Why We're Not Concerned Yet About Jinyu Bio-technology Co., Ltd.'s (SHSE:600201) 25% Share Price Plunge

Jinyu Bio-technology Co., Ltd. (SHSE:600201) shares have had a horrible month, losing 25% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

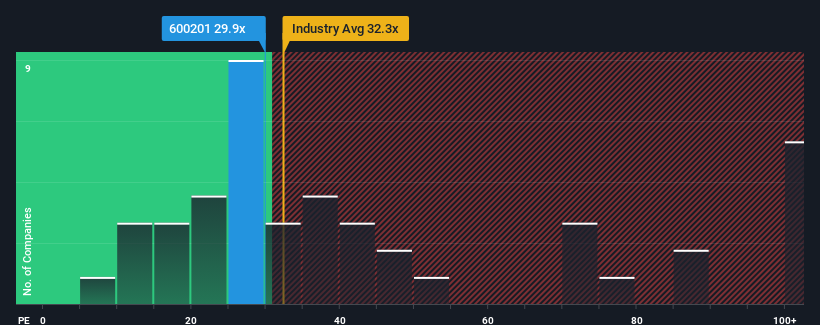

Although its price has dipped substantially, it's still not a stretch to say that Jinyu Bio-technology's price-to-earnings (or "P/E") ratio of 29.9x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been advantageous for Jinyu Bio-technology as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Jinyu Bio-technology

How Is Jinyu Bio-technology's Growth Trending?

In order to justify its P/E ratio, Jinyu Bio-technology would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 19% gain to the company's bottom line. Still, incredibly EPS has fallen 40% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 23% per year during the coming three years according to the ten analysts following the company. With the market predicted to deliver 25% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Jinyu Bio-technology's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Jinyu Bio-technology's P/E

Jinyu Bio-technology's plummeting stock price has brought its P/E right back to the rest of the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Jinyu Bio-technology maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Jinyu Bio-technology, and understanding them should be part of your investment process.

Of course, you might also be able to find a better stock than Jinyu Bio-technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600201

Jinyu Bio-technology

Engages in the research and development, production, and sale of veterinary products in China.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives