As global markets navigate a landscape of easing trade tensions and mixed economic signals, investors are closely watching U.S. equities, which have shown resilience amid constructive trade headlines and strong corporate earnings reports. In this environment, growth companies with significant insider ownership can be particularly appealing, as high insider stakes often signal confidence in the company's long-term potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| AcrelLtd (SZSE:300286) | 34.2% | 34.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Let's uncover some gems from our specialized screener.

Servyou Software Group (SHSE:603171)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Servyou Software Group Co., Ltd. and its subsidiaries offer financial and tax information services in China, with a market cap of CN¥17.96 billion.

Operations: The company's revenue is primarily derived from its Digital Finance and Taxation Service Cloud Business, which generated CN¥1.29 billion, and its Digital Government Business, which contributed CN¥857.47 million.

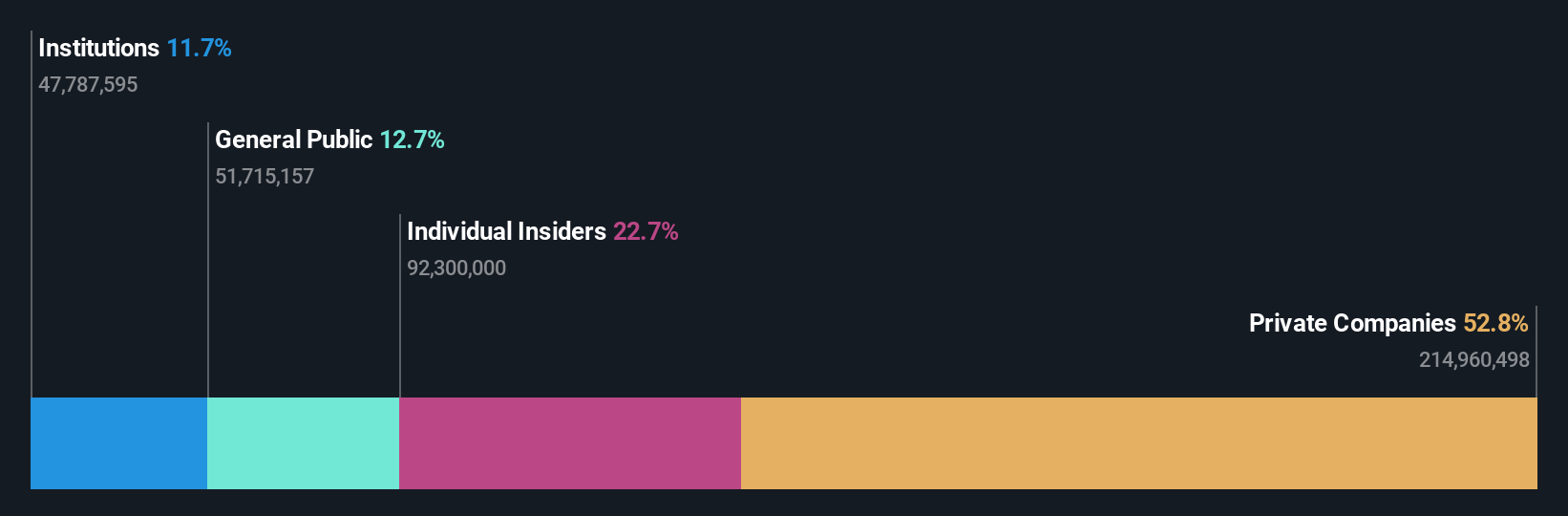

Insider Ownership: 22.7%

Servyou Software Group has demonstrated substantial earnings growth, with a 35% increase over the past year and an expected annual profit growth of 42.5%, surpassing the Chinese market average. Although its revenue growth forecast of 18.3% is slower than anticipated for high-growth companies, it still exceeds the market's average rate. The company's financial results are impacted by large one-off items, and its share price remains highly volatile despite no significant insider trading activity recently observed.

- Get an in-depth perspective on Servyou Software Group's performance by reading our analyst estimates report here.

- Our valuation report here indicates Servyou Software Group may be overvalued.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. operates in the biopharmaceutical industry, focusing on the research, development, and commercialization of innovative drugs, with a market cap of CN¥27.29 billion.

Operations: Suzhou Zelgen Biopharmaceuticals Co., Ltd. generates its revenue primarily through the research, development, and commercialization of innovative drugs.

Insider Ownership: 29.4%

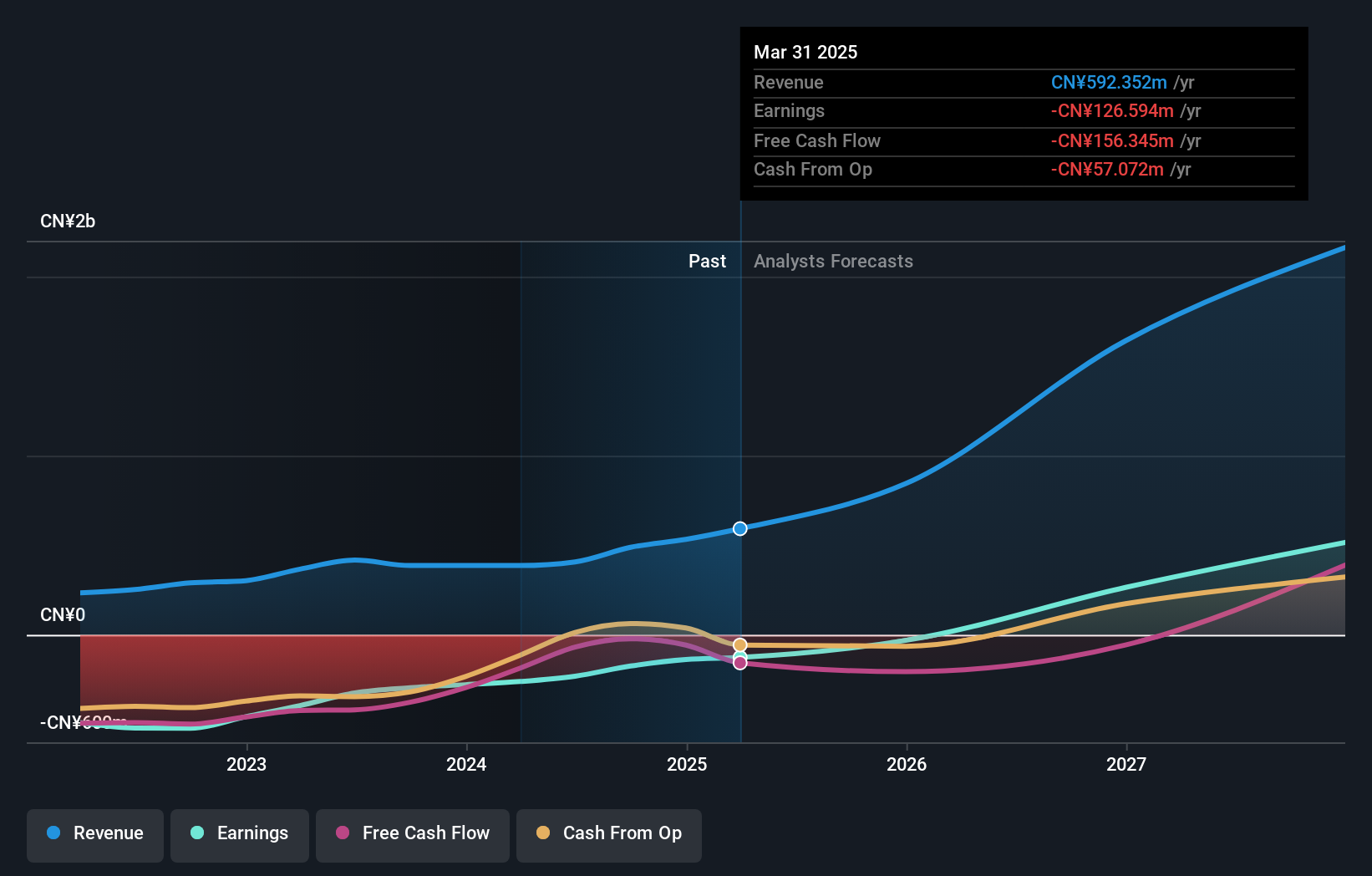

Suzhou Zelgen Biopharmaceuticals has shown promising growth, with first-quarter sales rising to CNY 167.64 million from CNY 108.24 million year-on-year, while reducing its net loss to CNY 28.26 million. Revenue is projected to grow at a robust rate of 45.6% annually, outpacing the Chinese market average of 12.6%. The company is expected to become profitable within three years and currently trades significantly below its estimated fair value without recent insider trading activity impacting stock perception.

- Click here to discover the nuances of Suzhou Zelgen BiopharmaceuticalsLtd with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Suzhou Zelgen BiopharmaceuticalsLtd shares in the market.

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. manufactures and sells printed circuit boards (PCBs) both in China and internationally, with a market cap of CN¥19.20 billion.

Operations: The company's revenue is derived from the manufacturing and sale of printed circuit boards (PCBs) both domestically and globally.

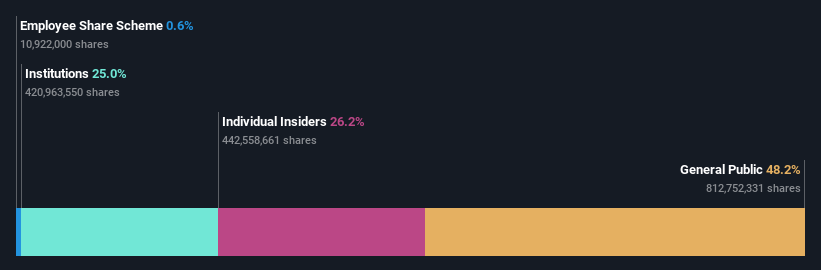

Insider Ownership: 26.2%

Shenzhen Fastprint Circuit Tech Ltd. is forecast to grow its revenue by 19.7% annually, outpacing the Chinese market's average of 12.6%, though still below a high-growth threshold of 20%. The company is expected to become profitable within three years, with earnings projected to increase significantly at 111.25% per year. Despite recent first-quarter sales growth from CNY 1,388.47 million to CNY 1,579.6 million, net income declined to CNY 9.37 million from CNY 24.82 million year-on-year without notable insider trading activity recently impacting the stock's outlook.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Fastprint Circuit TechLtd.

- In light of our recent valuation report, it seems possible that Shenzhen Fastprint Circuit TechLtd is trading beyond its estimated value.

Make It Happen

- Embark on your investment journey to our 850 Fast Growing Global Companies With High Insider Ownership selection here.

- Contemplating Other Strategies? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603171

Servyou Software Group

Provides financial and tax information services in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives