- Saudi Arabia

- /

- Real Estate

- /

- SASE:4150

Undiscovered Gems to Explore in December 2024

Reviewed by Simply Wall St

As global markets continue to experience gains, with indices like the Russell 2000 reaching record highs, small-cap stocks are drawing increased attention amid a backdrop of geopolitical developments and economic indicators. In this environment, identifying promising small-cap stocks requires focusing on companies that demonstrate resilience and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Arriyadh Development (SASE:4150)

Simply Wall St Value Rating: ★★★★★★

Overview: Arriyadh Development Co. focuses on the purchase and sale of lands and real estate in Saudi Arabia, with a market capitalization of SAR4.80 billion.

Operations: Arriyadh Development Co. generates revenue primarily from its Trade Center Sector, contributing SAR165.51 million, and the Utility Sector Hydration at SAR150.54 million.

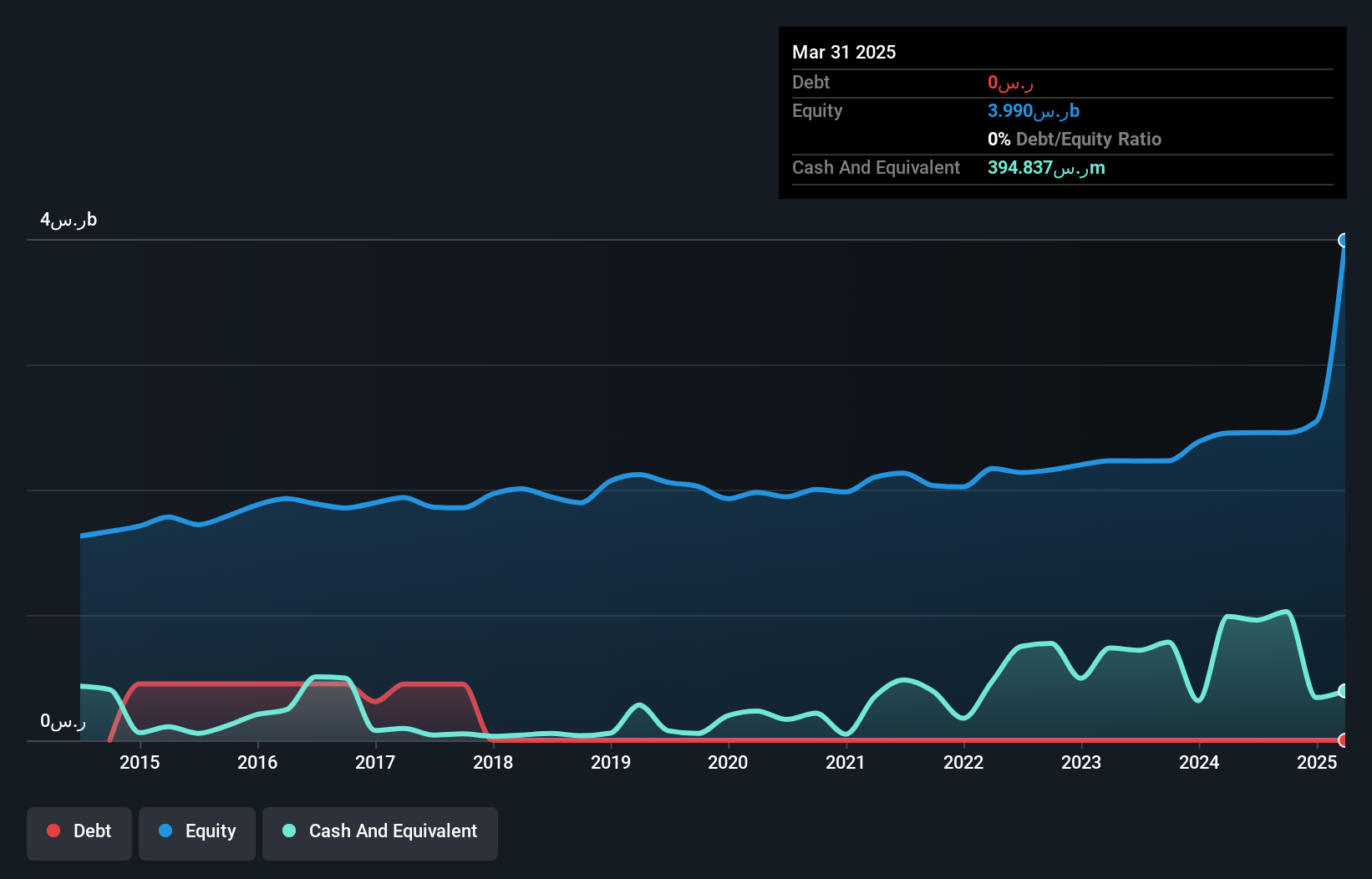

Arriyadh Development stands out with its debt-free status and impressive earnings growth of 121.6% over the past year, significantly surpassing the Real Estate industry's 15%. Trading at a price-to-earnings ratio of 13.8x, it offers good value compared to the SA market's 23.6x. Recent results show third-quarter sales at SAR 79.62 million, slightly up from last year's SAR 77.99 million, though net income dipped to SAR 44.23 million from SAR 46.41 million previously. Over nine months, however, sales rose to SAR 235.09 million with net income jumping to SAR 206.63 million from SAR 122.07 million last year.

- Take a closer look at Arriyadh Development's potential here in our health report.

Evaluate Arriyadh Development's historical performance by accessing our past performance report.

GRG Metrology & Test Group (SZSE:002967)

Simply Wall St Value Rating: ★★★★★★

Overview: GRG Metrology & Test Group Co., Ltd. operates as a third-party metrology and testing company with a market capitalization of CN¥9.84 billion.

Operations: The company generates revenue primarily through its metrology and testing services. It has a market capitalization of CN¥9.84 billion, reflecting its position in the industry.

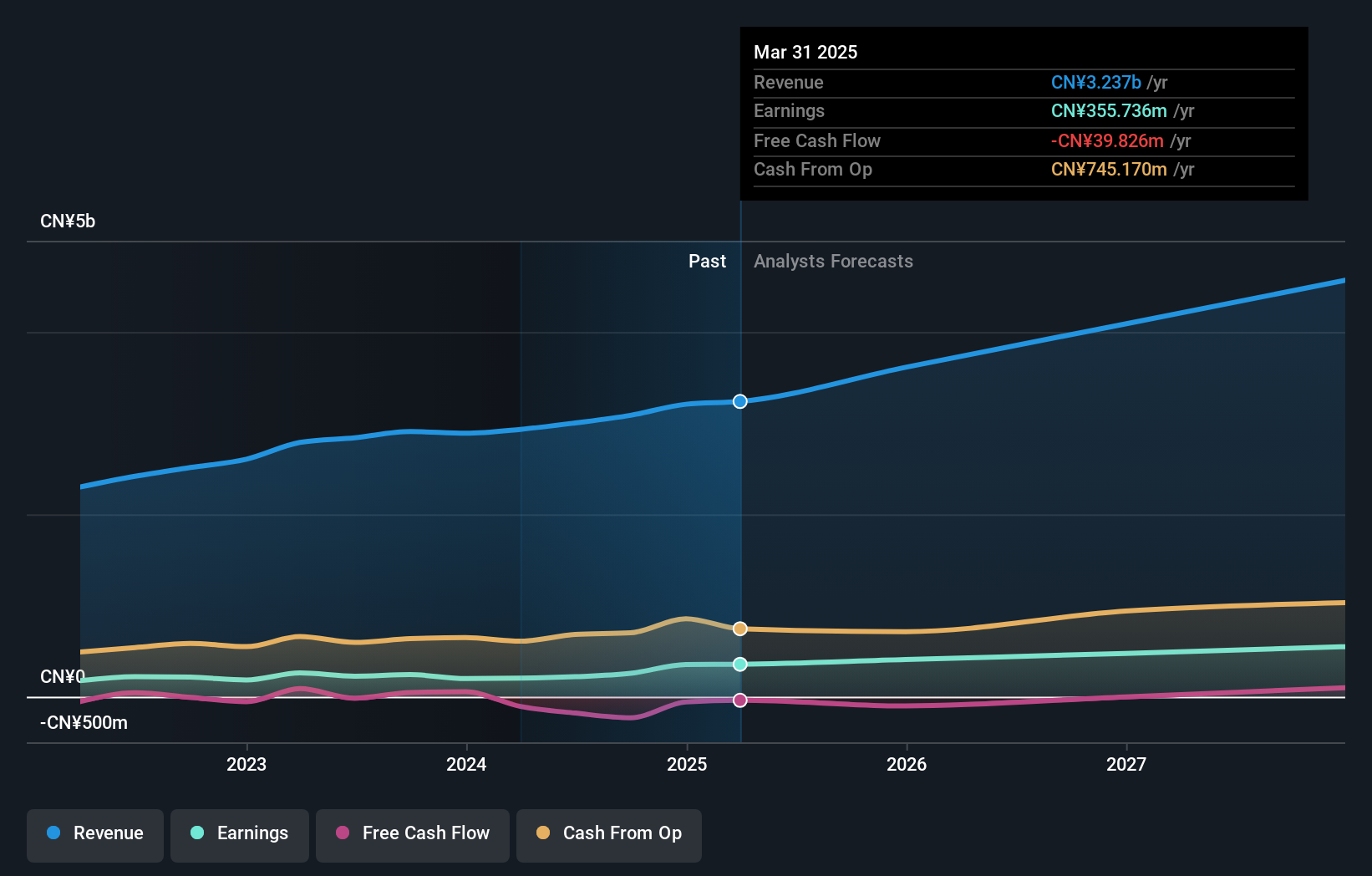

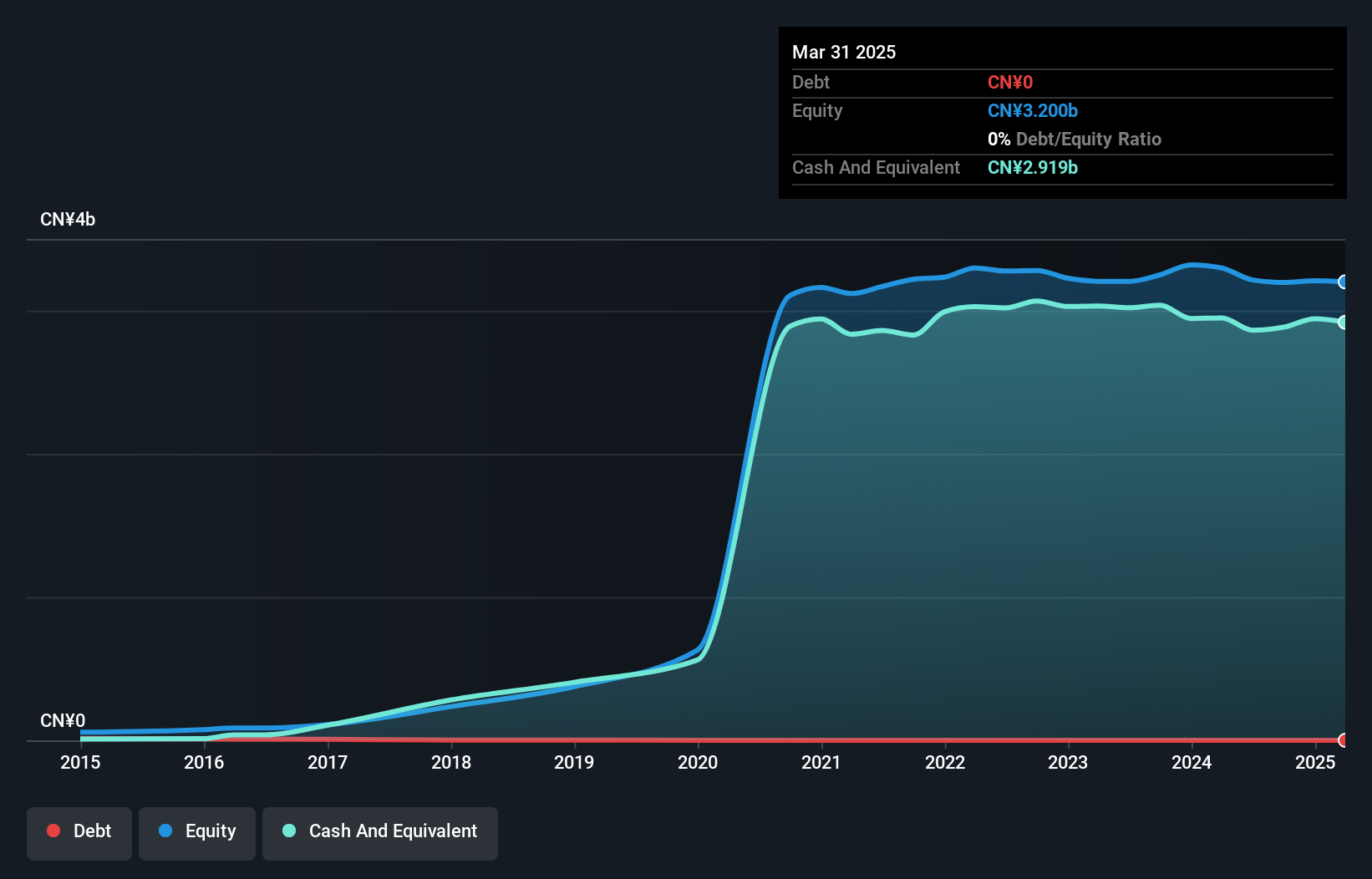

GRG Metrology & Test Group, a nimble player in its sector, reported a net income of CNY 188.77 million for the first nine months of 2024, up from CNY 132.77 million the previous year. The company's earnings per share rose to CNY 0.33 from CNY 0.23, reflecting robust performance against industry trends. With a net debt to equity ratio at a satisfactory level of 12.3%, GRG demonstrates financial prudence while trading at nearly two-thirds below estimated fair value suggests potential undervaluation opportunities for investors eyeing growth prospects with forecasted earnings growth of over 23% annually and recent buyback plans worth up to CNY 400 million further underscore management's confidence in long-term stability and value enhancement strategies.

Funshine Culture GroupLtd (SZSE:300860)

Simply Wall St Value Rating: ★★★★★★

Overview: Funshine Culture Group Co., Ltd. operates in China, focusing on cultural performing events, cultural tourism, and public artistic lighting, with a market capitalization of CN¥5.10 billion.

Operations: Funshine Culture Group Ltd generates revenue primarily through its cultural performing events, cultural tourism, and public artistic lighting sectors. The company's net profit margin has shown variation over recent reporting periods.

Funshine Culture Group seems to be a promising player in the entertainment sector, showcasing impressive earnings growth of 296.8% over the past year, far outpacing the industry's -16.1%. Despite a dip in net income to CNY 22.04 million from CNY 58.65 million last year, its debt-free status and high level of non-cash earnings paint a stable financial picture. The company has also repurchased 1,323,600 shares for CNY 44.02 million this year, signaling confidence in its valuation. With sales rising slightly to CNY 380.71 million from CNY 370.01 million, Funshine appears poised for potential future growth amidst industry challenges.

- Get an in-depth perspective on Funshine Culture GroupLtd's performance by reading our health report here.

Learn about Funshine Culture GroupLtd's historical performance.

Taking Advantage

- Discover the full array of 4637 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4150

Arriyadh Development

Engages in the purchase and sale of lands and real estate in Saudi Arabia.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives