Undiscovered Gems In Global Highlighted By These 3 Promising Stocks

Reviewed by Simply Wall St

In a week where major U.S. stock indexes reached record highs, the Federal Reserve's decision to cut interest rates for the first time this year has sparked a rally in small-cap stocks, with the Russell 2000 Index gaining over 2%. This environment of lower borrowing costs and renewed trade negotiations between global powers creates fertile ground for identifying promising small-cap stocks that may offer unique opportunities amid shifting economic landscapes. In such market conditions, a good stock often exhibits resilience and growth potential by effectively navigating interest rate changes and capitalizing on emerging trends or sectors poised for expansion.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| China Post Technology | NA | -35.78% | 7.84% | ★★★★★★ |

| Center International GroupLtd | 17.61% | 0.53% | -25.53% | ★★★★★★ |

| Zhejiang JW Precision MachineryLtd | 14.74% | 4.97% | -20.59% | ★★★★★★ |

| Nacity Property Service GroupLtd | 6.90% | 6.11% | -8.48% | ★★★★★☆ |

| Shenzhen Coship Electronics | 39.15% | 24.47% | 53.77% | ★★★★★☆ |

| DYPNFLtd | 26.11% | 13.24% | 0.06% | ★★★★★☆ |

| Praise Victor Industrial | 46.95% | 8.93% | 39.31% | ★★★★★☆ |

| Forth Smart Service | 60.42% | -5.83% | -3.47% | ★★★★☆☆ |

| Hollyland (China) Electronics Technology | 6.78% | 17.88% | 19.84% | ★★★★☆☆ |

| Hangzhou Zhengqiang | 28.34% | 1.55% | 16.73% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Anhui Anfu Battery TechnologyLtd (SHSE:603031)

Simply Wall St Value Rating: ★★★★★★

Overview: Anhui Anfu Battery Technology Co., Ltd specializes in the research, development, production, and sale of zinc-manganese batteries in China with a market capitalization of approximately CN¥10.31 billion.

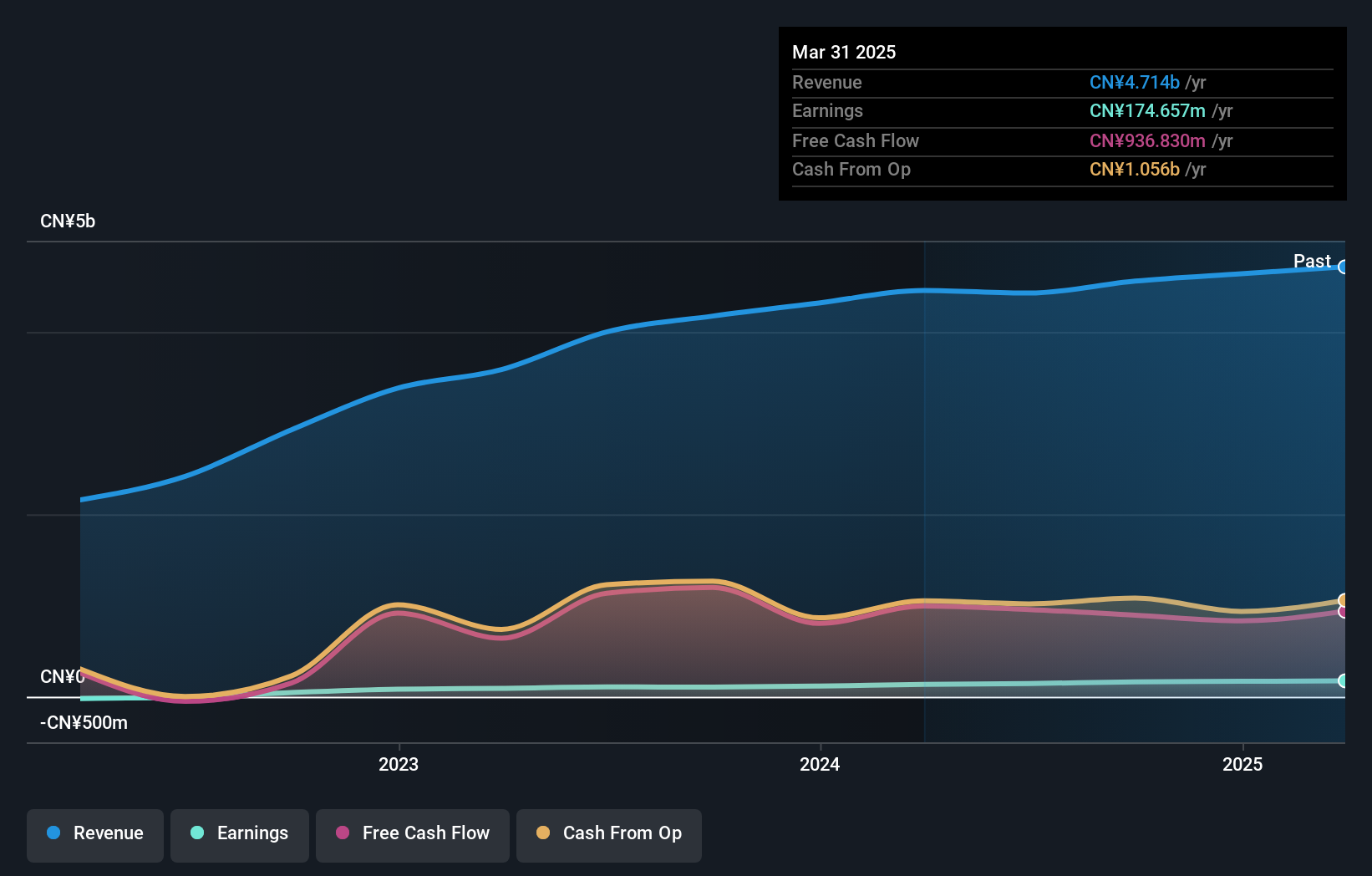

Operations: Anhui Anfu Battery Technology derives its revenue primarily from the sale of zinc-manganese batteries. The company's financial performance includes a notable gross profit margin trend, with recent figures indicating 25.6%. Operating costs are a significant component of the overall expenses, impacting profitability.

Anhui Anfu Battery Technology, a smaller player in the battery industry, has shown robust financial health with a satisfactory net debt to equity ratio of 4.1%, reflecting prudent financial management. Over the past five years, their debt to equity ratio impressively decreased from 79.1% to 44.1%. The company reported half-year sales of CNY 2.43 billion and net income of CNY 106.55 million, up from CNY 93.15 million last year, though basic earnings per share dipped slightly to CNY 0.5 from CNY 0.52 previously. Earnings growth at an impressive rate of 26.3% outpaces the electrical industry average significantly by comparison.

GUOMAI Culture & Media (SZSE:301052)

Simply Wall St Value Rating: ★★★★★★

Overview: GUOMAI Culture & Media Co., Ltd. operates in China focusing on book planning and distribution, digital content and advertising, and IP derivative operations, with a market capitalization of CN¥6.93 billion.

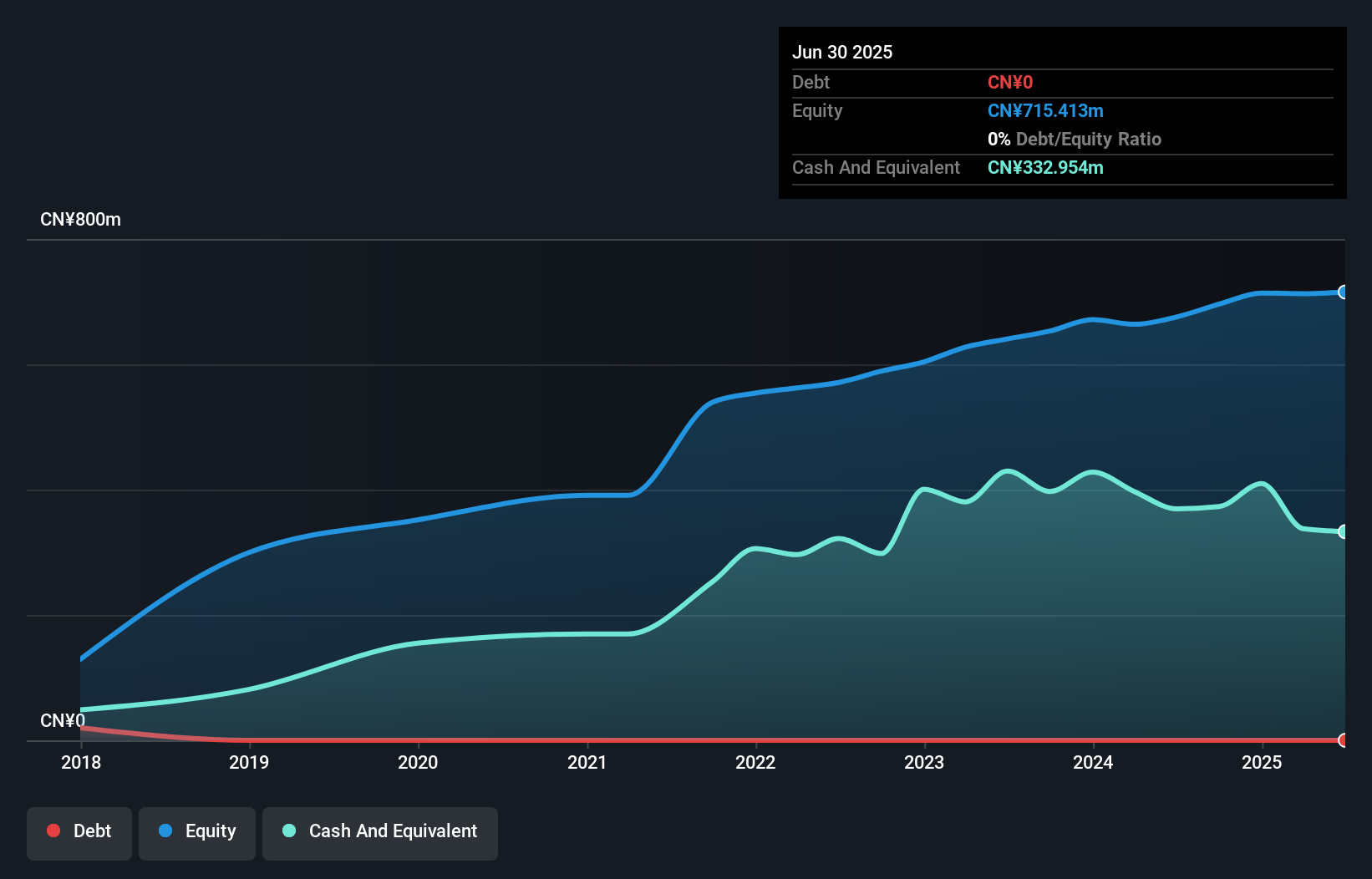

Operations: GUOMAI Culture & Media generates revenue primarily from its printing and publishing segment, contributing CN¥650.37 million. The company's financial performance includes a focus on managing its cost structure to support profitability.

Guomai Culture & Media is making waves with a notable earnings growth of 58.3% over the past year, outpacing the media industry's -9.5%. This debt-free company has consistently shown high-quality earnings, with recent half-year revenue reaching CNY 297.53 million, up from CNY 229.3 million last year. Net income also improved to CNY 5.66 million from CNY 3.14 million a year ago, reflecting its strong performance despite market volatility in recent months. Recent amendments to its articles of association suggest strategic shifts that could influence future operations and governance structures positively for this dynamic player in the media space.

- Click here and access our complete health analysis report to understand the dynamics of GUOMAI Culture & Media.

Gain insights into GUOMAI Culture & Media's past trends and performance with our Past report.

Syntec Technology (TWSE:7750)

Simply Wall St Value Rating: ★★★★★☆

Overview: Syntec Technology Co., Ltd. manufactures PC-based digital controllers specializing in machine tools, with a market cap of NT$59.80 billion.

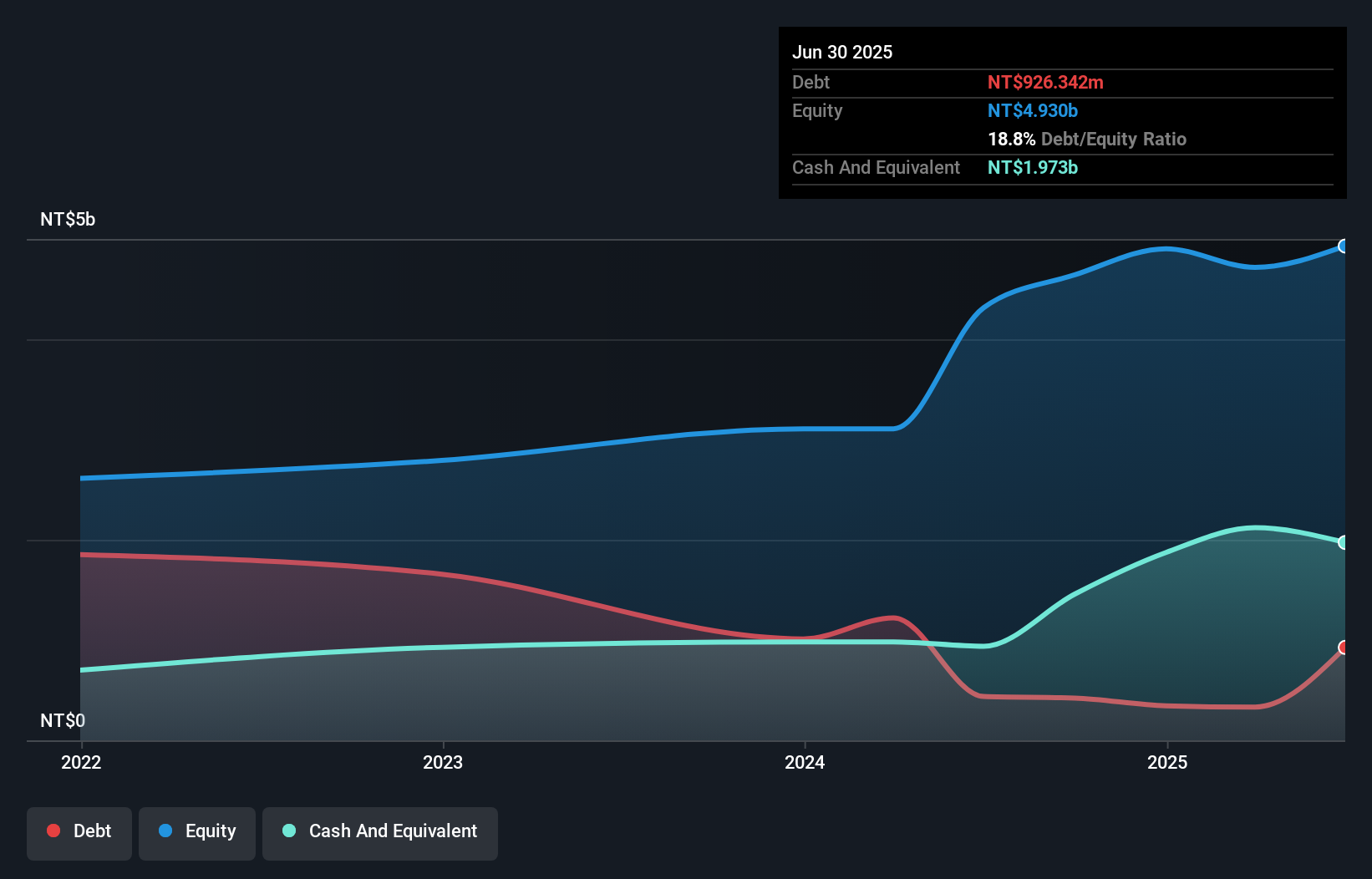

Operations: Syntec Technology's primary revenue stream is from its Machinery & Industrial Equipment segment, generating NT$12.41 billion. The company's financial performance can be analyzed through its gross profit margin, which shows notable trends over time.

Syntec Technology, a nimble player in the industry, has demonstrated impressive growth with earnings surging by 45.1% over the past year, outpacing its sector's -11.1%. The company reported robust sales of TWD 3.98 billion for Q2 2025, up from TWD 3.30 billion a year prior, while net income increased to TWD 598.58 million from TWD 498.75 million last year. Despite high share price volatility recently, Syntec remains free cash flow positive with levered free cash flow reaching US$1.70 billion as of September 2025 and maintains more cash than its total debt position, reflecting financial resilience and potential for continued expansion in its market segment.

- Click to explore a detailed breakdown of our findings in Syntec Technology's health report.

Assess Syntec Technology's past performance with our detailed historical performance reports.

Taking Advantage

- Explore the 2949 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301052

GUOMAI Culture & Media

Engages in the book planning and distribution, digital content and advertising, and IP derivative and operation businesses in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives