- China

- /

- Auto Components

- /

- SZSE:000700

Undiscovered Gems And 2 Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week marked by U.S. inflation concerns and political uncertainty, small-cap stocks have notably underperformed their larger counterparts, with the Russell 2000 Index slipping into correction territory. Amid this backdrop of choppy market conditions and resilient labor data, investors may find potential opportunities in overlooked small-cap stocks that demonstrate strong fundamentals and growth potential. Identifying such undiscovered gems requires a keen eye for companies with solid financial health and the ability to navigate economic headwinds effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Getein Biotech (SHSE:603387)

Simply Wall St Value Rating: ★★★★★☆

Overview: Getein Biotech, Inc is engaged in the research, development, production, and sale of in vitro diagnostic reagents and instruments both in China and internationally, with a market cap of CN¥4.18 billion.

Operations: Getein Biotech generates revenue primarily from the sale of in vitro diagnostic reagents and instruments. The company has a market capitalization of CN¥4.18 billion, reflecting its presence in both domestic and international markets.

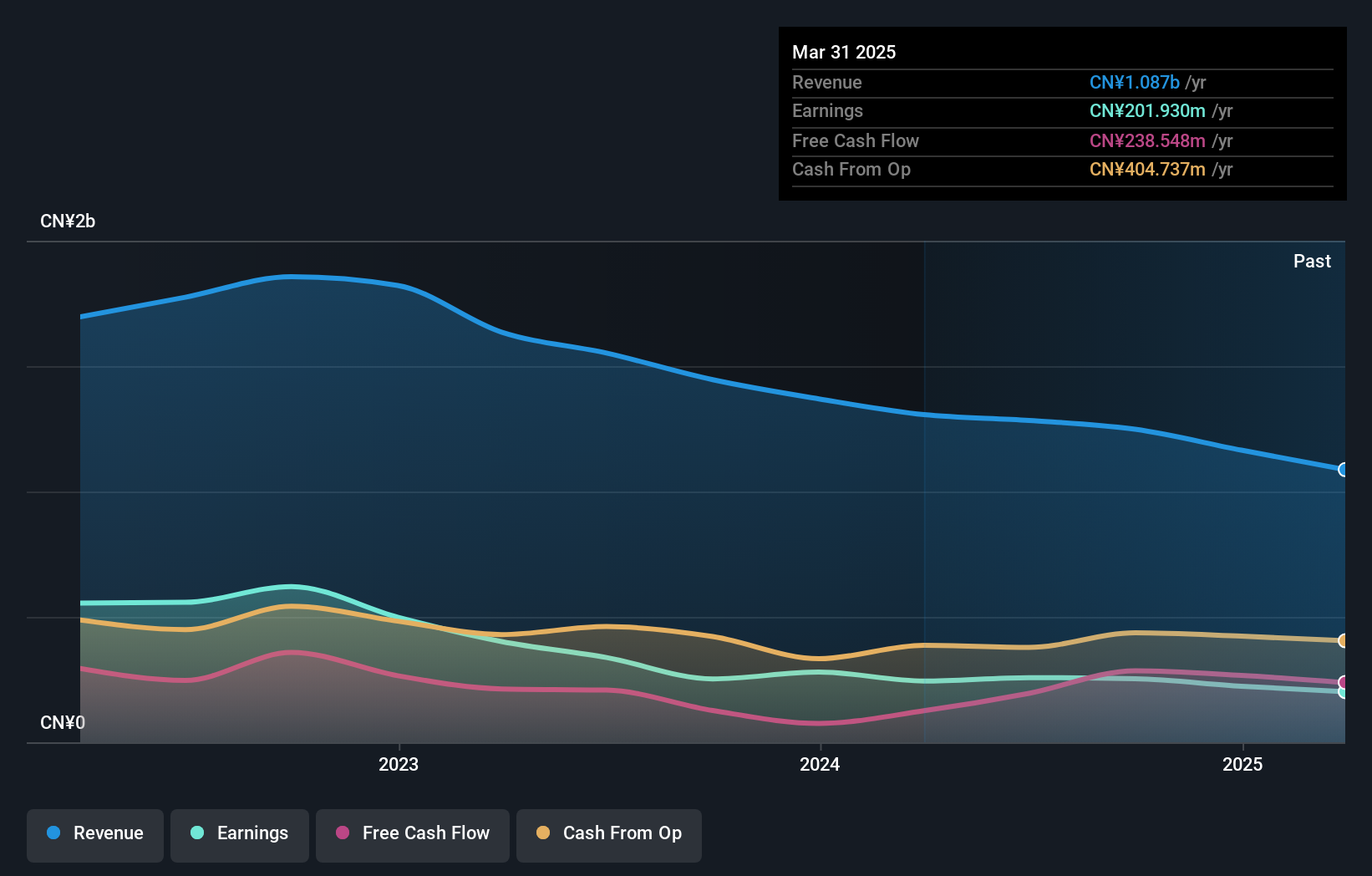

Getein Biotech, a biotech player, has faced some challenges recently. Over the past five years, its earnings have dipped by 0.5% annually and its debt-to-equity ratio climbed from 0.8 to 25.3, indicating rising leverage concerns despite having more cash than total debt. The company's recent sales for the nine months ended September 2024 were CNY 879.82 million compared to CNY 1 billion in the previous year, with net income at CNY 202.28 million down from CNY 229.07 million last year and basic earnings per share at CNY 0.4 versus CNY 0.45 previously, reflecting a need for strategic adjustments moving forward.

- Navigate through the intricacies of Getein Biotech with our comprehensive health report here.

Assess Getein Biotech's past performance with our detailed historical performance reports.

Ningbo Gaofa Automotive Control System (SHSE:603788)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ningbo Gaofa Automotive Control System Co., Ltd. is a company that specializes in the production of automotive control systems, with a market capitalization of CN¥3.17 billion.

Operations: Ningbo Gaofa generates revenue primarily from its automotive parts segment, totaling CN¥1.47 billion.

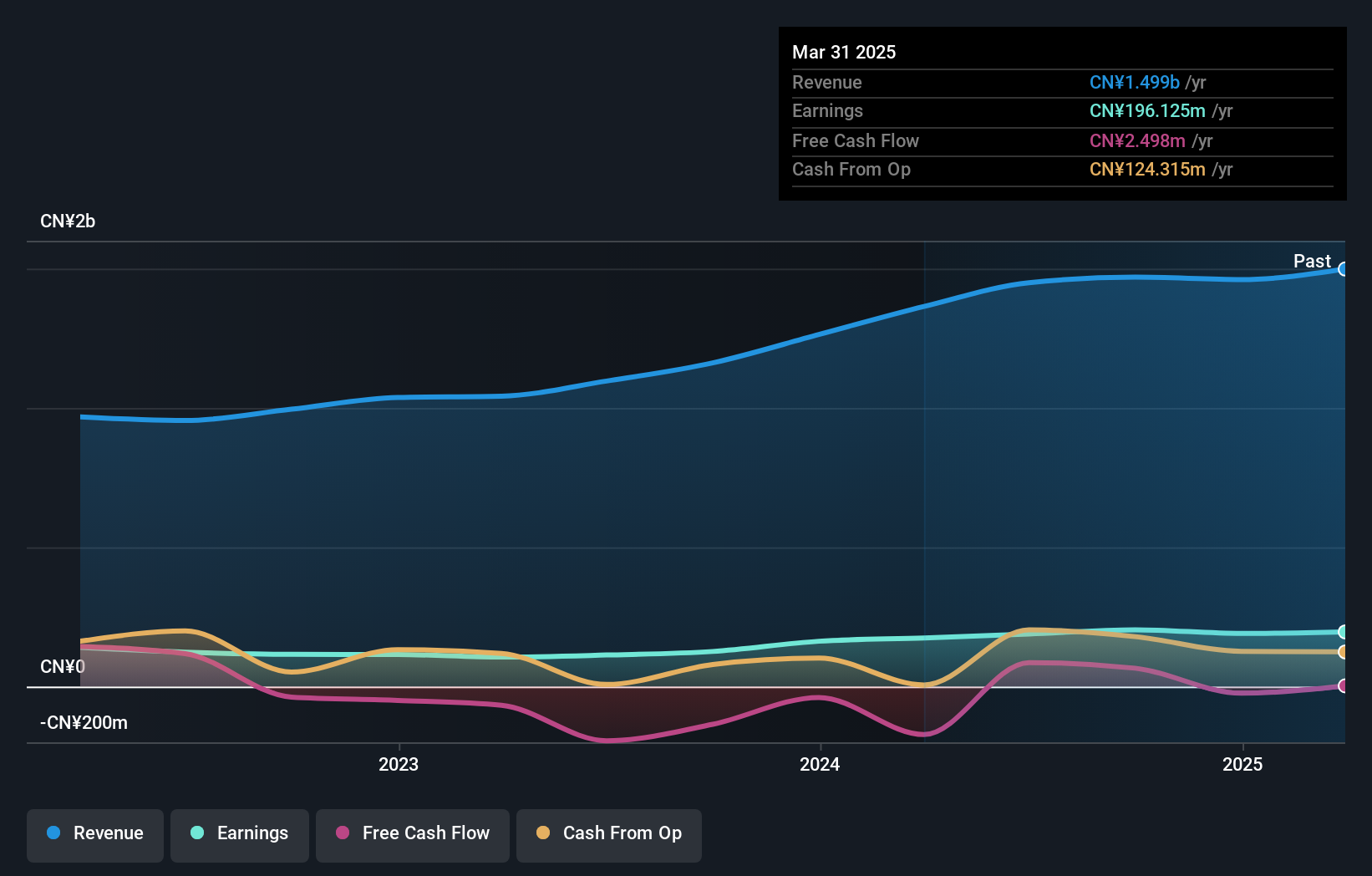

Ningbo Gaofa, a player in the automotive control systems sector, has shown promising financial performance with earnings surging by 61.9% over the past year, outpacing industry growth of 10.5%. The company reported sales of CNY 1.08 billion for the first nine months of 2024, up from CNY 877 million last year, while net income rose to CNY 152 million from CNY 111 million. With a price-to-earnings ratio of just 15.5x against the broader CN market's average of 33.4x, it appears attractively valued despite a slight increase in its debt-to-equity ratio over five years to just under half a percent.

- Unlock comprehensive insights into our analysis of Ningbo Gaofa Automotive Control System stock in this health report.

Understand Ningbo Gaofa Automotive Control System's track record by examining our Past report.

Jiangnan Mould & Plastic Technology (SZSE:000700)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangnan Mould & Plastic Technology Co., Ltd. operates in the mould and plastic industry with a market capitalization of approximately CN¥6.36 billion.

Operations: Jiangnan Mould & Plastic Technology generates revenue primarily from its mould and plastic segments. The company has a market capitalization of approximately CN¥6.36 billion.

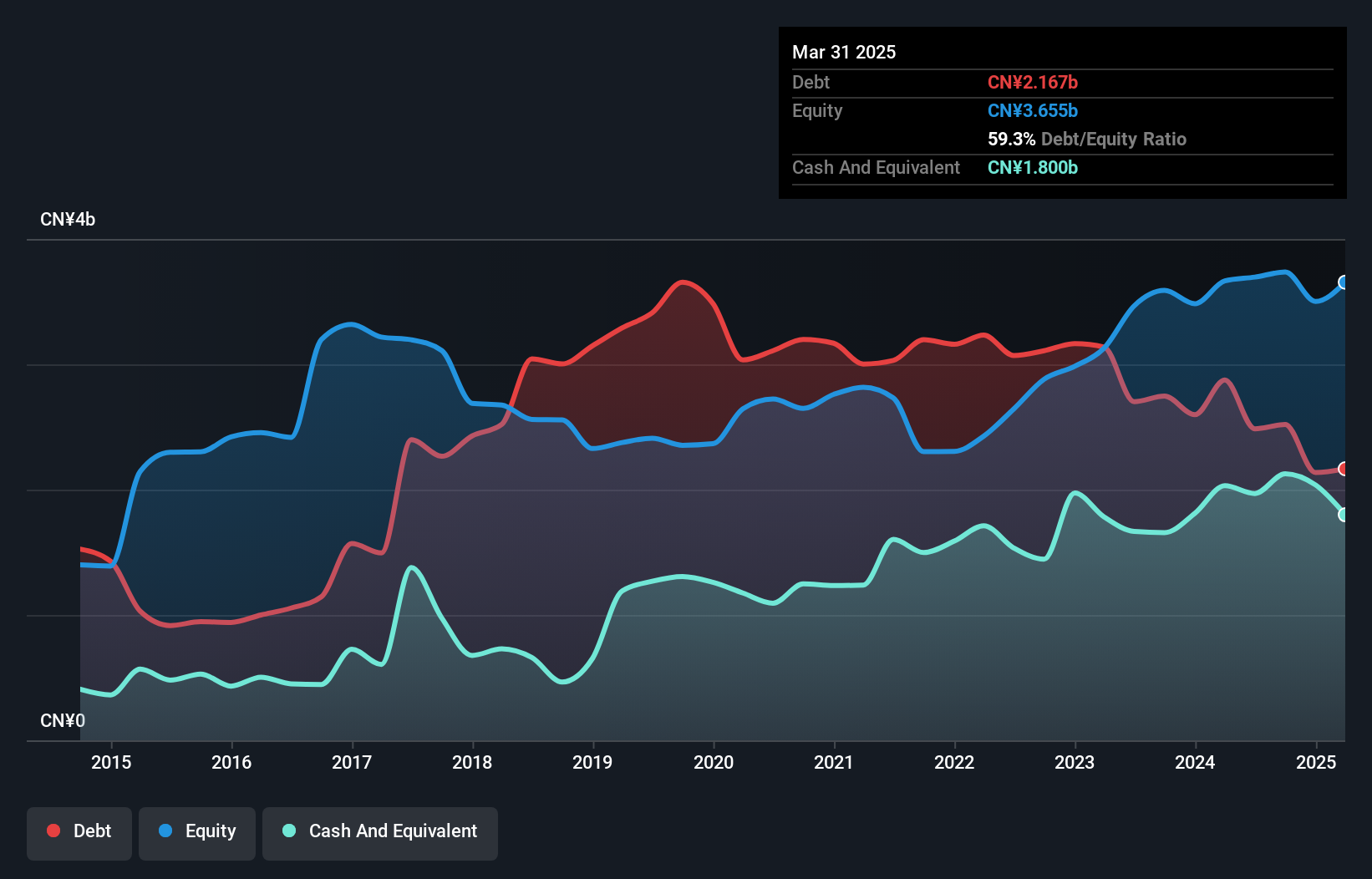

Jiangnan Mould & Plastic Technology, a small player in the auto components industry, has demonstrated notable financial resilience. Over the past year, its earnings grew by 17.1%, outpacing the industry's 10.5% growth rate. The company has effectively reduced its debt to equity ratio from 155% to a more manageable 67% over five years, with a satisfactory net debt to equity ratio of 10%. Despite experiencing a one-off gain of CN¥103.9M impacting recent results, it continues trading at nearly half its estimated fair value and recently approved dividends per ten shares totaling CNY 2.17 for Q3 of 2024.

Key Takeaways

- Gain an insight into the universe of 4617 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000700

Jiangnan Mould & Plastic Technology

Jiangnan Mould & Plastic Technology Co., Ltd.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives