Qinghai Spring Medicinal Resources Technology Co., Ltd.'s (SHSE:600381) 27% Price Boost Is Out Of Tune With Revenues

Those holding Qinghai Spring Medicinal Resources Technology Co., Ltd. (SHSE:600381) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 34% in the last twelve months.

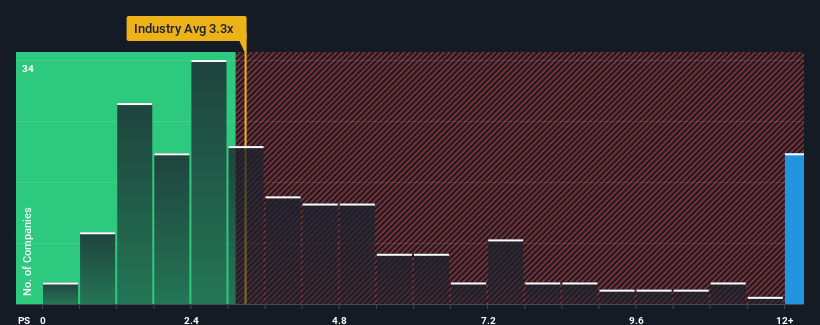

Following the firm bounce in price, you could be forgiven for thinking Qinghai Spring Medicinal Resources Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 19.5x, considering almost half the companies in China's Pharmaceuticals industry have P/S ratios below 3.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Qinghai Spring Medicinal Resources Technology

What Does Qinghai Spring Medicinal Resources Technology's Recent Performance Look Like?

Revenue has risen firmly for Qinghai Spring Medicinal Resources Technology recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Qinghai Spring Medicinal Resources Technology will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Qinghai Spring Medicinal Resources Technology?

Qinghai Spring Medicinal Resources Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 9.9% gain to the company's revenues. Pleasingly, revenue has also lifted 51% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 18% shows it's noticeably less attractive.

With this in mind, we find it worrying that Qinghai Spring Medicinal Resources Technology's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Qinghai Spring Medicinal Resources Technology's P/S

Qinghai Spring Medicinal Resources Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Qinghai Spring Medicinal Resources Technology revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Qinghai Spring Medicinal Resources Technology, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Qinghai Spring Medicinal Resources Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600381

Qinghai Spring Medicinal Resources Technology

Qinghai Spring Medicinal Resources Technology Co., Ltd.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives