Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited's (SHSE:600329) Subdued P/E Might Signal An Opportunity

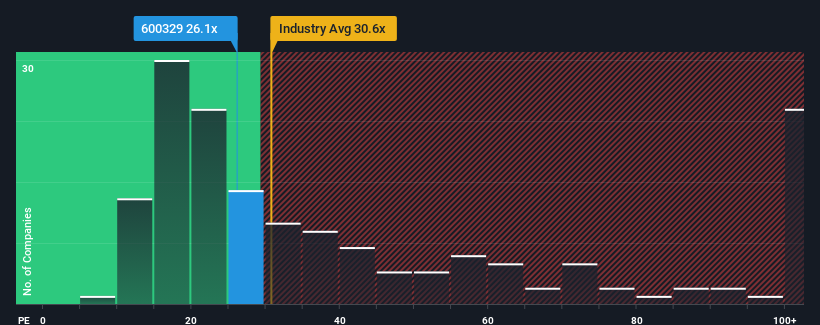

With a price-to-earnings (or "P/E") ratio of 26.1x Tianjin Pharmaceutical Da Ren Tang Group Corporation Limited (SHSE:600329) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 40x and even P/E's higher than 77x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for Tianjin Pharmaceutical Da Ren Tang Group as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Tianjin Pharmaceutical Da Ren Tang Group

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Tianjin Pharmaceutical Da Ren Tang Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 5.5% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 10% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 38% during the coming year according to the two analysts following the company. Meanwhile, the rest of the market is forecast to expand by 37%, which is not materially different.

With this information, we find it odd that Tianjin Pharmaceutical Da Ren Tang Group is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Tianjin Pharmaceutical Da Ren Tang Group's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Tianjin Pharmaceutical Da Ren Tang Group currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Tianjin Pharmaceutical Da Ren Tang Group.

Of course, you might also be able to find a better stock than Tianjin Pharmaceutical Da Ren Tang Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Pharmaceutical Da Ren Tang Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600329

Tianjin Pharmaceutical Da Ren Tang Group

Produces and sells traditional Chinese medicine, western medicine, and other products primarily in the People’s Republic of China.

Outstanding track record, undervalued and pays a dividend.

Market Insights

Community Narratives