Investors Appear Satisfied With Shanghai Kai Kai Industry Company Limited's (SHSE:600272) Prospects As Shares Rocket 30%

Despite an already strong run, Shanghai Kai Kai Industry Company Limited (SHSE:600272) shares have been powering on, with a gain of 30% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

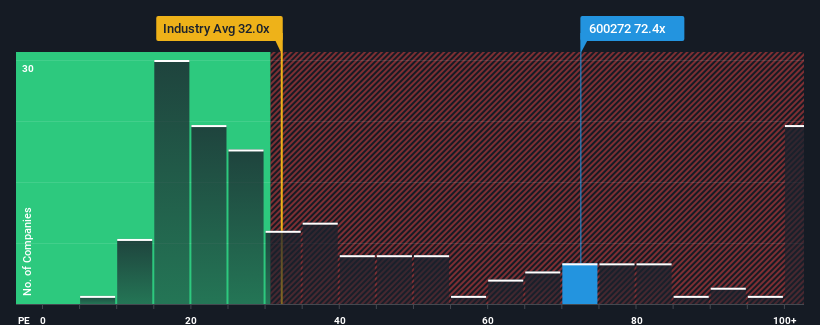

Following the firm bounce in price, Shanghai Kai Kai Industry's price-to-earnings (or "P/E") ratio of 72.4x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 37x and even P/E's below 21x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Shanghai Kai Kai Industry as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Shanghai Kai Kai Industry

Is There Enough Growth For Shanghai Kai Kai Industry?

The only time you'd be truly comfortable seeing a P/E as steep as Shanghai Kai Kai Industry's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 110%. Pleasingly, EPS has also lifted 240% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 38% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Shanghai Kai Kai Industry is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Shanghai Kai Kai Industry's P/E?

The strong share price surge has got Shanghai Kai Kai Industry's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Shanghai Kai Kai Industry maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Shanghai Kai Kai Industry, and understanding should be part of your investment process.

You might be able to find a better investment than Shanghai Kai Kai Industry. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600272

Shanghai Kai Kai Industry

Engages in the production, distribution, and sale of pharmaceutical and clothing products in China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives