As global markets navigate a landscape marked by record highs in major U.S. indices and mixed performances across sectors, growth stocks have notably outpaced their value counterparts, highlighting the shifting investor sentiment towards companies with robust expansion potential. In this context of market divergence and economic updates, insider-backed growth companies stand out as compelling opportunities due to their alignment of interests between management and shareholders, often indicating confidence in the company's future prospects amidst current economic conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's review some notable picks from our screened stocks.

Humble Group (OM:HUMBLE)

Simply Wall St Growth Rating: ★★★★☆☆

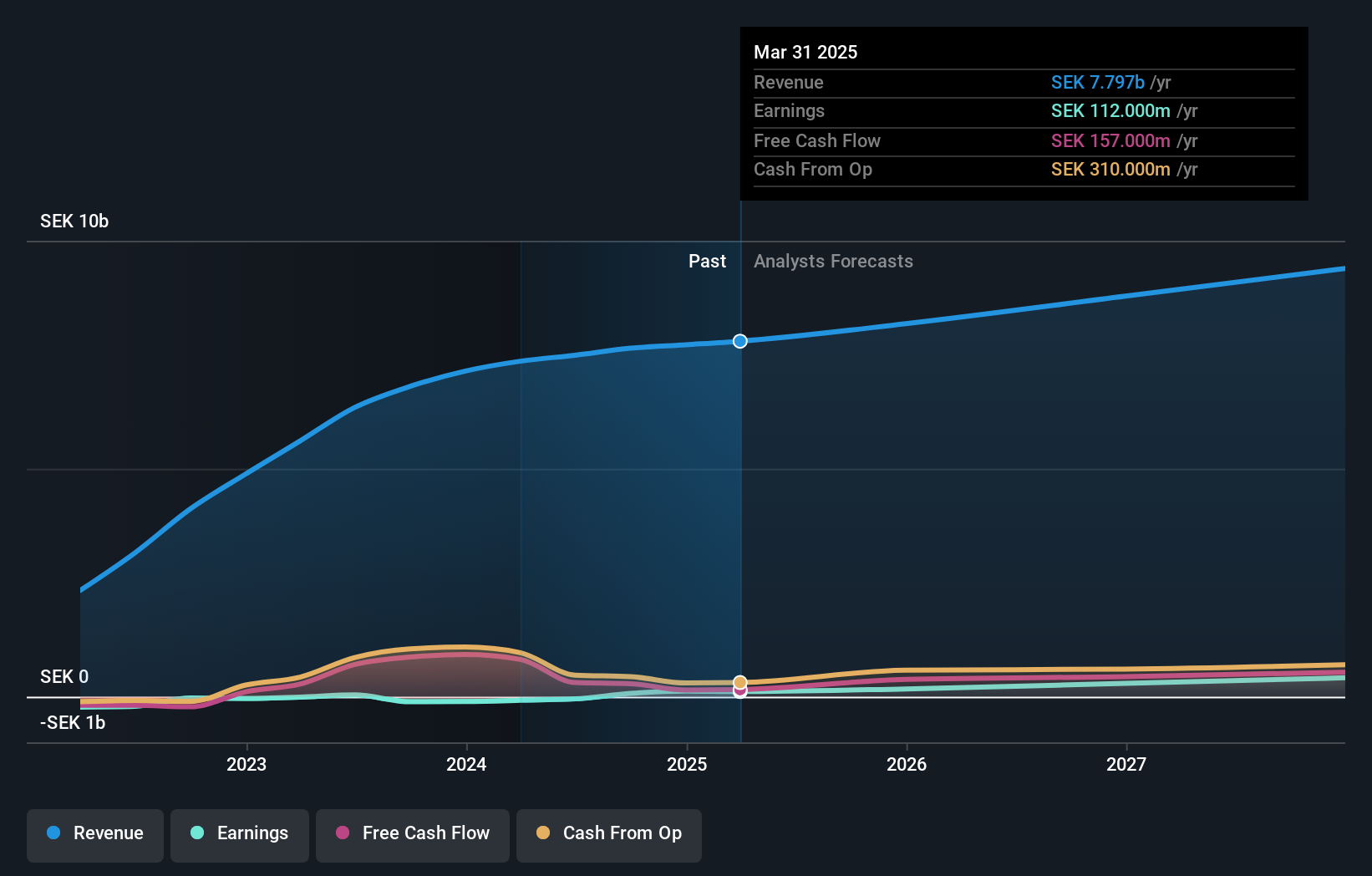

Overview: Humble Group AB (publ) is involved in the refining, development, and distribution of fast-moving consumer products both in Sweden and internationally, with a market capitalization of approximately SEK5.52 billion.

Operations: The company's revenue is derived from four primary segments: Future Snacking (SEK959 million), Sustainable Care (SEK2.34 billion), Quality Nutrition (SEK1.58 billion), and Nordic Distribution (SEK2.74 billion).

Insider Ownership: 15.9%

Earnings Growth Forecast: 65.1% p.a.

Humble Group has seen substantial insider buying over the past three months, indicating confidence in its growth prospects. The company recently turned profitable, with Q3 2024 net income at SEK 27 million compared to a loss last year. Forecasts suggest earnings will grow significantly above the Swedish market average. Despite trading at a significant discount to estimated fair value, its return on equity is expected to remain low in three years.

- Get an in-depth perspective on Humble Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Humble Group is priced higher than what may be justified by its financials.

Jiangsu Sinopep-Allsino Biopharmaceutical (SHSE:688076)

Simply Wall St Growth Rating: ★★★★★★

Overview: Jiangsu Sinopep-Allsino Biopharmaceutical Co., Ltd. is a biomedical company focused on the research, development, production, sale, and technical service of peptides and small molecule drugs in China with a market cap of CN¥11.54 billion.

Operations: The company generates revenue primarily from its Medicine Manufacturing segment, amounting to CN¥1.58 billion.

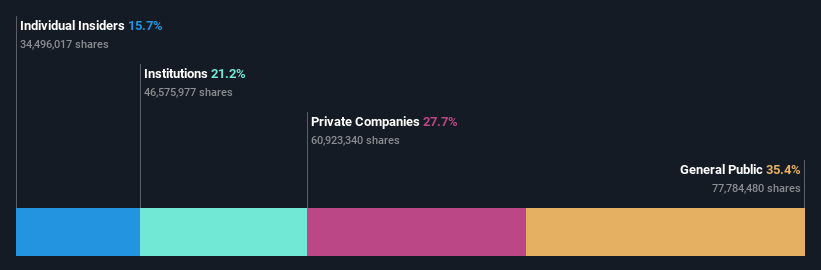

Insider Ownership: 15.7%

Earnings Growth Forecast: 31.4% p.a.

Jiangsu Sinopep-Allsino Biopharmaceutical's recent earnings report shows strong growth, with net income rising to CNY 350.25 million from CNY 91.71 million a year ago. The company trades significantly below its estimated fair value and forecasts suggest earnings and revenue will grow faster than the Chinese market average over the next three years. Despite no substantial insider trading activity recently, its high non-cash earnings quality supports its growth trajectory.

- Click here to discover the nuances of Jiangsu Sinopep-Allsino Biopharmaceutical with our detailed analytical future growth report.

- The analysis detailed in our Jiangsu Sinopep-Allsino Biopharmaceutical valuation report hints at an deflated share price compared to its estimated value.

World (TSE:3612)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: World Co., Ltd. operates in the apparel and fashion industry by planning, manufacturing, retailing, selling, and importing/exporting products both in Japan and internationally, with a market cap of ¥84.15 billion.

Operations: World Co., Ltd. generates revenue through its subsidiaries by engaging in the planning, manufacturing, retailing, selling, and importing/exporting of apparel and fashion products across domestic and international markets.

Insider Ownership: 13.9%

Earnings Growth Forecast: 23.6% p.a.

World Co., Ltd. is trading at a significant discount to its estimated fair value, with earnings expected to grow 23.6% annually, outpacing the JP market's growth rate. Despite high debt levels and a volatile share price, the company recently reported strong online sales growth of 102.1% year on year for October 2024 and increased its dividend to JPY 37 per share from JPY 26 last year, indicating robust financial performance amidst challenges.

- Delve into the full analysis future growth report here for a deeper understanding of World.

- Insights from our recent valuation report point to the potential undervaluation of World shares in the market.

Seize The Opportunity

- Reveal the 1511 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688076

Jiangsu Sinopep-Allsino Biopharmaceutical

A biomedical company, engages in the research and development, production, sale, and technical service of peptides and small molecule drugs in China.

Exceptional growth potential and undervalued.