3 Penny Stocks In Global With Market Caps Larger Than US$100M

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape marked by steady U.S. inflation and geopolitical uncertainties, small-cap stocks have shown resilience, with the Russell 2000 Index outperforming larger indices. For investors seeking opportunities beyond established giants, penny stocks—despite their vintage nomenclature—remain a relevant investment area. This article explores three noteworthy penny stocks that combine solid financial foundations with the potential for growth, offering intriguing prospects in today's market conditions.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.71 | MYR377.44M | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.62 | MYR315.26M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.47 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.775 | SGD314.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.52 | MYR610.36M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.06 | SGD12.04B | ✅ 5 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.075 | €286.81M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.93 | €31.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,732 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Serko (NZSE:SKO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Serko Limited offers online travel booking and expense management services across New Zealand, Australia, the United States, Europe, and other international markets with a market cap of NZ$312.04 million.

Operations: The company generates revenue primarily from its provision of software solutions, amounting to NZ$88.48 million.

Market Cap: NZ$312.04M

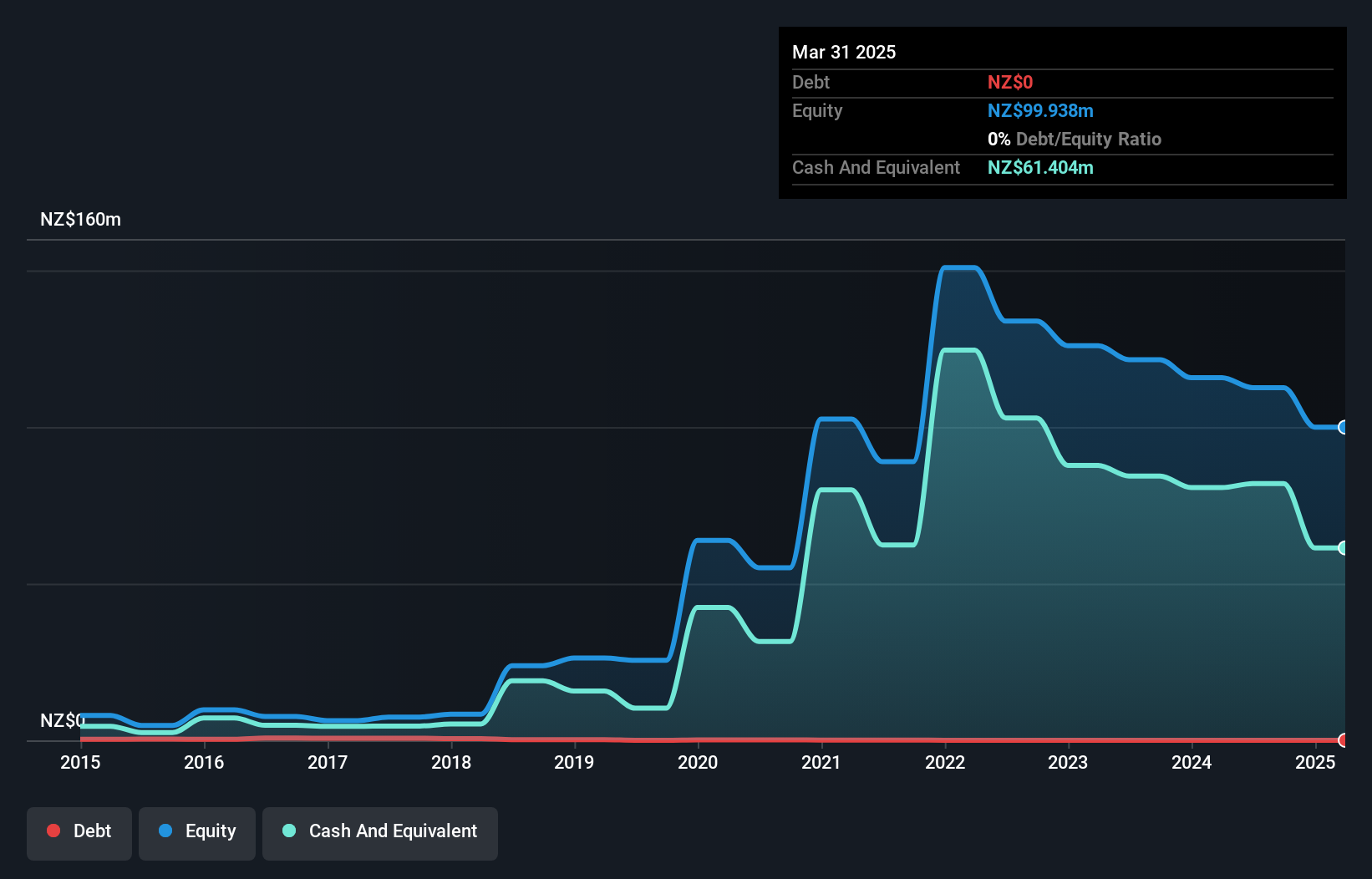

Serko Limited, with a market cap of NZ$312.04 million and revenue of NZ$88.48 million, recently renewed its partnership with Flight Centre Travel Group, which contributes significantly to its booking volume in Australia and New Zealand. The company reaffirmed its FY26 income guidance of US$115 million to US$123 million. Despite being unprofitable with a negative return on equity, Serko has managed to reduce losses over the past five years by 4.4% annually and maintains a strong cash runway exceeding three years without any debt burden. Significant insider selling occurred recently, but shareholder dilution has been minimal over the past year.

- Unlock comprehensive insights into our analysis of Serko stock in this financial health report.

- Understand Serko's earnings outlook by examining our growth report.

Qinghai Spring Medicinal Resources Technology (SHSE:600381)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qinghai Spring Medicinal Resources Technology Co., Ltd. operates in the medicinal resources sector and has a market cap of CN¥2.98 billion.

Operations: Qinghai Spring Medicinal Resources Technology Co., Ltd. has not reported any revenue segments.

Market Cap: CN¥2.98B

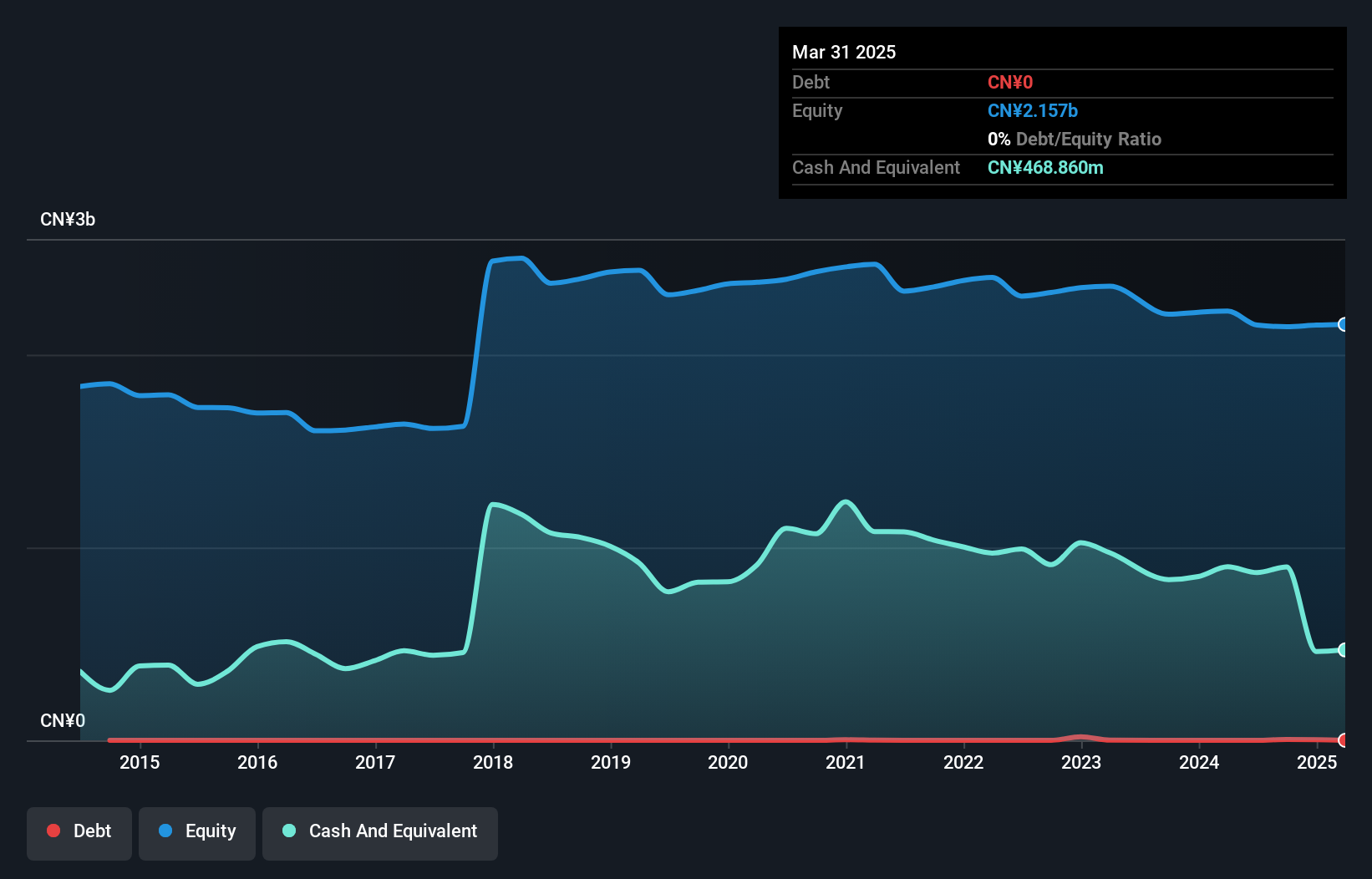

Qinghai Spring Medicinal Resources Technology, with a market cap of CN¥2.98 billion, is currently pre-revenue and unprofitable, having seen losses increase by 8.5% annually over the past five years. Despite this, the company benefits from a strong cash position with sufficient runway for over three years based on current free cash flow and remains debt-free. Its experienced management team has an average tenure of 10.5 years, and short-term assets significantly outweigh liabilities. The stock's weekly volatility has remained stable at 6%, and shareholders have not faced significant dilution recently.

- Jump into the full analysis health report here for a deeper understanding of Qinghai Spring Medicinal Resources Technology.

- Examine Qinghai Spring Medicinal Resources Technology's past performance report to understand how it has performed in prior years.

Jiangsu Jiangnan High Polymer FiberLtd (SHSE:600527)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu Jiangnan High Polymer Fiber Co., Ltd specializes in the production and sale of polyester tops and composite staple fibers, serving both domestic and international markets, with a market cap of CN¥3.72 billion.

Operations: No specific revenue segments are reported for Jiangsu Jiangnan High Polymer Fiber Co., Ltd.

Market Cap: CN¥3.72B

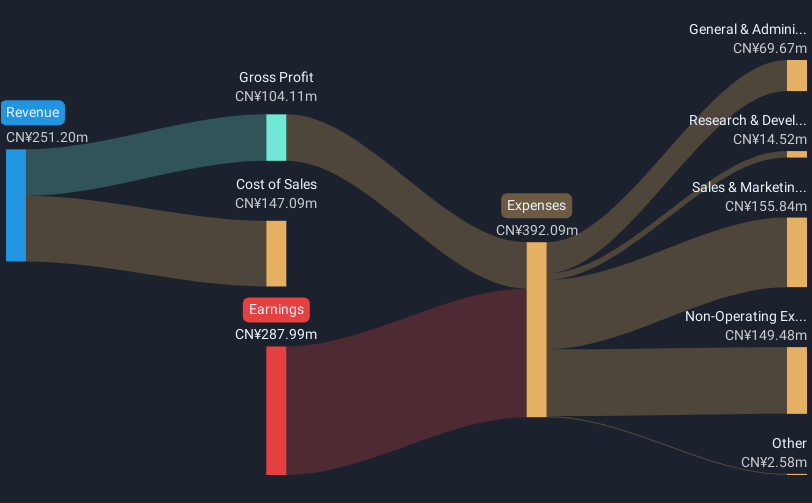

Jiangsu Jiangnan High Polymer Fiber Co., Ltd, with a market cap of CN¥3.72 billion, remains debt-free and has stable weekly volatility at 3%. Despite a negative earnings growth of 13.6% over the past year, its net profit margin improved to 7%, partly due to a significant one-off gain of CN¥13.1 million. The company's short-term assets exceed both short-term and long-term liabilities, indicating strong liquidity. It completed a share buyback plan on June 26, 2025, repurchasing shares worth CN¥40.91 million in total since June 2024 without causing shareholder dilution in the past year.

- Click to explore a detailed breakdown of our findings in Jiangsu Jiangnan High Polymer FiberLtd's financial health report.

- Evaluate Jiangsu Jiangnan High Polymer FiberLtd's historical performance by accessing our past performance report.

Summing It All Up

- Unlock more gems! Our Global Penny Stocks screener has unearthed 3,729 more companies for you to explore.Click here to unveil our expertly curated list of 3,732 Global Penny Stocks.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600527

Jiangsu Jiangnan High Polymer FiberLtd

Engages in the production and sale of polyester tops and composite staple fibers in China and internationally.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives