Hunan Fangsheng Pharmaceutical Co., Ltd.'s (SHSE:603998) 34% Share Price Surge Not Quite Adding Up

Hunan Fangsheng Pharmaceutical Co., Ltd. (SHSE:603998) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

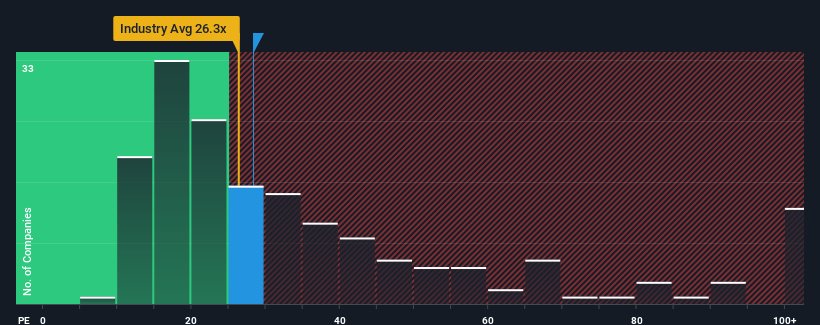

In spite of the firm bounce in price, there still wouldn't be many who think Hunan Fangsheng Pharmaceutical's price-to-earnings (or "P/E") ratio of 28.3x is worth a mention when the median P/E in China is similar at about 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Hunan Fangsheng Pharmaceutical has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Hunan Fangsheng Pharmaceutical

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Hunan Fangsheng Pharmaceutical's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 127% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 23% as estimated by the dual analysts watching the company. With the market predicted to deliver 42% growth , the company is positioned for a weaker earnings result.

With this information, we find it interesting that Hunan Fangsheng Pharmaceutical is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Hunan Fangsheng Pharmaceutical's P/E

Hunan Fangsheng Pharmaceutical appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Hunan Fangsheng Pharmaceutical's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Hunan Fangsheng Pharmaceutical that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Fangsheng Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603998

Hunan Fangsheng Pharmaceutical

Engages in research, develops, produces, and sells traditional Chinese medicine industry and chemical pharmaceutical products in China.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives