Market Participants Recognise Hangzhou Onechance Tech Crop.'s (SZSE:300792) Earnings Pushing Shares 30% Higher

Hangzhou Onechance Tech Crop. (SZSE:300792) shareholders have had their patience rewarded with a 30% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 62%.

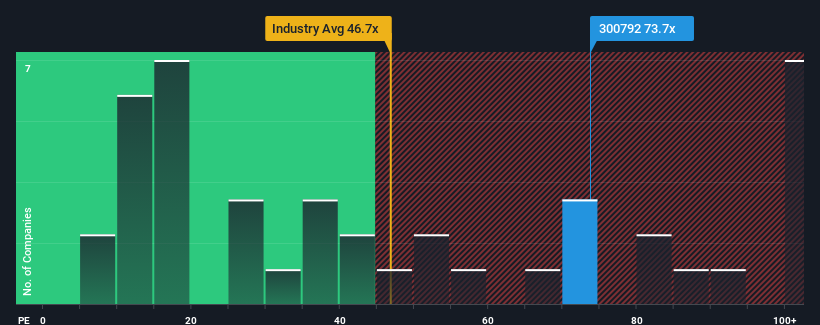

Following the firm bounce in price, Hangzhou Onechance Tech Crop may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 73.7x, since almost half of all companies in China have P/E ratios under 34x and even P/E's lower than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times haven't been advantageous for Hangzhou Onechance Tech Crop as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Hangzhou Onechance Tech Crop

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Hangzhou Onechance Tech Crop would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 76% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 71% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

In light of this, it's understandable that Hangzhou Onechance Tech Crop's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has got Hangzhou Onechance Tech Crop's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Hangzhou Onechance Tech Crop's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Hangzhou Onechance Tech Crop (1 is a bit unpleasant!) that we have uncovered.

If you're unsure about the strength of Hangzhou Onechance Tech Crop's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Onechance Tech Crop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300792

Hangzhou Onechance Tech Crop

Provides brand online marketing and management services.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives