In a week marked by tariff uncertainties and mixed economic signals, global markets experienced fluctuations, with U.S. stocks ending lower and European indices showing resilience despite trade concerns. As investors navigate these volatile conditions, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking to balance risk in their portfolios amidst the current market dynamics.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.82% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.51% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

China World Trade Center (SHSE:600007)

Simply Wall St Dividend Rating: ★★★★★★

Overview: China World Trade Center Co., Ltd. operates commercial mixed-use developments in China and internationally, with a market cap of CN¥24.33 billion.

Operations: China World Trade Center Co., Ltd. generates revenue from its commercial mixed-use developments both domestically in China and on an international scale.

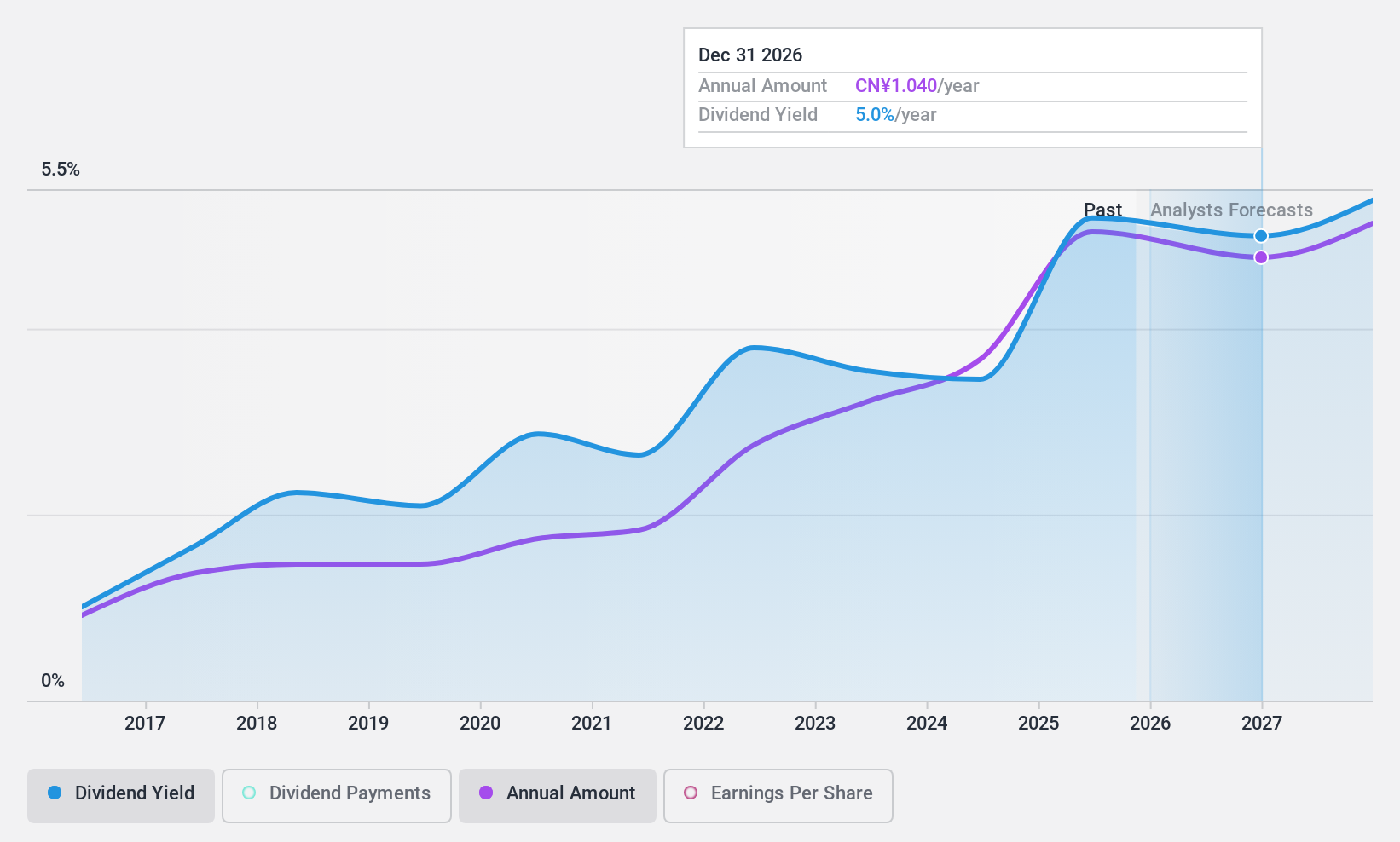

Dividend Yield: 3.3%

China World Trade Center offers a stable dividend profile with a 3.31% yield, placing it in the top 25% of CN market payers. Its dividends are well-supported by earnings and cash flows, with payout ratios of 63.5% and 46.4%, respectively. Over the past decade, dividends have been reliable and stable without volatility. However, projected earnings declines may impact future growth prospects despite its current valuation being below estimated fair value by 10.9%.

- Delve into the full analysis dividend report here for a deeper understanding of China World Trade Center.

- Upon reviewing our latest valuation report, China World Trade Center's share price might be too pessimistic.

Hubei Jumpcan Pharmaceutical (SHSE:600566)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hubei Jumpcan Pharmaceutical Co., Ltd. is involved in the research, development, manufacturing, and trading of both Chinese traditional and western medicines, as well as daily use chemical-based Chinese traditional medicines and health products in China, with a market cap of CN¥25.44 billion.

Operations: Hubei Jumpcan Pharmaceutical Co., Ltd. generates revenue through its activities in Chinese traditional medicines, western medicines, daily use chemical-based Chinese traditional medicines, and health products within China.

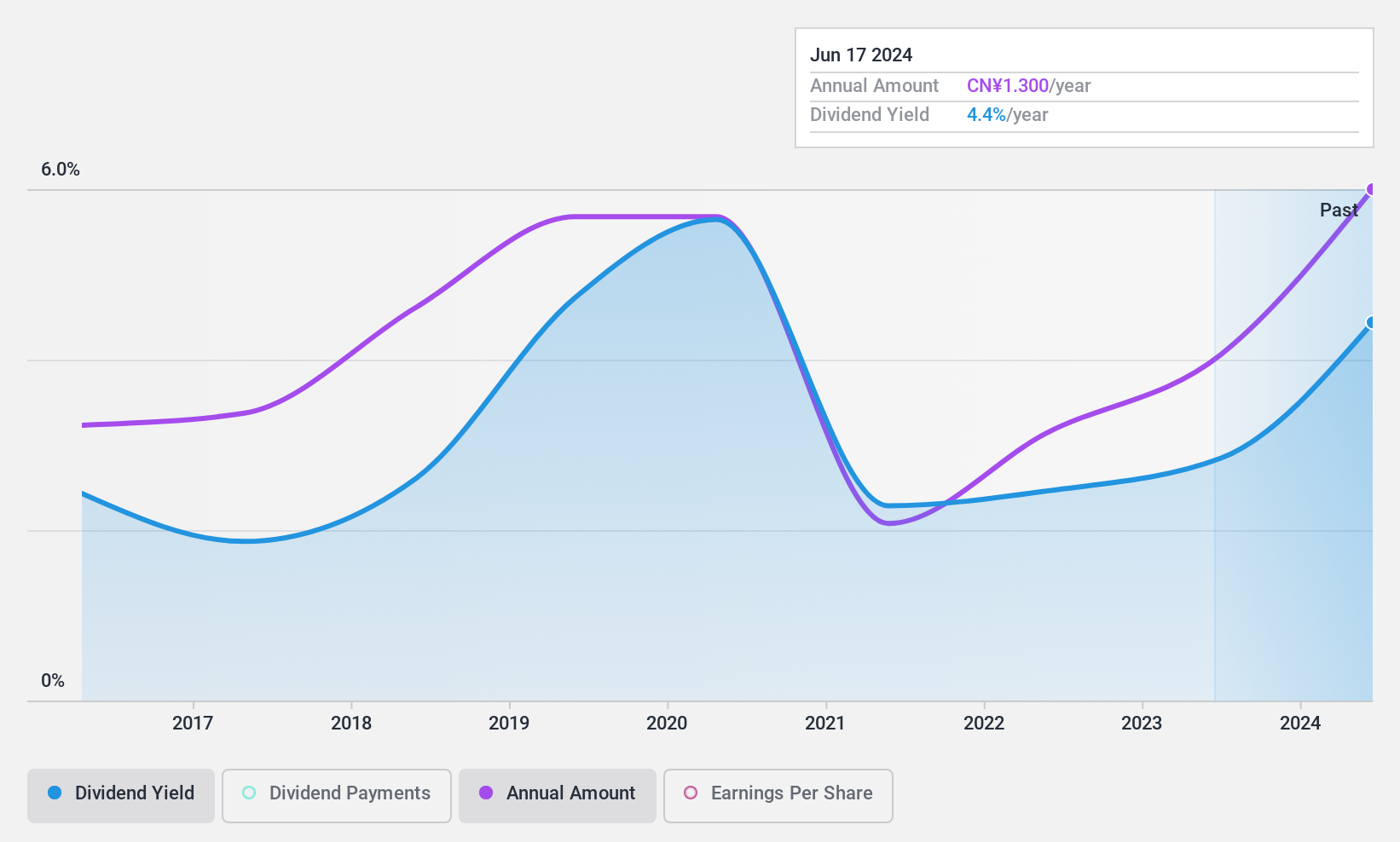

Dividend Yield: 4.7%

Hubei Jumpcan Pharmaceutical's dividend yield of 4.71% ranks in the top 25% of CN market payers. Dividends are well-covered by earnings and cash flows, with payout ratios of 42.9% and 56.1%, respectively. Despite a history of volatility, dividends have grown over the past decade. The stock trades at a favorable value compared to peers, though its unstable dividend track record remains a concern for sustainability despite recent earnings growth of CNY10 million last year.

- Take a closer look at Hubei Jumpcan Pharmaceutical's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Hubei Jumpcan Pharmaceutical is trading behind its estimated value.

Nichimo (TSE:8091)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nichimo Co., Ltd., with a market cap of ¥16.56 billion, primarily manufactures and sells fish products both in Japan and internationally through its subsidiaries.

Operations: Nichimo Co., Ltd.'s revenue segments include the Food Business at ¥84.56 billion, Marine Business at ¥23.85 billion, Machinery Business at ¥12.69 billion, Material Business at ¥9.22 billion, Biotech Business at ¥288 million, and Distribution Business at ¥2.39 billion.

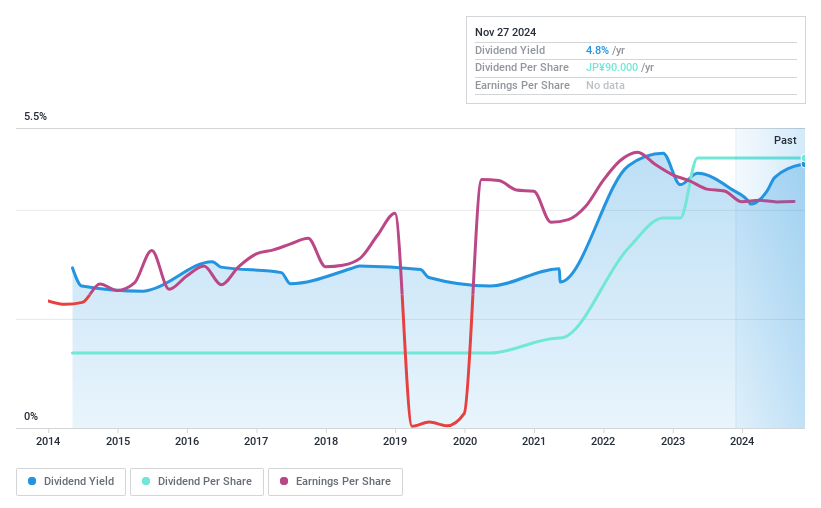

Dividend Yield: 4.5%

Nichimo's dividend yield of 4.53% ranks in the top 25% of the JP market, supported by a low payout ratio of 14.7%. However, dividends are not covered by free cash flow, raising sustainability concerns despite stable payments over the past decade. The stock trades slightly below its estimated fair value but faces challenges with debt coverage and large one-off items affecting earnings. Earnings have grown at 13.8% annually over five years, indicating potential for future stability.

- Click to explore a detailed breakdown of our findings in Nichimo's dividend report.

- Our valuation report unveils the possibility Nichimo's shares may be trading at a discount.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1970 more companies for you to explore.Click here to unveil our expertly curated list of 1973 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nichimo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8091

Nichimo

Primarily manufactures and sells fish products in Japan and internationally.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives