- China

- /

- Life Sciences

- /

- SHSE:688202

Shanghai Medicilon Inc. (SHSE:688202) Might Not Be As Mispriced As It Looks

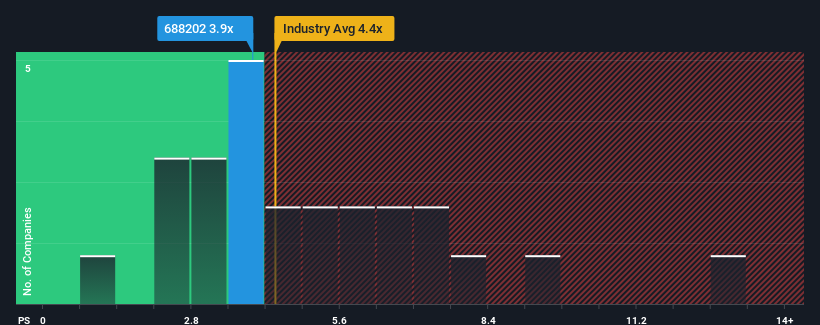

With a median price-to-sales (or "P/S") ratio of close to 4.4x in the Life Sciences industry in China, you could be forgiven for feeling indifferent about Shanghai Medicilon Inc.'s (SHSE:688202) P/S ratio of 3.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Shanghai Medicilon

What Does Shanghai Medicilon's Recent Performance Look Like?

Shanghai Medicilon has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Shanghai Medicilon's future stacks up against the industry? In that case, our free report is a great place to start.How Is Shanghai Medicilon's Revenue Growth Trending?

In order to justify its P/S ratio, Shanghai Medicilon would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 43%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 14% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 119% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 15%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Shanghai Medicilon's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Shanghai Medicilon's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shanghai Medicilon currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Shanghai Medicilon that you should be aware of.

If these risks are making you reconsider your opinion on Shanghai Medicilon, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688202

Shanghai Medicilon

A drug discovery contract research organization, provides drug discovery and development services to pharmaceutical and biotechnology companies in China and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives