What Zhejiang Ausun Pharmaceutical Co., Ltd.'s (SHSE:603229) 28% Share Price Gain Is Not Telling You

Zhejiang Ausun Pharmaceutical Co., Ltd. (SHSE:603229) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 27%.

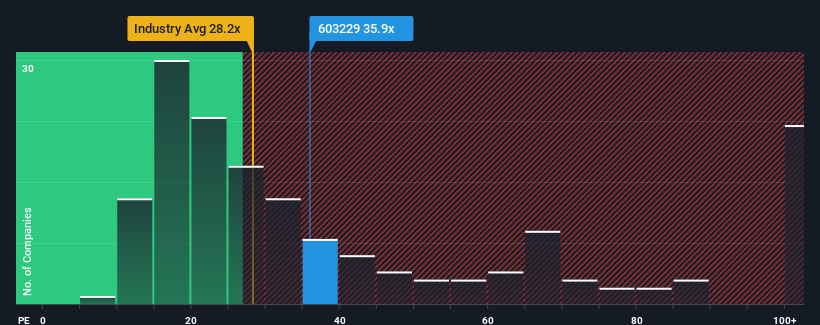

Although its price has surged higher, there still wouldn't be many who think Zhejiang Ausun Pharmaceutical's price-to-earnings (or "P/E") ratio of 35.9x is worth a mention when the median P/E in China is similar at about 33x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Zhejiang Ausun Pharmaceutical has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Zhejiang Ausun Pharmaceutical

Is There Some Growth For Zhejiang Ausun Pharmaceutical?

The only time you'd be comfortable seeing a P/E like Zhejiang Ausun Pharmaceutical's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 7.5% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 84% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 27% over the next year. That's shaping up to be materially lower than the 38% growth forecast for the broader market.

With this information, we find it interesting that Zhejiang Ausun Pharmaceutical is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Zhejiang Ausun Pharmaceutical's P/E?

Its shares have lifted substantially and now Zhejiang Ausun Pharmaceutical's P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Zhejiang Ausun Pharmaceutical's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with Zhejiang Ausun Pharmaceutical.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Ausun Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603229

Zhejiang Ausun Pharmaceutical

Engages in the research and development, process development, manufacture, and sale of APIs and pharmaceutical intermediates.

Excellent balance sheet and fair value.

Market Insights

Community Narratives