Some BrightGene Bio-Medical Technology Co., Ltd. (SHSE:688166) Shareholders Look For Exit As Shares Take 29% Pounding

BrightGene Bio-Medical Technology Co., Ltd. (SHSE:688166) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 34%, which is great even in a bull market.

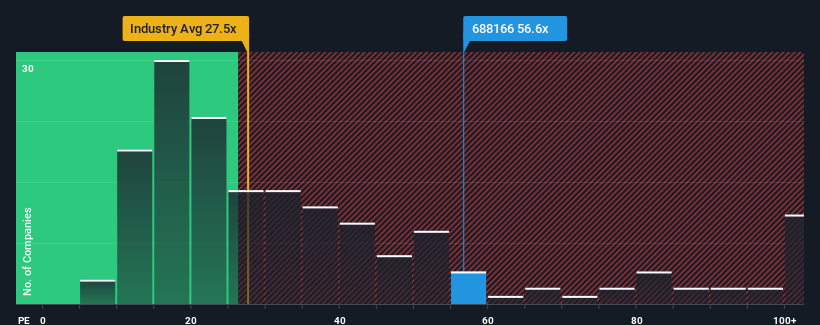

Even after such a large drop in price, BrightGene Bio-Medical Technology may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 56.6x, since almost half of all companies in China have P/E ratios under 28x and even P/E's lower than 17x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, BrightGene Bio-Medical Technology's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for BrightGene Bio-Medical Technology

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as BrightGene Bio-Medical Technology's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 20% per annum during the coming three years according to the one analyst following the company. Meanwhile, the rest of the market is forecast to expand by 24% each year, which is noticeably more attractive.

In light of this, it's alarming that BrightGene Bio-Medical Technology's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Even after such a strong price drop, BrightGene Bio-Medical Technology's P/E still exceeds the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of BrightGene Bio-Medical Technology's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 3 warning signs for BrightGene Bio-Medical Technology (2 don't sit too well with us!) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if BrightGene Bio-Medical Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688166

BrightGene Bio-Medical Technology

A pharmaceutical company, engages in the research and development, manufacture, and commercialization of pharmaceutical products in China.

High growth potential and slightly overvalued.

Market Insights

Community Narratives