- Japan

- /

- Real Estate

- /

- TSE:3496

Exploring Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative And 2 Other Undiscovered Gems

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic indicators, global markets have shown resilience, with the S&P 500 Index experiencing only a slight decline and European stocks maintaining gains despite trade policy concerns. As investors navigate these complex conditions, identifying lesser-known stocks with strong fundamentals can offer potential opportunities for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Formula Systems (1985) | 37.70% | 9.99% | 13.08% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 20.75% | 18.12% | ★★★★★★ |

| C. Mer Industries | 131.82% | 12.24% | 75.61% | ★★★★★☆ |

| Conoil | 65.11% | 21.04% | 44.95% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers diverse banking and financial services to various customer segments in France, with a market cap of approximately €1.10 billion.

Operations: CRBP2 generates revenue primarily from its retail banking segment, amounting to €626 million. The company has a market cap of approximately €1.10 billion.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie, a cooperative bank with €42.2B in assets and €5.0B in equity, stands out for its robust financial health. With total deposits of €33.8B and loans amounting to €34.1B, it has a sufficient allowance for bad loans at 115% and maintains an appropriate level of non-performing loans at 1.2%. The bank trades significantly below its estimated fair value by 57%, suggesting potential undervaluation in the market. Earnings growth of 6.2% over the past year surpassed industry averages, highlighting its strong performance despite a revenue dip of 2.2%.

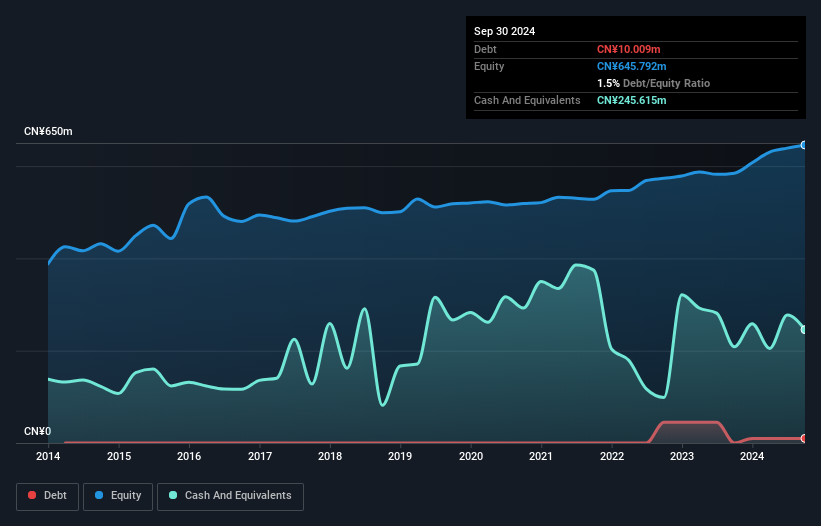

Shanghai Kai Kai Industry (SHSE:600272)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Kai Kai Industry Company Limited operates in the production, distribution, and sale of pharmaceutical and clothing products in China with a market capitalization of CN¥2.69 billion.

Operations: Shanghai Kai Kai Industry generates revenue primarily from its pharmaceutical and clothing segments. The company has seen fluctuations in its net profit margin, which provides insight into its profitability trends over time.

Shanghai Kai Kai Industry, a small cap player in its sector, has shown impressive earnings growth of 105.5% over the past year, outpacing the broader Pharmaceuticals industry which saw a -2.5% change. The company's financials reveal a significant one-off gain of CN¥76M impacting recent results up to September 2024, suggesting potential volatility in earnings quality. Despite this, it appears financially stable with more cash than total debt and sufficient interest coverage from profits. However, its share price has been highly volatile recently, hinting at market uncertainty or speculative trading influences around this stock.

- Navigate through the intricacies of Shanghai Kai Kai Industry with our comprehensive health report here.

Gain insights into Shanghai Kai Kai Industry's past trends and performance with our Past report.

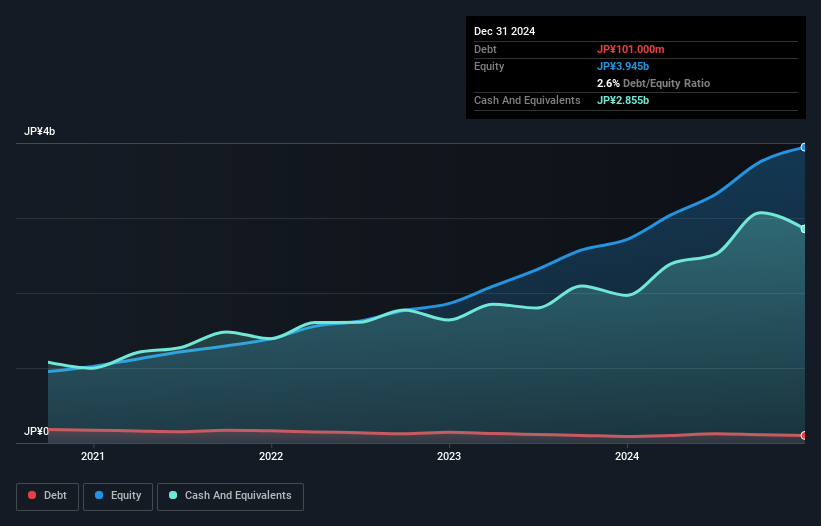

AzoomLtd (TSE:3496)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Azoom Co., Ltd operates in Japan offering a range of real estate services and has a market capitalization of ¥45.20 billion.

Operations: Azoom Co., Ltd generates revenue primarily from its Visualization Business, which contributed ¥206.48 million, and Idle Asset Utilization Business, which brought in ¥10.95 billion.

Azoom Ltd, with its nimble market footprint, has shown impressive earnings growth of 43.7% over the past year, outpacing the Real Estate industry's 25.8%. The company maintains a strong financial position with more cash than total debt and is free cash flow positive, evidenced by a levered free cash flow of US$1.09 billion as of September 2024. Despite this robust performance, its share price has been highly volatile in recent months. Looking ahead, Azoom's profitability suggests that its cash runway isn't a concern as it prepares to release Q1 2025 results soon.

- Delve into the full analysis health report here for a deeper understanding of AzoomLtd.

Examine AzoomLtd's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Investigate our full lineup of 4725 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3496

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives