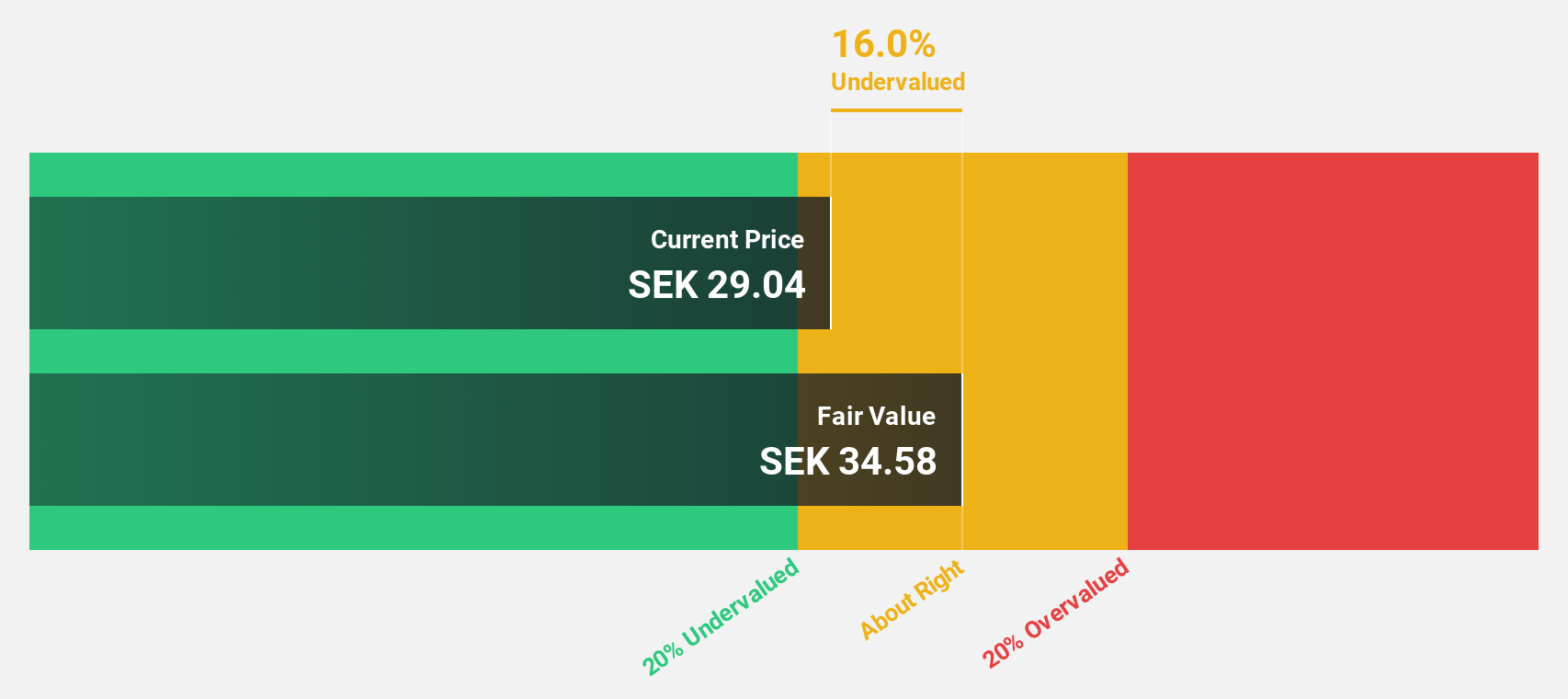

Sinch (OM:SINCH)

Overview: Sinch AB (publ) offers cloud communications services and solutions for enterprises and mobile operators across various countries globally, with a market cap of SEK17.64 billion.

Operations: Revenue Segments (in millions of SEK): Sinch AB generates revenue through its cloud communications services and solutions provided to enterprises and mobile operators across multiple regions including Sweden, France, the UK, Germany, Brazil, India, Singapore, other European countries, and the United States.

Estimated Discount To Fair Value: 38.4%

Sinch is trading at a significant discount to its estimated fair value, indicating potential undervaluation based on cash flows. Despite recent financial challenges, including a substantial goodwill impairment of SEK 6 billion impacting net income but not cash flow, Sinch's revenue growth is expected to outpace the Swedish market. The company anticipates becoming profitable within three years and continues to expand its innovative NG911 technology across North America, potentially enhancing future cash flows.

- The analysis detailed in our Sinch growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Sinch stock in this financial health report.

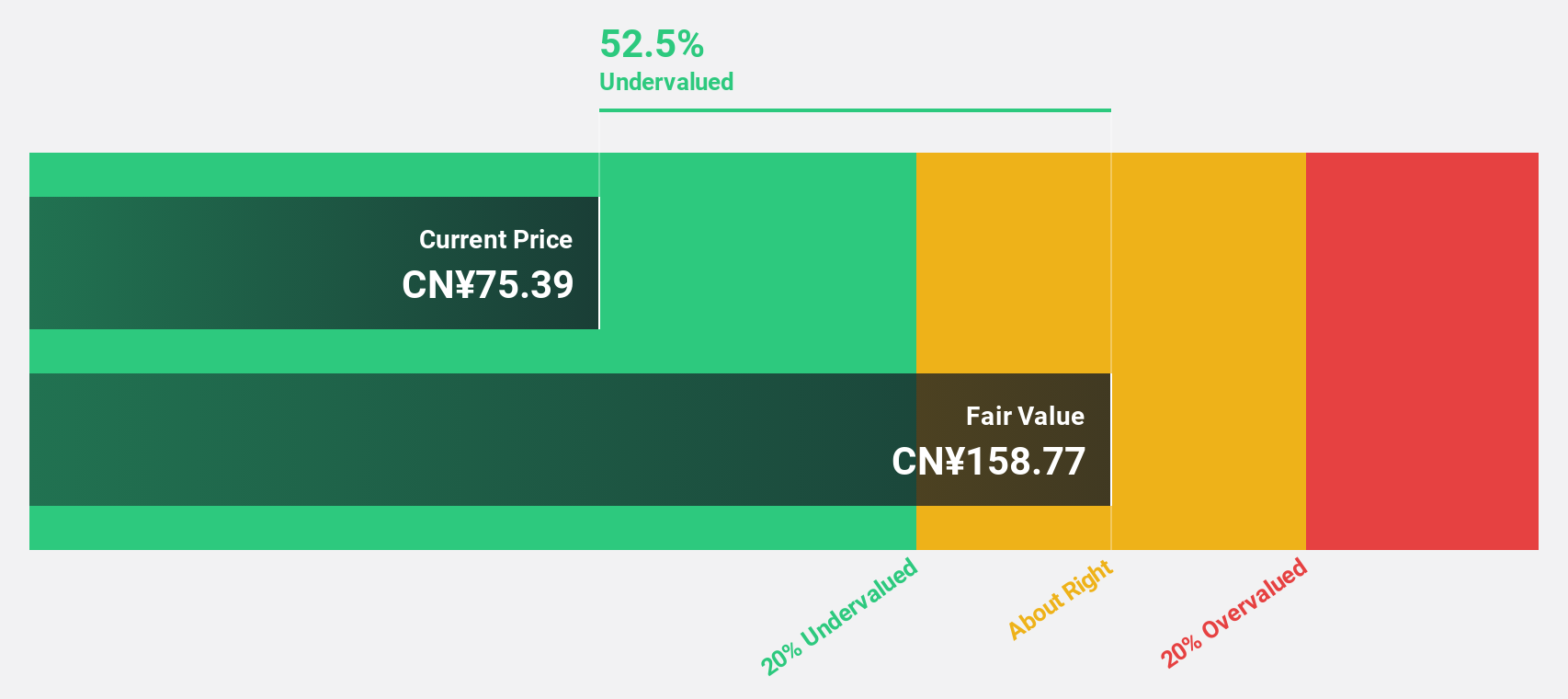

Xiamen Amoytop Biotech (SHSE:688278)

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs in China with a market cap of CN¥29.42 billion.

Operations: The company generates its revenue from the biologics segment, amounting to CN¥2.60 billion.

Estimated Discount To Fair Value: 25.2%

Xiamen Amoytop Biotech is trading at CN¥72.32, significantly below its estimated fair value of CN¥96.65, suggesting undervaluation based on cash flows. The company's revenue and earnings are forecast to grow substantially, outpacing the Chinese market's growth rates. Recent results show a strong performance with net income rising to CN¥554.15 million from CN¥368.91 million year-on-year, though its dividend yield remains poorly covered by free cash flows.

- Insights from our recent growth report point to a promising forecast for Xiamen Amoytop Biotech's business outlook.

- Dive into the specifics of Xiamen Amoytop Biotech here with our thorough financial health report.

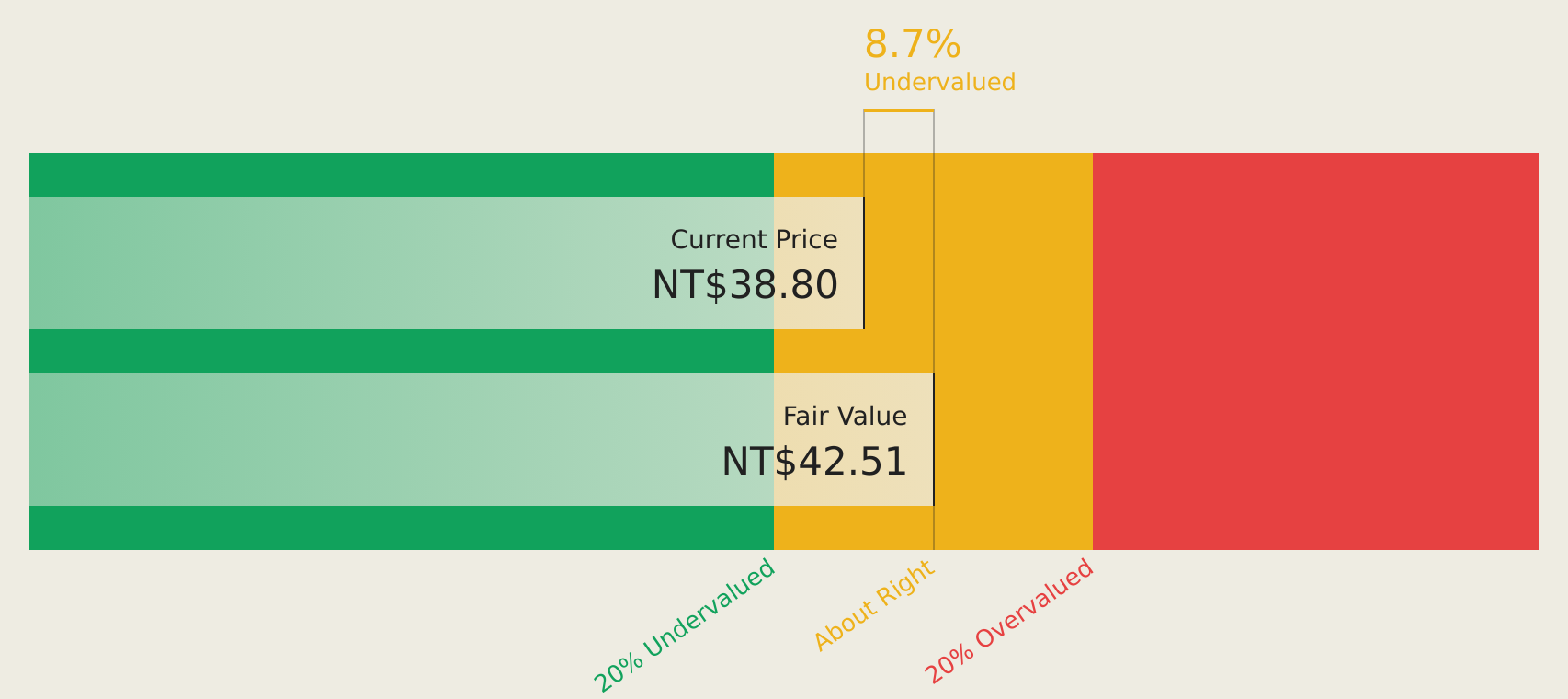

Shanghai Commercial & Savings Bank (TWSE:5876)

Overview: Shanghai Commercial & Savings Bank, Ltd. operates as a full-service bank offering a range of financial products and services, with a market cap of NT$197.16 billion.

Operations: The bank's revenue is primarily derived from its banking segment, which generated NT$32.41 billion.

Estimated Discount To Fair Value: 12.6%

Shanghai Commercial & Savings Bank, trading at NT$40.65, is undervalued with a fair value estimate of NT$46.53 based on cash flows. Despite recent legal issues in New York, the bank anticipates minimal financial impact. Earnings are forecast to grow 21.67% annually, surpassing Taiwan's market growth rate of 19.1%. However, Q3 results showed a slight decline in net income year-on-year to TWD 4,748.47 million from TWD 4,912.05 million previously.

- Our comprehensive growth report raises the possibility that Shanghai Commercial & Savings Bank is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Shanghai Commercial & Savings Bank.

Seize The Opportunity

- Unlock our comprehensive list of 871 Undervalued Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5876

Shanghai Commercial & Savings Bank

The Shanghai Commercial & Savings Bank, Ltd.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives